X-201 For A Sole Proprietorship

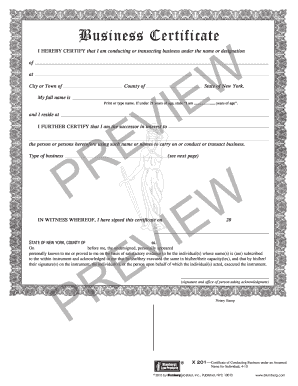

For sole proprietorship form x-201. Form Description Business Certificate.

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

December 15 2011 Introduction.

X-201 for a sole proprietorship. Complete Get The X 201 For A Sole Proprietorship Form 2020 online with US Legal Forms. A sole proprietorship is a business run by an executive owner. The New York County Clerk accepts for filing The Business Certificate form is X-74 for a partnership and X-201 for a sole proprietorship New Business Registration Form x-201 Is There Anyway I Can download.

Complete the forms and get all three of them notarized. You will need to buy three. W-2 Wage and Tax Statement and W-3 Transmittal of Wage and Tax Statements Report wages tips and other compensation and withheld income social security and Medicare taxes for employees.

The owner is liable for all business operations. The Business Certificate form is X-74 for a partnership and X-201 for a sole proprietorship and they can be purchased at any commercial or legal stationery store including the candy shopnewsstand in the lobby of the courthouse at 60 Centre Street. New York Source IncomeSole Proprietorships and Partnerships Tax Bulletin IT-620 TB-IT-620 Printer-Friendly Version PDF Issue Date.

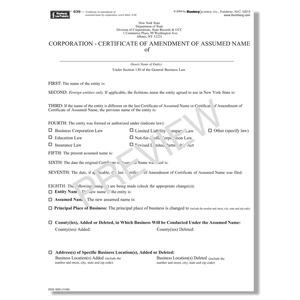

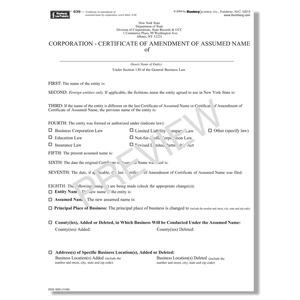

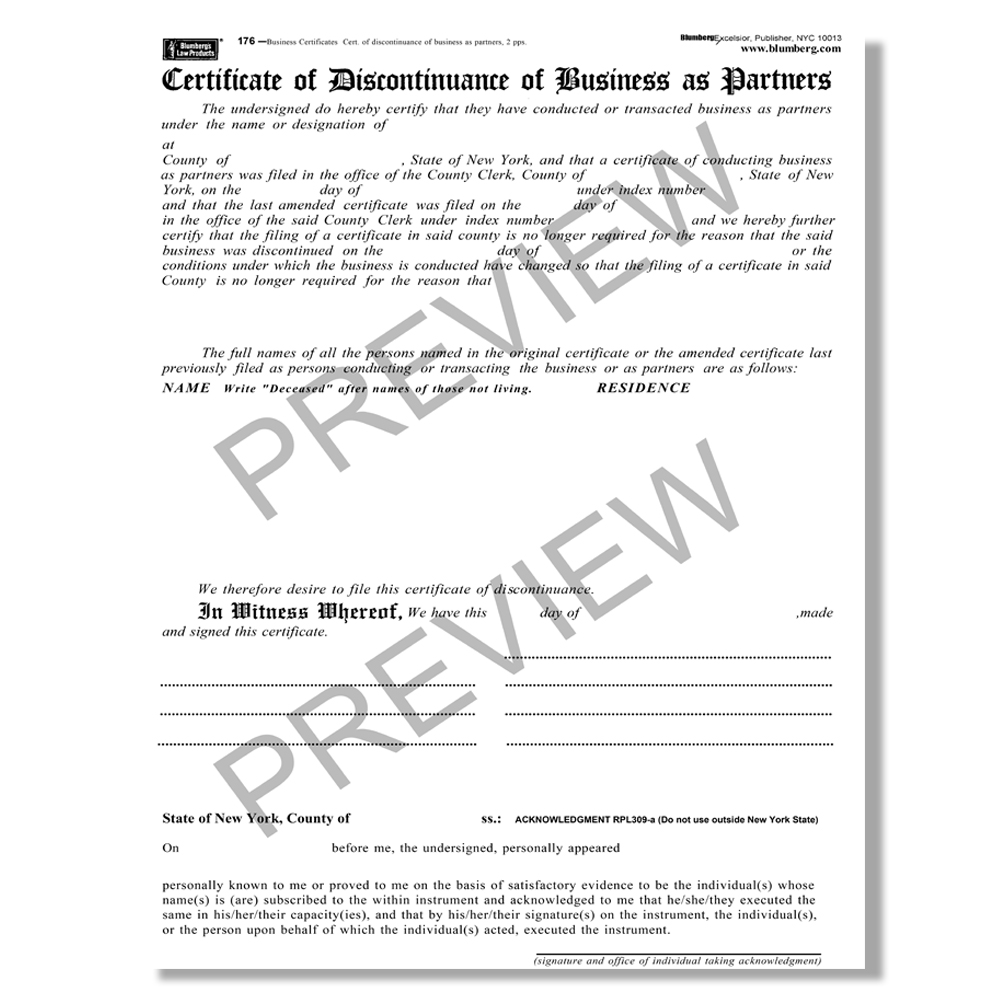

X 201 for a sole proprietorship blumberg form x201 x 201 blumberg form is x201 x201 form nyc form x201 sole proprietorship x 201 form business certificate pdf form x201 form x 201. Blumberg Form 201 Certificate to Conduct Business Under Assumed Name New York DBA doing business as form New York Business Certificate. Easily fill out PDF blank edit and sign them.

Of course before I could register my business with the county clerks office I first needed to obtain and fill out a blank business certificate which goes by the name of Form x201 in. Business Certificate For Partners. Heither 7 months ago.

Sole proprietorships often have their bank accounts in the name of the owner. Save or instantly send your ready documents. Make sure this fits by entering your model number.

For sole proprietorships and general partnerships Business Certificates can be filed at the appropriate County Clerks Office. Get three copies of the appropriate form. Go to your county clerks office to.

If you go into business without setting up another business structure then youre automatically considered a sole proprietor if youre the sole owner. You dont have to register or file any paperwork with the federal government to form a sole proprietorship. Sole proprietor owners can and often do mix personal and business property and funds something that partnerships LLCs and corporations cannot do.

The owner does business in their own name or with a trade name A business certificate is needed only if a trade name is used. County Clerks Offices Bronx 851 Grand Concourse Room 118 Bronx NY 10451 Queens 88-11 Sutphin Blvd Room 106 Queens NY 11435 Brooklyn Supreme Court Building 360 Adams St Room 189 Brooklyn NY 11201. If you are a nonresident individual estate or trust you are subject to tax on your New York source income.

In New York sole proprietors hoping to register their businesses must do so with their local county clerks office rather than with a statewide agency you can find out your states requirements here. Sole proprietors need not observe formalities such as voting and meetings associated with the more complex business forms. W-2G Certain Gambling Winnings PDF Report gambling winnings from.

Before going to the county clerks office get hold of form X-201 for sole proprietors only or form X-74 for two or more owners These forms are available at most stationary stores that sell business forms. Heres how I did it. X-201 for a sole proprietorship and they can be purchased at any commercial or legal stationery store including the candy shopnewsstand in the lobby of the courthouse at 60 Centre Street.

Certificate of Conducting Business Under An Assumed Name for an Individual also known as a DBA certificate Completion and Filing Instructions click here. For partnerships Form x-74. The filing is made in.

This rule differs for sole proprietorships and general partnerships. Sole Proprietorship Individual Business Forms. If you are starting a business as a sole proprietor or partnership you must file a document with the city county or state as required by the laws of the state in which your business will be conducted.

New York Business Certificate DBA Form x201 Certificate of Conducting Business under an Assumed Name What is a fictitious name a DBA.

Amended Business Certificate Blumberg Form T224 Fill Online Printable Fillable Blank Pdffiller

Amended Business Certificate Blumberg Form T224 Fill Online Printable Fillable Blank Pdffiller

Solved Research Problem 2 Joel Has Operated His Business As A Sole 1 Answer Transtutors

Solved Research Problem 2 Joel Has Operated His Business As A Sole 1 Answer Transtutors

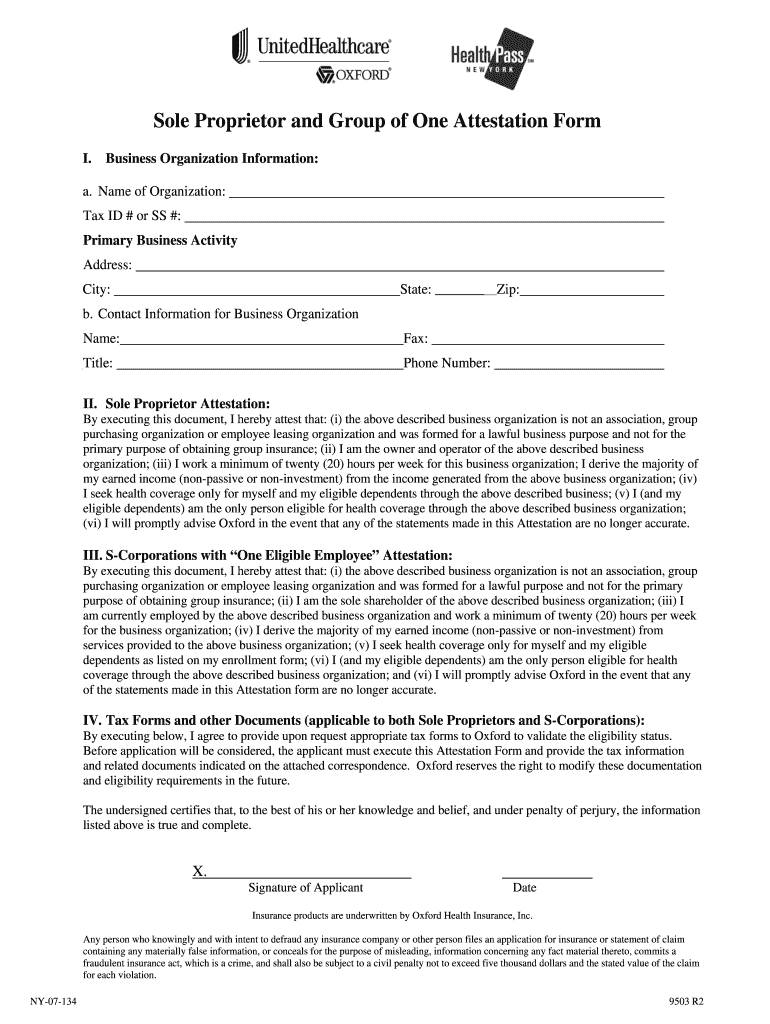

Proprietor Attestation Fill Online Printable Fillable Blank Pdffiller

Proprietor Attestation Fill Online Printable Fillable Blank Pdffiller

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Https Www Sec Gov Rules Other 2019 Memx Memx Form 1 Execution Pdf

The Taxbook 1040 Edition 2020 Item 90 201

The Taxbook 1040 Edition 2020 Item 90 201

Form X201 Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Form X201 Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Sole Proprietor Letter Of No Insurance Template Page 3 Line 17qq Com

Sole Proprietor Letter Of No Insurance Template Page 3 Line 17qq Com

Https Azre Gov Sites Default Files Lic Forms Form Li 201 Entity Address Change Pdf

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Sole Proprietor Letter Of No Insurance Template Page 3 Line 17qq Com

Sole Proprietor Letter Of No Insurance Template Page 3 Line 17qq Com

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

X201 Form Fill Online Printable Fillable Blank Pdffiller

X201 Form Fill Online Printable Fillable Blank Pdffiller

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form