Is The Small Business Grants Taxable

Emergency financial support such as the Self-Employment Income Support Scheme SEISS and Small Business Grant Fund SBGF are subject. Cant seem to find clarification if its taxable or non-taxable.

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

If youre unsure of whether a grant is taxable do your research.

Is the small business grants taxable. Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable. A grant is money you dont have to pay back. 2021-03-26T123707Z The letter F.

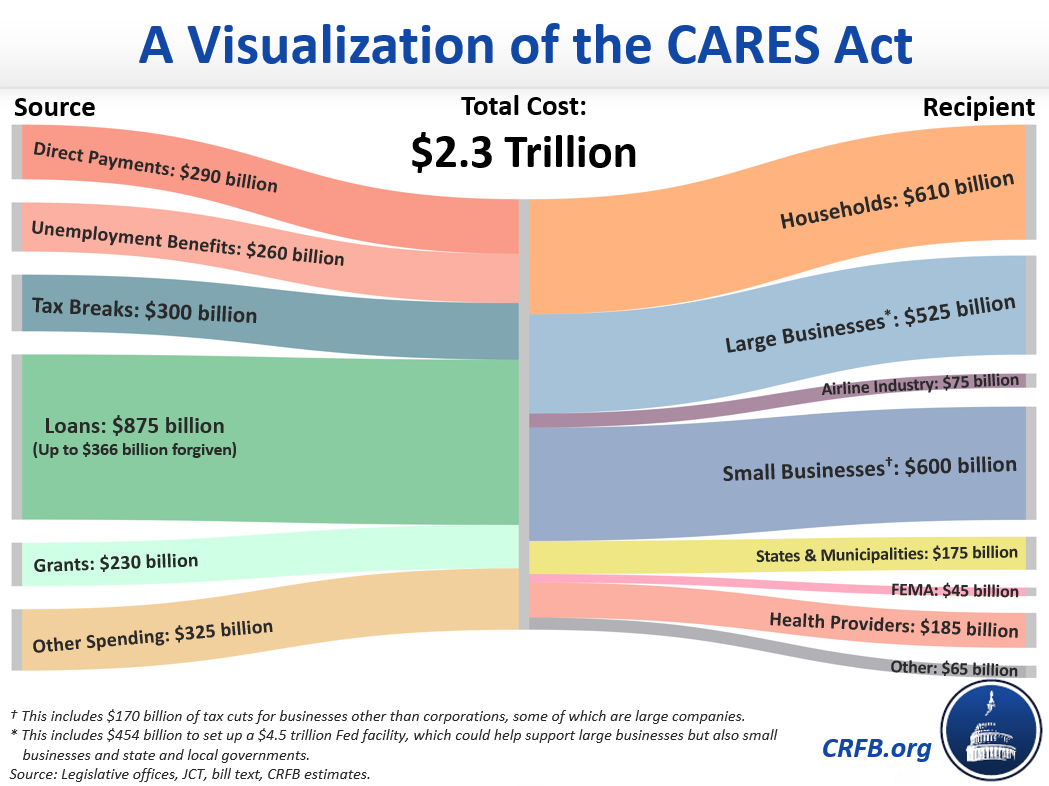

Grants to households ie individuals are taxed differently than grants to small businesses. Thus COVID-19-related government grants to businesses are taxable income unless. In contrast you have to pay back a loan.

You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make. Is COVID-19 Small Business Grant Scheme taxable. So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable.

For instance college grants are not taxable as long as the funds are spent on tuition expenses for the students chosen program. Yes if they meet the criteria above. For a sole trader or partnership preparing accounts on the cash basis this income will be taxable in the 202021 tax year and the income tax payable by 31 January 2022.

This might seem like a dumb question but well answer it anyway because there are no dumb tax questions. Payments to businesses do not qualify under the general welfare exclusion because they are not based on individual or family need. If you received the EIDL loan taxes on these funds work like any other business loan taxation.

Many of New Yorks restaurants and small businesses will be eligible for new state grants and tax credits that could act as an economic lifeline for establishments still navigating the COVID-19. SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such. 31 2021 small businesses with fewer than 500 employees that experienced a quarterly revenue decline of 20 previously 50 year-over-year can claim a payroll tax credit for 70 of qualified wages up to 10000 per employee per quarter.

This is in relation to the support for small businesses that already pay little or no business rates because of small business rate relief etc. What Is a Grant. Small Business Administration SBA Grants and Loans Federal.

What if I have not yet filed my 2019 tax return. As explained below need-based grants to households likely fall under the general welfare exclusion and are therefore not taxable whereas grants to small businesses are likely not covered by this exclusion and would be taxable. The PPP loan program is open.

Economic Injury Disaster Loan EIDL advances and grants are tax-free at the federal level. You must first file your 2019 Wisconsin tax return before applying for the Were All In Small Business Grant Phase 2 program. 1 2021 and through Dec.

Any links to that information. Most claimants will not therefore have received their grant until after 5 April 2020. In the United States some grants are not included as part of taxable income.

You can also lower your tax liability by deducting any expenses covered by the use of these funds. The financial impact of a grant come tax time depends on multiple factors including your business structure. In other words funds from the EIDL are not reported as taxable business income on your tax return.

How your small business can get loans grants and tax breaks from the new stimulus bill. For example they must have filed an income tax return reporting their business income on Schedule C of their federal tax return. Like most things in the world of taxes it depends.

Are Small Business Grants Fund Taxable Income. According to the New Jersey Division of Taxation any payments that the SBA makes for principal interest and fees are considered to be cancellation of debt COD. The receipt of a government grant by a business generally is not excluded from the businesss gross income under the Code and therefore is taxable.

COVID-Related Grants to Businesses. Are these grants taxable. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021.

As a general rule of thumb you should expect that the majority of grants are counted as taxable income.

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

Coronavirus Resources And Information Congresswoman Elise Stefanik

Coronavirus Resources And Information Congresswoman Elise Stefanik

Loan Programs The U S Small Business Administration Sba Gov

Loan Programs The U S Small Business Administration Sba Gov

Microloan Program The U S Small Business Administration Sba Gov

Microloan Program The U S Small Business Administration Sba Gov

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Paycheck Protection Program How It Works Funding Circle

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware

Covid 19 Information For Delaware Small Businesses Division Of Small Business State Of Delaware