How To Get Business Loan From Canara Bank

We offers wide range of consumer banking services like savings account fixed deposit debit card loan Mutual funds and many more that helps you meet personal financial needs. Documentation process forms an eminent part of loan approval process.

What are the Documents Required for Canara Business Loan.

How to get business loan from canara bank. Simply walk into the nearest branch of Canara Bank and talk to a customer service representative. The eligibility for business loan in Canara bank is as follows. The application form is available at the nearest branch office.

Canara Bank Business Loan EMI Calculator. Features of Canara Bank MSME Vahan Loan. Term Loan is offered for purchase of any land building machine or vehicles with working capital finance as one of the elements of the term loans.

But at the same time if you get your bank account statement then you will get the details about all the transactions for the chosen period of time. Which are online customer care or directly visiting the branch. Co Manufacture and Service providers and Partnership firm.

To take a loan from the Canara bank the applicants have to fulfill the minimum eligibility criteria. Canara Bank Education Loan Interest Rates. Yes just visit the official site of the bank and with the help of some simple steps apply online to get the loan for your various needs.

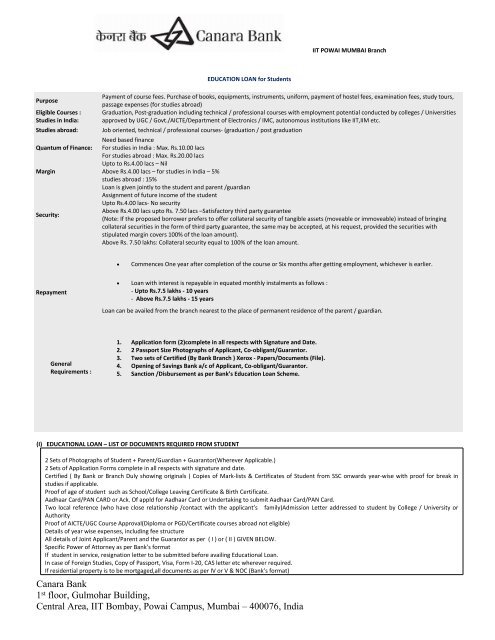

Canara Bank is pioneer in Education loans. With the Canara Bank Loan Restructuring Scheme existing customers of Canara Bank can get a wide range of benefits such as rescheduling their payments converting the accrued interest or to be accrued into another credit facility etc. Canara Bank Education Loans also cover various international admissions related expenses like examination fees SAT exams LSATS GMAT GRE etc VISA processing fees student insurance and more.

Education being one of Banks founding principles. Lets know the documents required by Canara Bank for the loan approval-. Types and Categories of Business Loans.

Compare Canara Bank Car loan interest rates with leading banks online at BankBazaar. The customer dealer will guide you regarding all the procedure. The age of the applicant should be 21 years to 65 years The applicant should have at least 3 years of their current business experience Self- employed individuals Proprietors Private Ltd.

6 times of average gross annual income of all the three years immediately preceding current financial year in the case of individuals engaged in business or self-employed persons subject to production of documentary evidence regarding the gross annual income. Every borrower needs to provide a set of documents in order to get the business loan approved by the bank. Canara Bank Savings Account FAQ.

The executive will give the form as per the amount the candidate is applying for. Canara Bank offers business loan in various categories such as Term Loan Working Capital Loan and Pradhan Mantri Mudra Yojana PMMY. If you get the mini statement of Canara Bank then you can get details only about your last 5 transactions.

Alternatively you can fill in the necessary details on the website and a bank representative will visit you to collect the documents. Selectively loan upto 8 years gross salary income also permitted. The maximum loan amount is Rs.

Two-Wheeler Loan By Canara Bank. Cost of the education including fees hosted fees equipment books etc are considered for finance. The Canara Bank provides education loans on the basis of institution type and academic level of any applicant.

Loan is permitted for taking up higher education. The business loan service is available in all regional offices. Canara Bank Car Loan Online.

You need to match the eligibility criteria decided by the bank and provide the requisite documents before the loan can be approved. No Mini Statement and the Bank account statement are totally different. Canara Bank is providing you the two-wheeler loan to its customers with some easy documentation.

Need a Business Loan. This loan helps MSME manufacturing and service units to invest in vehicles as business assets or to buy new vehicles excluding Goods Carriers for business use. Canara Bank Loan Restructuring Scheme Benefits for Personal Loan Borrowers.

25lakh or up to 90 of the On-Road cost of the vehicle whichever is lower. Canara MSME Vahan Loan. The candidates can apply for a business loan by visiting the nearest branch office.

Submit the necessary KYC documents and your account is opened within 24hrs. Canara Bank Business Loan Application Form The loan application form varies depending upon the quantum of loan applied for under MSME. If you are someone who wants to go on a traditional way you can opt for an offline medium wherein you simply need to visit the bank branch in person while carrying all the required document.

Find Canara Bank Car loan interest rate at. You can get a smallstartup business loan by applying for the loan at Canara Bank through one of the sources made available to the customer. Welcome to Canara Bank Ideal destination for Personal Banking need.