How To Fill 44ad In Itr 4

You can file return under section 44AD using code 16019 - other professionals. On Income Tax Return Page.

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Maintaining books of accounts are not mandatory.

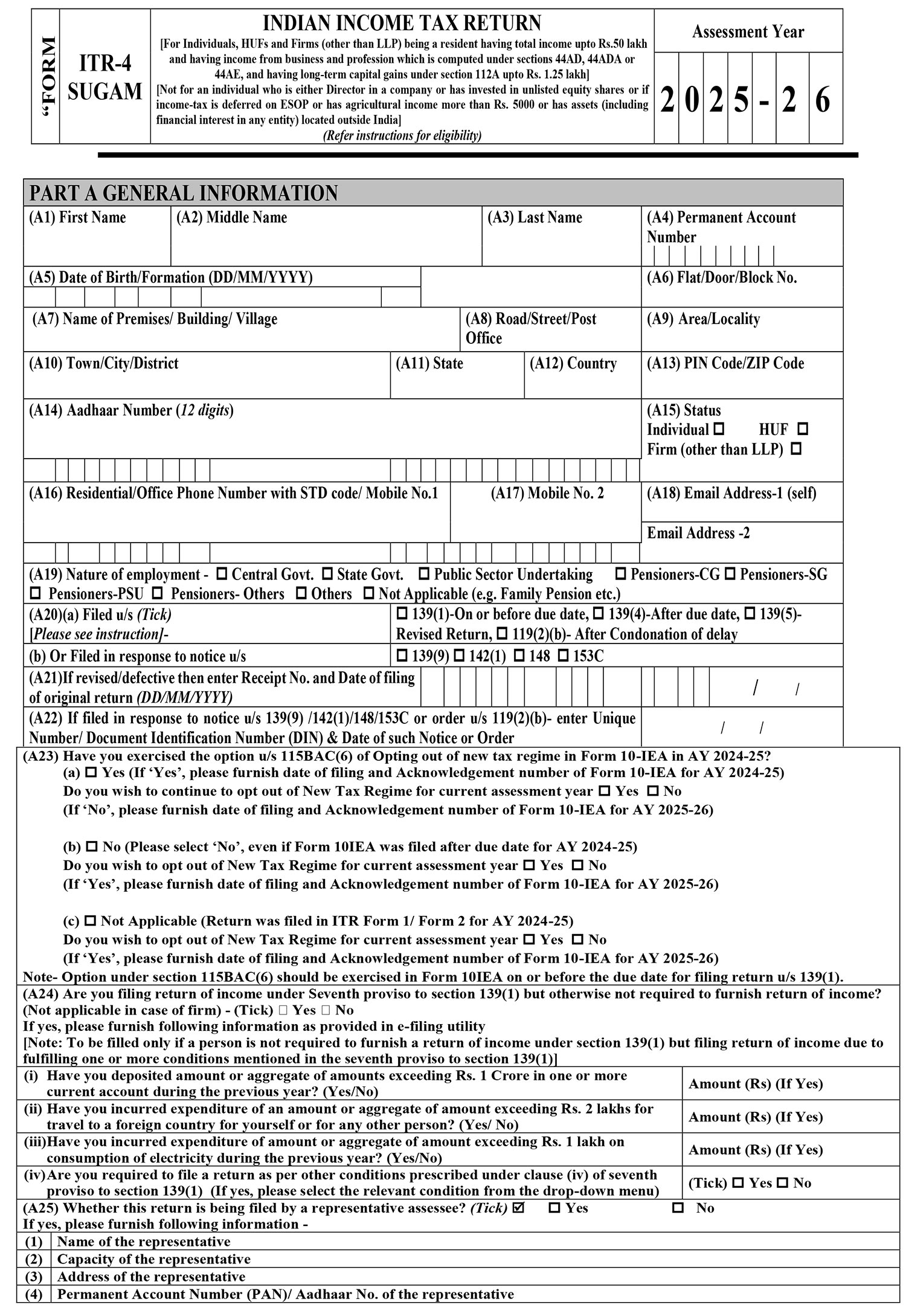

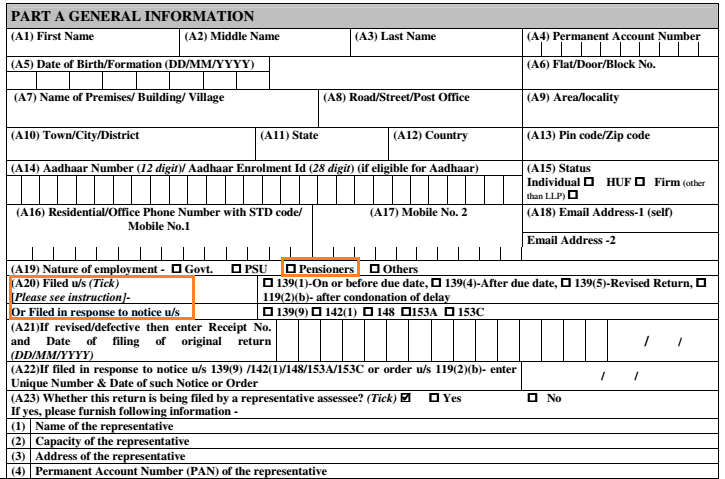

How to fill 44ad in itr 4. ITR 4 Indian Income Tax Return for Individuals and HUFs. 1 2 Your PAN will be auto-populated Select Assessment Year 3 4 Select ITR form Name as ITR-4 Select Filing Type as applicable. Cash Bank Bal.

General Instructions These instructions are guidelines to help the taxpayers for filling the particulars in Income-tax Return Form-4 for the Assessment Year 2020-21 relating to the Financial Year 2019-20. Latest Update in Form ITR 4. ITR-4 Sugam is not mandatory.

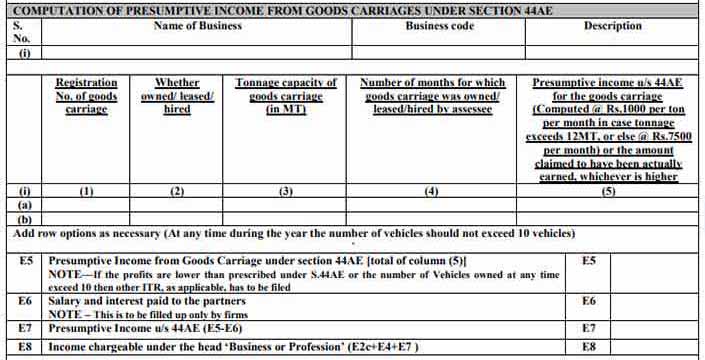

Business income under section 44AD or 44AEb. Instructions for filling ITR-4 SUGAM. Govt has released the official notification ITR forms for latest Income tax return filing.

There is not need to reflect other assets. However in case the assessee keeps and maintains all books of accounts and other documents referred to in section 44AA and also gets his accounts audited and obtains an audit report as per section 44AB filling up the Form ITR-4. ITR-4 SugamForm is an optional simplified return form which can be used by the taxpayer if he can declare profits and gains from business and profession on presumptive basis us 44AD 44ADA or.

CBDT started jhatpat filing processing for ITR-1 and ITR-4. Income tax login id PAN No Date of Birth. Fill ITR 4 under section 44ad.

The ITR form can be filed online by. 5 Select Submission Mode as. Form ITR-4 Sugam is a simplified return form to be used by an assessee at hisher option if the assessee is eligible to declare profits and gains from business and profession on presumptive basis under section 44AD 44ADA or 44AE.

44AD 44ADA or 44AE such as income from speculative business. No audit of the books is required. A complete guide How to fill ITR-4Income Tax return For Individuals and HUFs having income from business profession hereunderThis power point presentation is complete guide and prepared in the directions of Dr V K Singhania In this PPT examples and full explanation to each field has been given and summary of Income how to calculate has also been explained After viewing this.

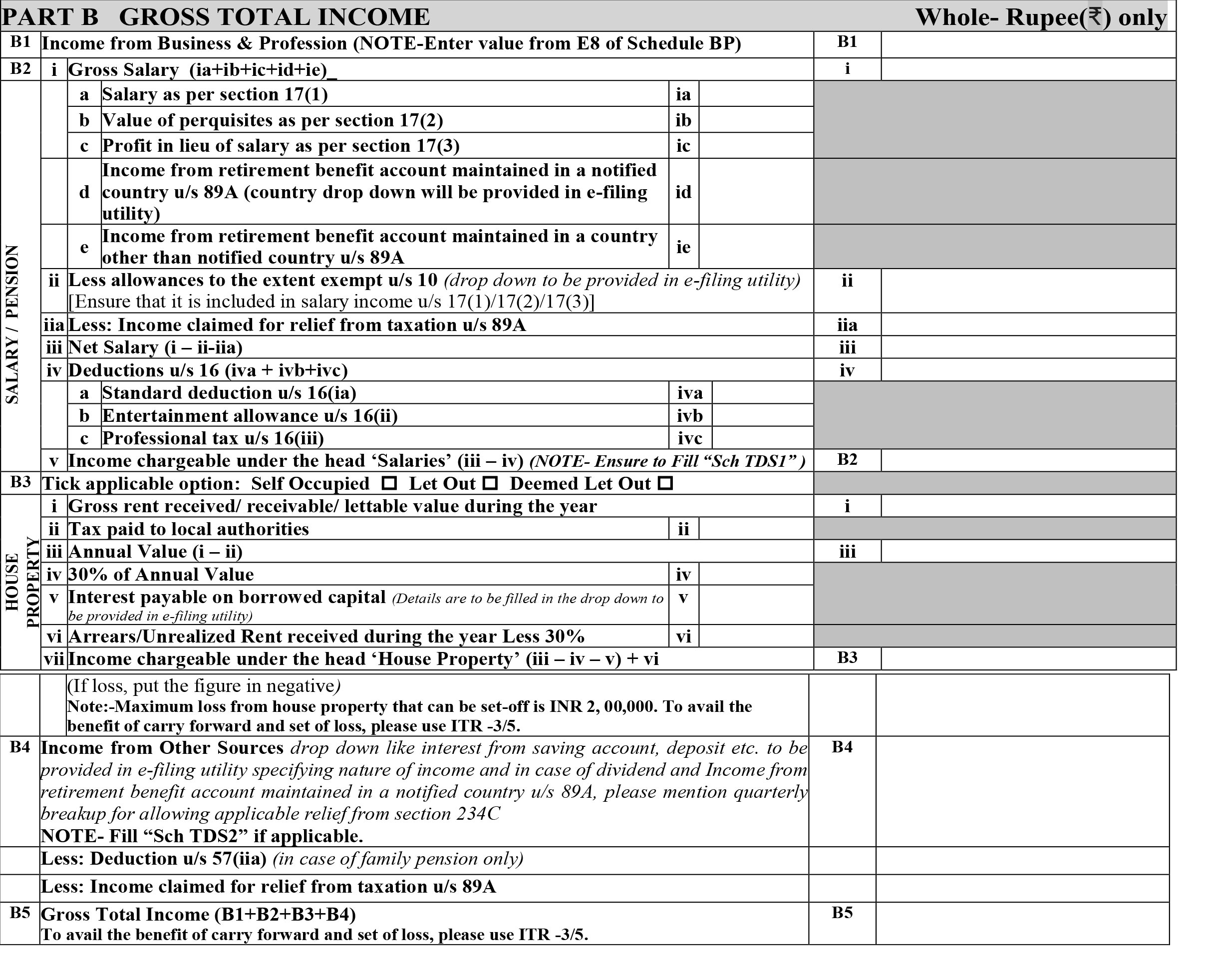

Gross total income through the five income heads. Debtors can be the amount receivable for the month of March. 188 rows These instructions are guidelines to help the taxpayers for filling the particulars in Income.

The first step of filing the ITR-4 form online is to download it from the official website of the Income Tax Department. Presumptive basis under section 44AD 44ADA or 44AE. The structure of the ITR 4 form can be divided into.

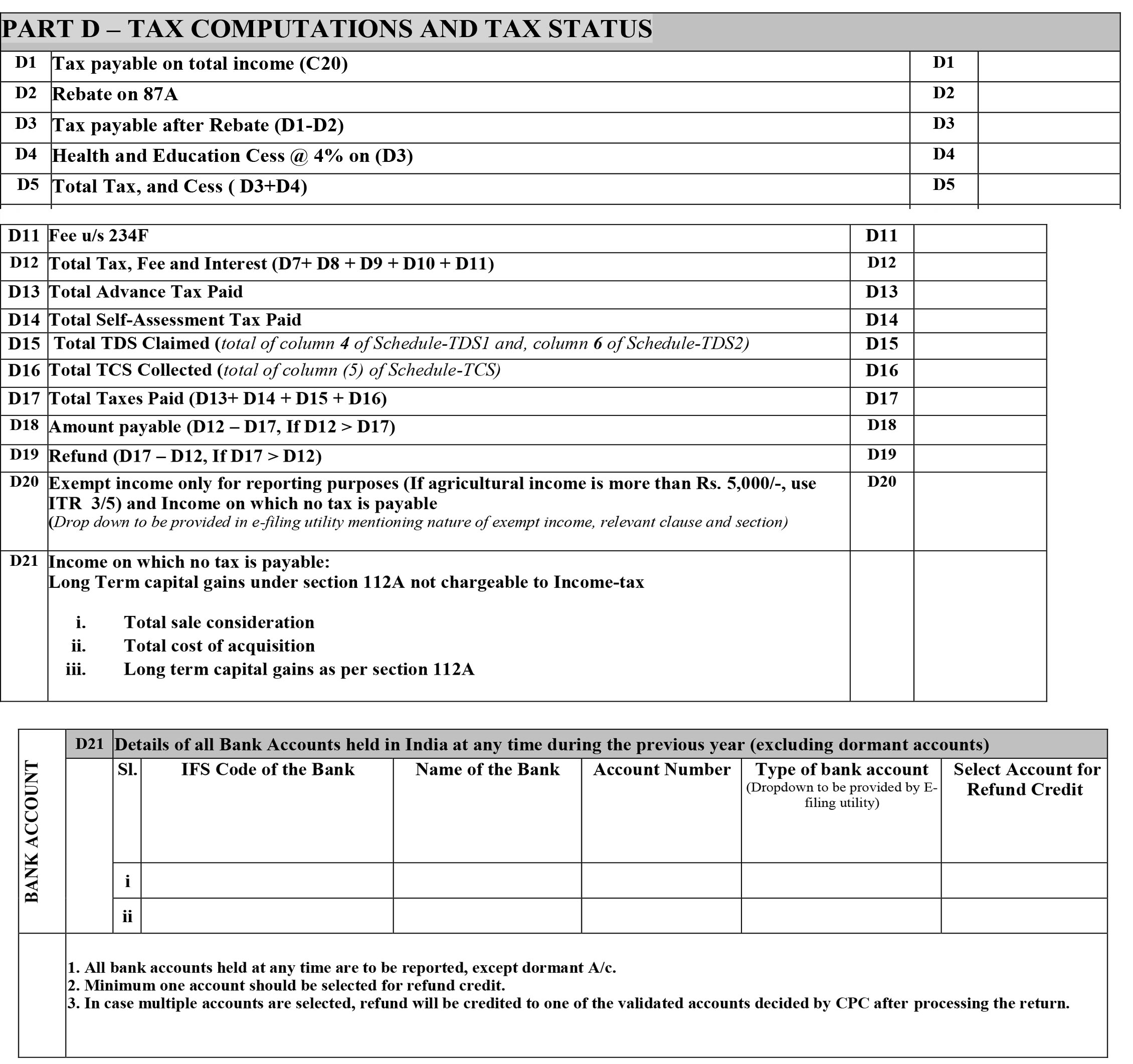

ITR 4 Sugam form can be filed by the individuals HUFs partnership. Who can File the ITR 4 Sugam Form. Tax status and computation.

Click on Income Tax Return Option under e-File menu STEP 5. Part A has 5 sections and Part B has 35 Schedules. Instruction sheets for filling the particulars in Form IT Return 4 for the FY 2019-20.

ITR 4 form has two parts Part A and Part B. ITR 4 is to be filed by the individualsHUF partnership firm whose total income of AY 2020-21 includes. Furnishing the form online along with a Digital Signature or by transmitting the data through electronic means and then submitting the verification form of ITR-V and the third option is verification through a 10-digit code.

Read the steps to fill ITR 4 form online download ITR 4 form. WRT to ITR-4 you can show creditors as 0. How to File Income Tax Return 4SITR 4S US 44AD online on Income Tax portal in 5 minutes.

ITR 4 can be used by an IndividualHUF to report income on presumptive basis as provided under specified sections for example Section 44AD44AE and 44ADA of the Income Tax Act 1961. Can be shown as actual. If your income is less then declared 8 us 44AD you need to maintain proper books and get it audited on the other hand if your net income is more then 8.

Structures of ITR 4 Form. Total taxable income and Deduction. ITR 4 is the form used by the individuals and Hindu Undivided Family having income from proprietary business or profession to declare their Income Tax Return.

Hope your queries are resolved. ITR 4 form for AY 2020-21 has been released online. Details of income from Business.

In case of any doubt.

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

How To File Income Tax Return India If I Left My Job Mid Year To Do Freelancing Consultant Contractor Do I File Multiple Returns Itr 1 And Itr 4 How Can I Get Benefits From

Income Tax Return Itr 4 Filing Form How Do I File My Itr 4 Form

Income Tax Return Itr 4 Filing Form How Do I File My Itr 4 Form

Itr 2 For Financial Year 2019 20 Key Additions

Itr 2 For Financial Year 2019 20 Key Additions

How To Fill Itr 4 For Software Professionals And Consultants Ay 2018 19 Section 44ada Youtube

How To Fill Itr 4 For Software Professionals And Consultants Ay 2018 19 Section 44ada Youtube

Itr 4 Sugam Income Tax Department Income Tax India Efiling Efiler In

Itr 4 Sugam Income Tax Department Income Tax India Efiling Efiler In

Form Itr4 For Individuals Or Hufs With Proprietary Business Or Profession

Form Itr4 For Individuals Or Hufs With Proprietary Business Or Profession

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Itr 4 Sugam Who Can File Who Cannot File Itr 4 How To File Itr 4

Itr 4 Sugam Who Can File Who Cannot File Itr 4 How To File Itr 4

How To E File Itr 4 Sugam For Ay 2020 21 Youtube

How To E File Itr 4 Sugam For Ay 2020 21 Youtube

Https Www Policybazaar Com Income Tax Itr4 Form

Https Www Policybazaar Com Income Tax Itr4 Form

What Is Itr 4 Or Sugam Know How To File Itr 4 Form Fincash Com

What Is Itr 4 Or Sugam Know How To File Itr 4 Form Fincash Com

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21