How Do I Transfer My Llc To A New Owner

The most common mechanism for transferring title from an individual to and LLC is a quit claim deed. Form a new LLC and dissolve the old.

Ep 17 Legal Advice For Solopreneurs New Business Owners Jamie Lieberman Of Hashtag Legal Successful Business Tips Legal Business Llc Business

Ep 17 Legal Advice For Solopreneurs New Business Owners Jamie Lieberman Of Hashtag Legal Successful Business Tips Legal Business Llc Business

How to Transfer Ownership in an LLC.

How do i transfer my llc to a new owner. In addition to the shareholder agreement you must issue the new shares of stock to the new owner. You should put a new shareholder agreement into place that specifies that there is a transfer of the shares of stock to the new owner. An experienced corporate lawyer can help as your company makes changes in ownership or crafts an agreement that aligns with the goals of your owners and investors.

There is nothing you would do with a federal agency regarding transferring ownership of the LLC. Any dramatic changes to ownership organizational structure or business status such as converting a sole proprietorship to a partnership require a new EIN application. LLC limited liability company Business LLC operating agreement.

If the LLC has its own provisions regarding the timing of a vote and the number of votes required to make changes in ownership continue as directed. Once that process is complete you can close the LLC in the previous state. Once you transfer business ownership the company dissolves and the buyer restructures the assets under a new business entity.

When an owner of an LLC or partnership dies this usually dissolves the business. Applying for a New EIN. Sign it date it have it notarized.

However if you inherit a company as a sole proprietor you will need to apply for a new EIN. If the LLC does not have such provisions for adding members California law requires that a majority of current LLC members vote to approve the addition of a new member. How do I transfer title from my name to an LLC.

If you do it through your will youre probably going to have to. File that paperwork along with articles of domestication with your new state. Ultimately the business type and structure determine if a new business owner must apply for a new tax ID number.

Ask a lawyer - its free. After you pass away if you have an intent to transfer the interest after you have died you want to make sure you also do that very formally. Any restructuring of the company requires a new EIN.

I want to make my son the owner of my LLC. When ownership of a business changes hands the new owner must apply for a different business EIN number or tax ID number. To register an LLC as a domesticated LLC in your new state you need to obtain a certificate of good standing from your old state.

You can draft your Operating Agreement to address ownership transfer conditions which then modify the standard state rules. An operating agreement should provide an LLCs members with the rules for transferring ownership interests. How can I transfer ownership of an LLC in New york.

You could that either in a will or in a trust. Some states dictate ownership interests can only be transferred with the unanimous consent of all owners. If you need to transfer ownership within an LLC start by researching your respective states LLC regulations.

A well-drafted operating agreement is crucial. The reason for this is that the specific articles of organization of your LLC will determine if. You will probably need to see an attorney or use a legal service in order to affect a transfer.

Depending on where you live you can download a template and file it with your local county recorders office for a nominal fee usually around 100. When a New EIN Is Required for Your Business. That actually acts as a formal transfer of ownership interest.

Once you separate the debts and other elements that will remain yours you can transfer the doing business as DBA name to the new owner as well as ongoing contracts and property. It formalizes it and makes it very clear what your intent was. All of the documented changes should be kept organized in the corporate kit.

Can I Transfer My Llc To A New State Small Business Tax Business Tax Coaching Business

Can I Transfer My Llc To A New State Small Business Tax Business Tax Coaching Business

The Llc Operating Agreement Sample Operating Agreement Nolo

The Llc Operating Agreement Sample Operating Agreement Nolo

Starting A Wondering How You Should Pay Yourself As A Business Owner This Video Will Show You In 2021 Small Business Planner Llc Business Small Business Organization

Starting A Wondering How You Should Pay Yourself As A Business Owner This Video Will Show You In 2021 Small Business Planner Llc Business Small Business Organization

Transfer Of Ownership Agreement Template Lovely Transfer Business Ownership Agreement Business Ownership Contract Template Lettering

Transfer Of Ownership Agreement Template Lovely Transfer Business Ownership Agreement Business Ownership Contract Template Lettering

How To Transfer Your Llc Business Ownership To Someone Else Connect2capital

How To Transfer Your Llc Business Ownership To Someone Else Connect2capital

It S Tax Time Do You Own An Rv Are You Struggling With What You Can And Can T Deduct On Your Taxes If So Grab Small Business Tax Business Tax Llc

It S Tax Time Do You Own An Rv Are You Struggling With What You Can And Can T Deduct On Your Taxes If So Grab Small Business Tax Business Tax Llc

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Tangible Go Business Tax Irs Gov Broward

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Tangible Go Business Tax Irs Gov Broward

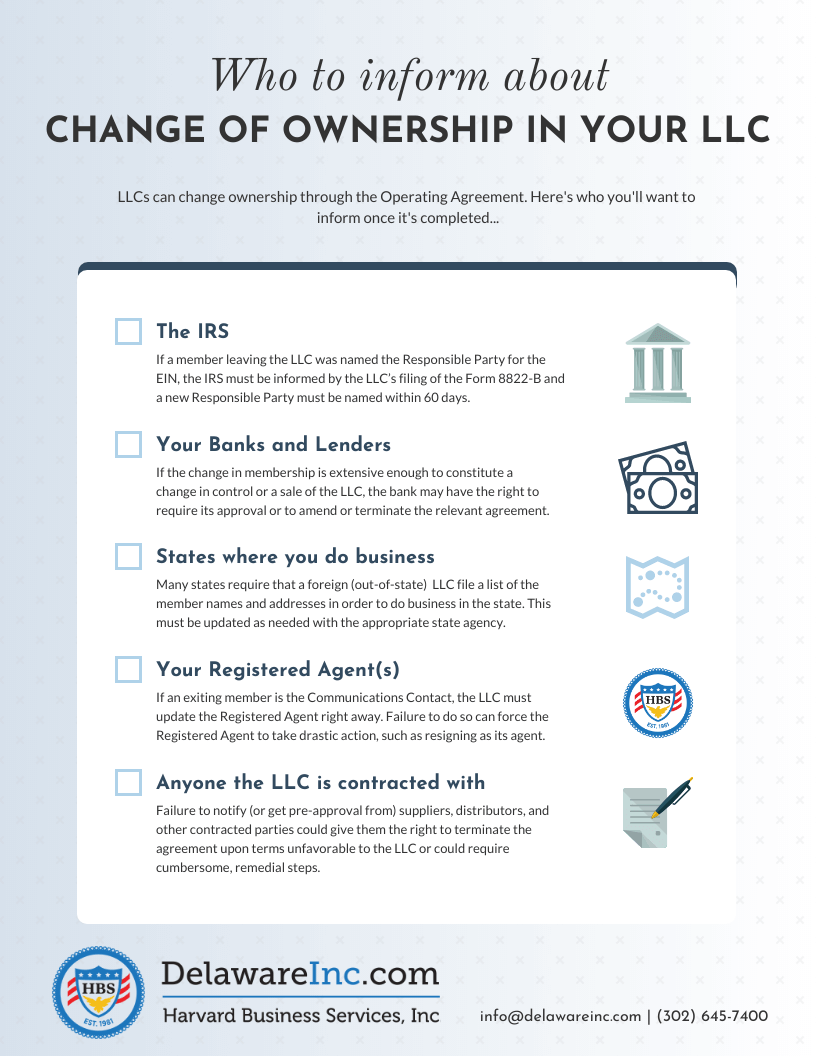

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Can An Llc Transfer To Another State Legalzoom Com

Can An Llc Transfer To Another State Legalzoom Com

4 Simple Steps As Part Of Your Annual Llc Checklist Llc Business Small Business Organization Business Checklist

4 Simple Steps As Part Of Your Annual Llc Checklist Llc Business Small Business Organization Business Checklist

How Do I Add Another Owner To My Llc Legalzoom Com

How Do I Add Another Owner To My Llc Legalzoom Com

Transfer Of Business Ownership Agreement Template Unique Llc Transfer Of Ownership Agreement Sampl Cover Letter Sample Cover Letter For Resume Job Cover Letter

Transfer Of Business Ownership Agreement Template Unique Llc Transfer Of Ownership Agreement Sampl Cover Letter Sample Cover Letter For Resume Job Cover Letter

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Advantages And Disadvantages Of An Llc Website Tips And Tutorials Llc Business Starting A Business Small Business Success

Advantages And Disadvantages Of An Llc Website Tips And Tutorials Llc Business Starting A Business Small Business Success

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

Advantages And Disadvantages Of An Llc Website Tips And Tutorials Llc Business Business Basics Business Tips

Advantages And Disadvantages Of An Llc Website Tips And Tutorials Llc Business Business Basics Business Tips

Llc Vs S Corp How To Choose The Best Small Business Entity Business Checklist Small Business Bookkeeping Small Business Accounting

Llc Vs S Corp How To Choose The Best Small Business Entity Business Checklist Small Business Bookkeeping Small Business Accounting

How Do You Record A Paycheck To Yourself If You Re An Llc Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Llc Business Small Business Finance

How Do You Record A Paycheck To Yourself If You Re An Llc Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Llc Business Small Business Finance

How Much Should You Pay Yourself A Free Calculator Small Business Bookkeeping Small Business Finance Small Business Accounting

How Much Should You Pay Yourself A Free Calculator Small Business Bookkeeping Small Business Finance Small Business Accounting