Can You 1099 Without A Business License

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. If your husband has made income that has been reported to him on a Form 1099-MISC and this income is in his typical line of work this income will be subject to Self Employment Taxes 153 in addition to being taxed at your Federal Tax Rate.

Tell your employer to send you a w2 or your calling.

Can you 1099 without a business license. You do not need to have a business license to file a Schedule C. UpCounsel accepts only the top 5 percent of lawyers to its site. Can I Work As 1099 Without A Business Licence.

If the IRS classifies your business as a hobby youll have to prove that you had a valid profit motive if you want to claim those deductions. In California for example a handyman must have a license for any job over 500 while in Arizona its 750. How do you claim business deductions.

You dont need to issue 1099s for payment made for personal purposes. New Port Richey File DBA. New Port Richey Start a Business.

If you need help with a 1099 contractor needing a business license you can post your job on UpCounsels marketplace. You can change the way you write off your business expenses and the amount of taxable income you show. New Port Richey TaxID.

For example if you earned less than 600 from a side gig in 2020 the payer doesnt have to send you a 1099 form but you still have to report the earnings. If you deduct the expenses related to this income via a Schedule C every dollar you add of expense will. Operating a business without a license can be considered to be fraudulent activity so some jurisdictions might decide to arrest the parties responsible.

If your husband has made income that has been reported to him on a Form 1099-MISC and this income is in his typical line of work this income will be subject to Self Employment Taxes 153 in addition to being taxed at your Federal Tax Rate. If the following four conditions are met you must generally report a payment as nonemployee compensation. It may also specify the kind of work you can do without a license.

Your basically committing fraud with a signature. You can file your tax return without 1099 forms. If you use this method you must keep records of your actual cost.

Its important to be aware that each state has different licensing laws and criteria. Can I Work As 1099 Without A Business Licence. Yes you can file a tax return without obtaining a business license.

Additionally if youre in a field like medicine or law practicing without a license is illegal and can result in arrest. However all you need is one irritated neighbor to complain and your business operations could be disrupted. 1099s are from one business to another.

Can I Work As 1099 Without A Business Licence small appliance repair. Failing to do so can result in penalties and fines. If you are self-employed you can start with Form 1040-ES Estimated Tax for Individuals and then file the other necessary forms with your 1040 Form during the tax season.

The IRS has several ways of tracking your earnings via Form 1099. You can figure all your travel meal expenses using either of the following methods. Expect to get one if you sold.

If you file it. Generally reimbursed meal expenses are deductible if your business trip is overnight or long enough that you need to stop for substantial sleep or rest to properly perform your duties. Get Licening for my small appliance repair tax id in 34653 New Port Richey Can I Work As 1099 Without A Business LicenceTax ID Registration Requirements for small appliance repair in New Port Richey.

If your business claims a net loss for too many years or fails to meet other requirements the IRS may classify it as a hobby which would prevent you from claiming a loss related to the business. Therefore if you earned money at a side job during the tax year you should report your earnings to the IRS. New Port Richey Business License.

Limited Liability Co LLC Licenses Business Permit LLCs and or Fictitious Business Name Required To Start Your Own Business. In other words youll likely work in peace without the need for a business license as long as youre preserving the sanctity of your immediate environment. How are you running a legal business.

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. IF you are not a registered business with the state and dont have a sales tax permit. You do not need to have a business license to file a Schedule C.

Alternatively you can amend previous tax returns to show higher income from the past. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax. As a self-employed individual generally you are required to file an annual return and pay estimated tax quarterly.

You should file a Schedule C.

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

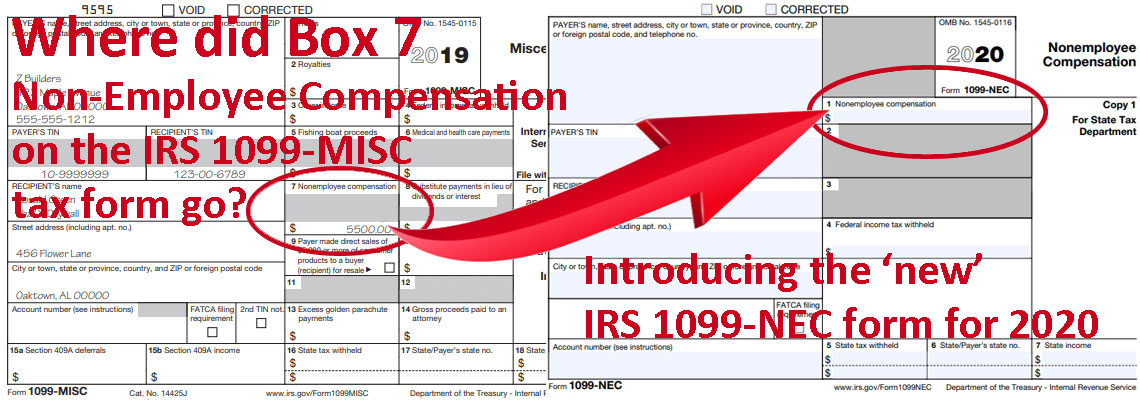

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

The Most Common 1099 Tax Deductions For Independent Contractors In 2019 Money Mimosas Tax Deductions Deduction Tax Deductions List

The Most Common 1099 Tax Deductions For Independent Contractors In 2019 Money Mimosas Tax Deductions Deduction Tax Deductions List

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Fill Ss4 Form Online Make Tax Return Process More Simpler Financial Information Online Application Limited Liability Company

Fill Ss4 Form Online Make Tax Return Process More Simpler Financial Information Online Application Limited Liability Company

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Tax Document Income Statement Income Tax

1099 Tax Document Income Statement Income Tax

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

1099 Employees Need A Business License Quickbooks First Class Flights Enterprise

1099 Employees Need A Business License Quickbooks First Class Flights Enterprise