Best Business Insurance For Sole Proprietor

Enjoy the freedom and flexibility of your business without losing sleep over being bankrupted by a lawsuit. Youre considered self-employed if you have a business that takes in income but doesnt have any employees.

Llc Vs Sole Proprietorship Vs S Corp Limited Liability Corporation S Corporation Smllc Sole Proprietorship S Corporation Sole Proprietor

Llc Vs Sole Proprietorship Vs S Corp Limited Liability Corporation S Corporation Smllc Sole Proprietorship S Corporation Sole Proprietor

Kim is a sole proprietor who pays 10000 each year for health insurance.

Best business insurance for sole proprietor. It is not a separate entity. Take a look at the most common business insurance policies for sole proprietorships. Self-employed health insurance deduction example.

While all the above ways can protect a sole proprietor and hisher business from liability the most effective and inexpensive way of liability protection is to effectively change the business from a sole proprietorship to a Limited Liability Company LLC. If the answers to these questions are mostly yes it is possible your sole proprietorship has a qualified employee. The owner has unlimited liability for any and all business obligations resulting in the owners personal assets being at risk.

As a sole proprietor your odds of staying in business without insurance are infinitesimal if you get taken to court. Create an LLC. They can help you determine which structure will be best for you.

Sole proprietors have the same legal liabilities corporations do and they are generally eligible for protections with most small business insurance policies. For example if a service they perform for a client has a negative financial impact or causes property damage the client could take legal action. The business is part of the individual.

So if a client has a valid EO claim that exceeds your limits your personal assets are at risk. Unlike other types of small businesses there is no legal division between you as the owner and your business as an entity within the context of a sole proprietorship so any lawsuit could prove financially. If youre self-employed you can use the individual Health Insurance Marketplace to enroll in flexible high-quality health coverage that works well for people who run their own businesses.

You can purchase a CGL policy as a standalone policy or as part of a policy with broader coverage. According to the IRS youre self-employed if you run a trade or business as an independent contractor a sole proprietor or as a member of a partnership or if youre in business for yourself including having a part-time business. Thats why were here to help.

Data breach insurance which helps protect your sole proprietorship from hacking and other data breaches. Sole proprietorships are easy to set up and run. Legally there is no distinction between the proprietor.

However for business owners who run a sole proprietorship purchasing insurance is more than a precaution. General liability insurance is a must-have for most small business owners. Business Owners Policy BOP which bundles business property and business liability insurance into one policy.

Commercial property insurance to help protect your business and its physical assets from fire theft or other covered losses. A sole proprietorship is a business owned and operated by one person. Simply Business insurance policies for sole proprietorships offer professional liability and general liability through its network of national providers.

Her business earns approximately 50000 in profit each year. Policies like small business interruption and professional liability insurance will cover your legal fees and keep your business afloat if someone tries to take you for all youve got. If LLCs are so much more work why doesnt every single-member business choose to.

She may deduct her 10000 annual health insurance expense from her gross income for federal and state income tax purposes. Its an absolute necessity. Sole proprietorship insurance Sole proprietorships and liability.

Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection. If youre strictly working nights and weekends out of your home the risk of a potential lawsuit is fairly low but it does still exist. In this case you may be eligible for group health insurance for your business.

With Sole Proprietorship Insurance in Canada you can protect yourself from risk and still choose the business structure that makes the most sense for your business. Small Business Administration SBA considers a sole proprietor as an unincorporated business. An LLC comes with numerous benefits not only to the business but to you as the business owner.

No matter what type of business you run a licensed insurance broker can help you find the best group plan at the right price. Sole Proprietorship As a sole proprietorship there is no differentiation between the agency owner and the business. All assets and income of the business belong to the proprietor.

General liability insurance for sole proprietors provides coverage against costs associated with third-party accidents property damage and bodily injury to third parties like customers or vendors. If a single person owns and operates a business and hasnt registered it as any other business entity it is a sole proprietorship. Commercial General Liability Insurance for Sole Proprietors Your Commercial General Liability Insurance CGL is the foundation for a well-planned insurance coverage strategy.

It can help you respond to a breach by paying to notify impacted. Start with the basics.

Best Gst Registration At Kolkata Business Insurance Professional Liability Limited Liability Partnership

Best Gst Registration At Kolkata Business Insurance Professional Liability Limited Liability Partnership

Does A Sole Proprietor Need Professional Liability Insurance Sole Proprietor Business Liability Insurance Business Insurance

Does A Sole Proprietor Need Professional Liability Insurance Sole Proprietor Business Liability Insurance Business Insurance

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

Reasons To Consider Business Insurance Providers Business Insurance Commercial Business Insurance Small Business Insurance

Reasons To Consider Business Insurance Providers Business Insurance Commercial Business Insurance Small Business Insurance

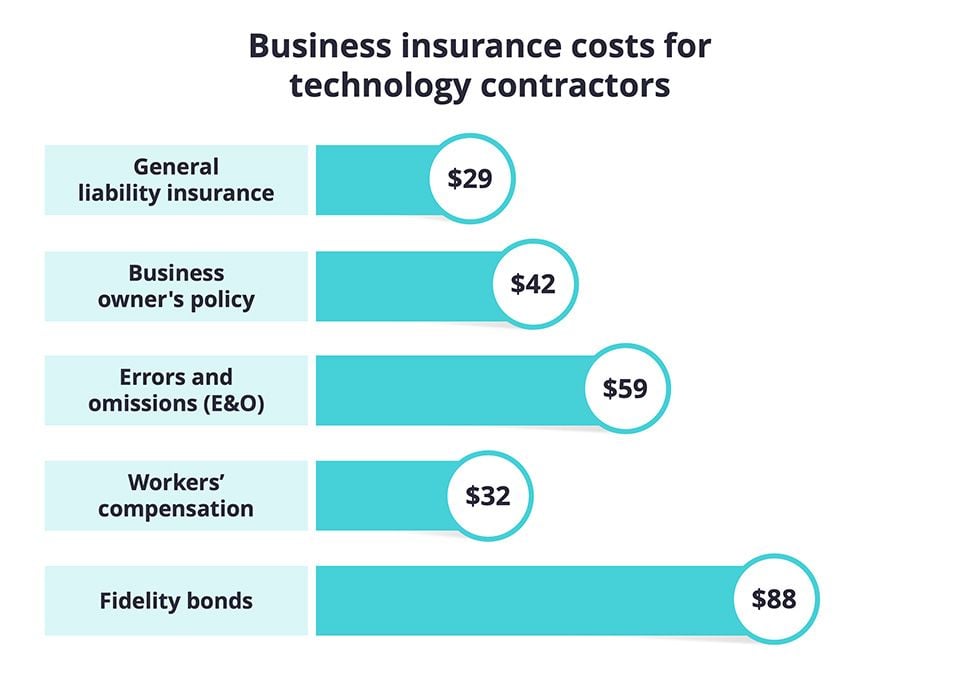

How Much Does Independent Contractor Insurance Cost Techinsurance

How Much Does Independent Contractor Insurance Cost Techinsurance

Which Insurance Policies Do Sole Proprietors Need Insureon

Which Insurance Policies Do Sole Proprietors Need Insureon

12 Ways To Improve Your Cash Flow Business Insurance Commercial Insurance Small Business Social Media

12 Ways To Improve Your Cash Flow Business Insurance Commercial Insurance Small Business Social Media

Starting A New Business As A Sole Proprietorship In 10 Steps Mui Tsun Sole Proprietorship Starting A Business Business Bank Account

Starting A New Business As A Sole Proprietorship In 10 Steps Mui Tsun Sole Proprietorship Starting A Business Business Bank Account

The Complete Guide To Small Business Insurance

The Complete Guide To Small Business Insurance

Work With An Independent Agent To Get The Best Pricing On Liability Insurance For Independent C Liability Insurance Small Business Insurance Business Insurance

Work With An Independent Agent To Get The Best Pricing On Liability Insurance For Independent C Liability Insurance Small Business Insurance Business Insurance

Sole Proprietorships Guide Advantages And Disadvantages On Startup Trove Sole Proprietorship Sole Proprietor Sole

Sole Proprietorships Guide Advantages And Disadvantages On Startup Trove Sole Proprietorship Sole Proprietor Sole

This Is A Great Podcast Explaining When You Need To Have Liability Insurance For Your Tutoring Busines Liability Insurance Tutoring Business Business Insurance

This Is A Great Podcast Explaining When You Need To Have Liability Insurance For Your Tutoring Busines Liability Insurance Tutoring Business Business Insurance

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Start A Business Choose The Best Type Of Business Structure Llc C Corporation S Corporation Sole Pro Business Structure Sole Proprietorship S Corporation

Start A Business Choose The Best Type Of Business Structure Llc C Corporation S Corporation Sole Pro Business Structure Sole Proprietorship S Corporation

4 Types Of Businesses Business Basics Business Skills Business Savvy

4 Types Of Businesses Business Basics Business Skills Business Savvy

Spreadsheet Property Management Free Download Auto Insurance For Car Insurance Card Template Download Best Bu Card Templates Free Card Template Car Insurance

Spreadsheet Property Management Free Download Auto Insurance For Car Insurance Card Template Download Best Bu Card Templates Free Card Template Car Insurance

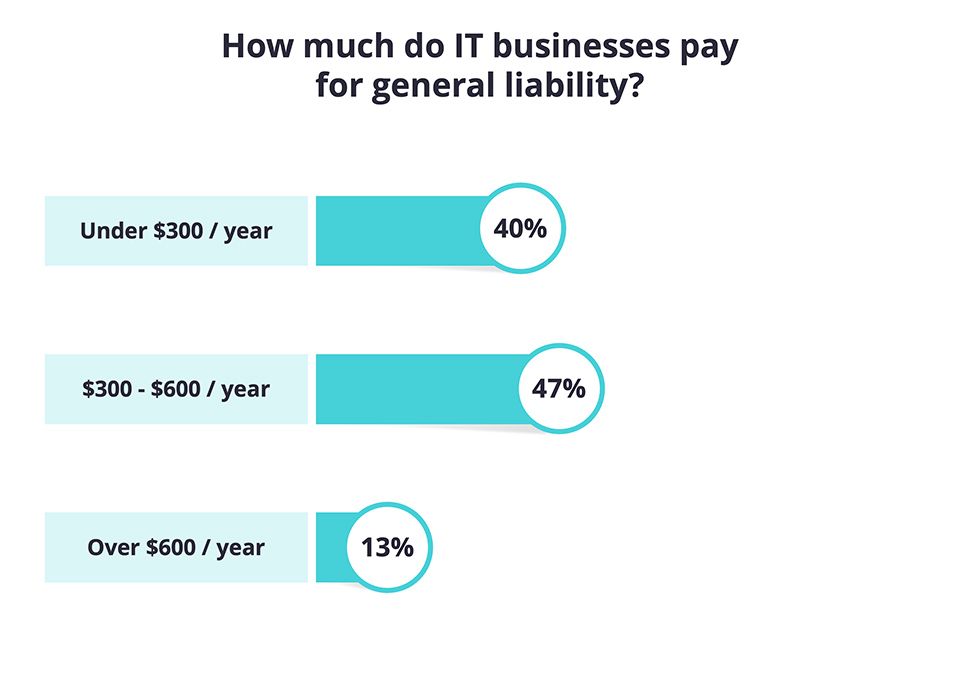

Commercial General Liability Insurance Cost Techinsurance

Commercial General Liability Insurance Cost Techinsurance

Browse Our Image Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

Browse Our Image Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor