Who Can A Business Use To Sign Off And Lodge Their Activity Statements

For example if you lodge through Online services for business your next statement will be available there. Individuals and sole traders who have a myGov account linked to the ATO can lodge view and revise their activity statements.

Cash Drawer Count Sheet Template Fresh Cash Register Countet Template Printing Pinterest Drawer Counting Cash Out Sheet

Cash Drawer Count Sheet Template Fresh Cash Register Countet Template Printing Pinterest Drawer Counting Cash Out Sheet

Its a well known fact that almost everyone can prepare and lodge the Business Activity Statement BAS.

Who can a business use to sign off and lodge their activity statements. How you lodge your BAS determines how you receive statements. Utilize our custom online printing and IT services for small. Begin the complimentary closing on a new line after the last paragraph of the body of your message.

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. A business activity statement is a report that is submitted by a business to the Australian Taxation Office ATO. Others however who fit certain criteria see below dont have to register but can still prepare and lodge BAS.

Use these tips to professionally format the end of your business letter. This is a Business Activity Statement which issued monthly or quarterly so you can report on Goods and Services Tax GST Pay As You Go PAYG instalments PAYG withholding tax and any other tax obligations that you have as a business. Individuals and sole traders can also lodge their BAS and pay online through a myGov account that is linked to the ATO.

Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. If a specific volume or frequency is not stated then evidence must be provided at least once. Those who charge a fee for this task must become registered with the Tax Practitioners Board TPB as stipulated by the TASA 2009 legislation.

This will make it easier for you to lodge your activity statement via the Business Portal. If you use our online services we will notify you by email 21 days before the due date when your BAS is available so make sure your contact details are up to date. Online through the Business Portal or Standard Business Reporting SBR software.

They have authorised the tax agent or BAS agent to lodge the document on their behalf and. Goods and services tax GST pay as you go PAYG instalments. Present business activity statements for verification and approval.

61 Check activity statement and ensure sign-off by authorising person required by statutory legislative and regulatory requirements. Not everyone needs to lodge one. You have probably found that running a business means learning a lot of new acronyms one of the most common being a BAS.

The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. The information is true and correct. On the basis of this report various business taxes are paid to the relevant tax.

You can use the Business Portal to lodge and revise most types of activity statements. From basic office supplies such as printer paper and labels to office equipment like file cabinets and stylish office furniture Office Depot and OfficeMax have the office products you need to get the job doneMaintain a well-stocked office breakroomSave on printer ink and toner to keep your office efficient and productive. If you are registered through the ATOs business portal or have Standard Business Reporting SBR enabled accounting software you can lodge your statement using either of those methods.

27 Mar 2020 QC 26962. The Business Portal is a free secure website for managing your business tax affairs with us. Complete and return by the due date on your BAS along with any payment due.

If the letter is in a block format all lines flush with the left margin the closing line should also begin on the left. You will only be required to lodge. There are two types of activity statements an instalment activity statement IAS and a business activity statement BAS.

Use it to lodge activity statements request refunds and more. Through a registered tax or BAS agent. Were introducing changes from 1 July 2017 to support the Simpler BAS changes.

Your BAS will help you report and pay your. You can lodge your BAS. For registered tax agents or BAS agents to be able to lodge and electronic activity statements or tax returns on behalf of a client they needed to have a signed declaration from the client stating that.

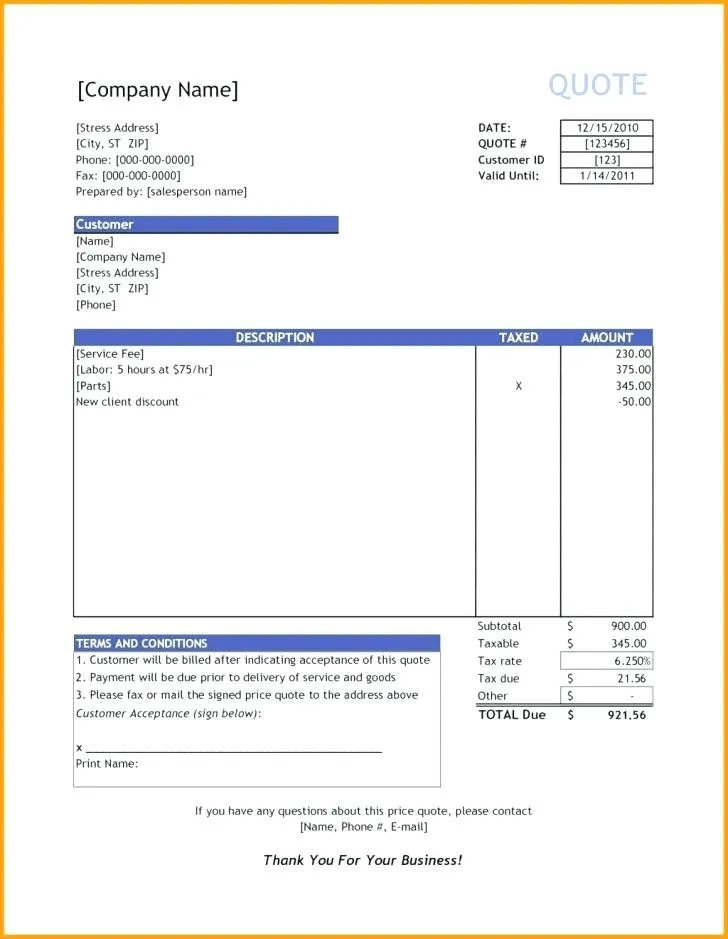

Create A Quote In 8 Simple Steps A Guide For Small Businesses

Create A Quote In 8 Simple Steps A Guide For Small Businesses

Profit Loss Statement Example Fresh Profit And Loss Statement P L Profit And Loss Statement Statement Template Profit

Profit Loss Statement Example Fresh Profit And Loss Statement P L Profit And Loss Statement Statement Template Profit

Industry Analysis Example Pdf Sample In Business Plan For A Throughout Industry Analysis Report Template Financial Statement Analysis Analysis Stock Analysis

Industry Analysis Example Pdf Sample In Business Plan For A Throughout Industry Analysis Report Template Financial Statement Analysis Analysis Stock Analysis

Chase Online Chase Bank Homepage With Paperless Statement Sweepstakes Click To Chase Bank Chase Online Paperless

Chase Online Chase Bank Homepage With Paperless Statement Sweepstakes Click To Chase Bank Chase Online Paperless

Create A Quote In 8 Simple Steps A Guide For Small Businesses

Create A Quote In 8 Simple Steps A Guide For Small Businesses

Memorandum Yahoo Search Results Yahoo Image Search Results Memo Template Memo Memorandum

Memorandum Yahoo Search Results Yahoo Image Search Results Memo Template Memo Memorandum

Open Concept Barndominium Floor Plans Barndominium Floor Plans Floor Plans Barndominium

Open Concept Barndominium Floor Plans Barndominium Floor Plans Floor Plans Barndominium

I Messages I Statements Small Problems Digital Lesson Video Social Emotional Learning Activities Social Skills Lessons School Counseling Activities

I Messages I Statements Small Problems Digital Lesson Video Social Emotional Learning Activities Social Skills Lessons School Counseling Activities

Hr Templates Free Premium Templates Free Premium Templates Human Resource Management Templates Policy Template Employee Recognition

Hr Templates Free Premium Templates Free Premium Templates Human Resource Management Templates Policy Template Employee Recognition

Grant Financial Report Template Fresh Munitynet Aotearoa Financial Reporting In 2021 Excel Templates Statement Template Account Reconciliation

Grant Financial Report Template Fresh Munitynet Aotearoa Financial Reporting In 2021 Excel Templates Statement Template Account Reconciliation

How To Price Your Products Money Mindset Sucess Entrepreneurial

How To Price Your Products Money Mindset Sucess Entrepreneurial

Red Flags That Can Trigger An Ato Audit Audit Red Flag Trigger

Red Flags That Can Trigger An Ato Audit Audit Red Flag Trigger

Get The Best Tax Returns By Taking The Service Of Tax Adviser Accounting Interview Questions Bookkeeping Services Accounting

Get The Best Tax Returns By Taking The Service Of Tax Adviser Accounting Interview Questions Bookkeeping Services Accounting

Improve Your Business Performance With Professional Business Accountant Accounting Business Performance Accounting Firms

Improve Your Business Performance With Professional Business Accountant Accounting Business Performance Accounting Firms

Etsy Your Place To Buy And Sell All Things Handmade Farmhouse Kitchen Signs Farmhouse Signs Diy Kitchen Signs

Etsy Your Place To Buy And Sell All Things Handmade Farmhouse Kitchen Signs Farmhouse Signs Diy Kitchen Signs

Cdl Driver Resume Sample Resume Companion Dentist Resume Sample Resume Dental Hygienist Resume

Cdl Driver Resume Sample Resume Companion Dentist Resume Sample Resume Dental Hygienist Resume

The Cycle Of Business Intelligence Business Intelligence Business Intelligence Tools Visual Analytics

The Cycle Of Business Intelligence Business Intelligence Business Intelligence Tools Visual Analytics

Fun Fact Fun Facts Millennials Fun

Fun Fact Fun Facts Millennials Fun