How Long To Get Funds From Sba Disaster Loan

Find an SBA loan from top providers. If youre not familiar with the loan yet you can read our complete guide in just 6 minutes.

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

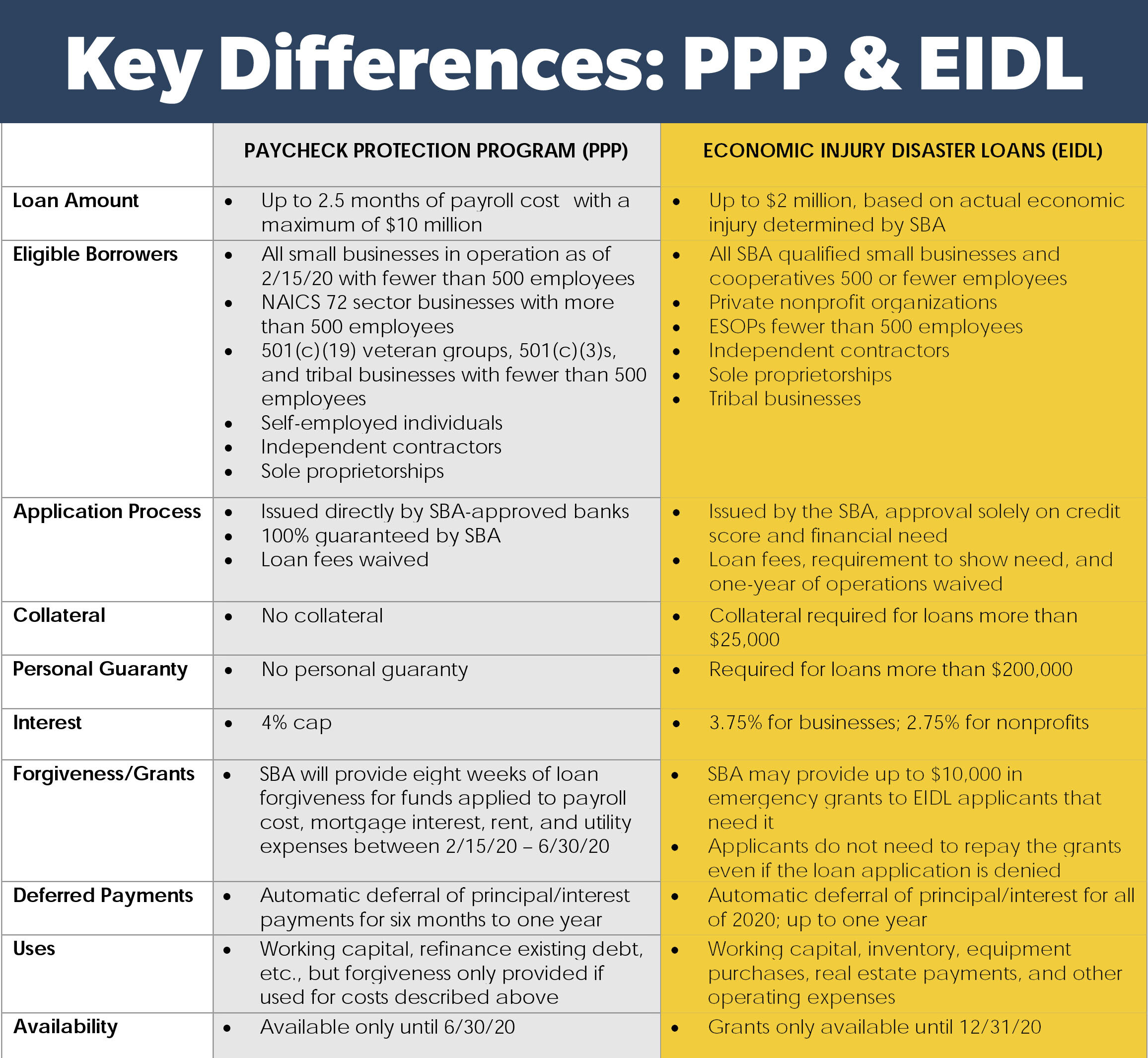

Luckily the SBA has created a separate COVID-19 Disaster Loan with less stringent eligibility criteria and a streamlined application process to hopefully make more funds available for more businesses.

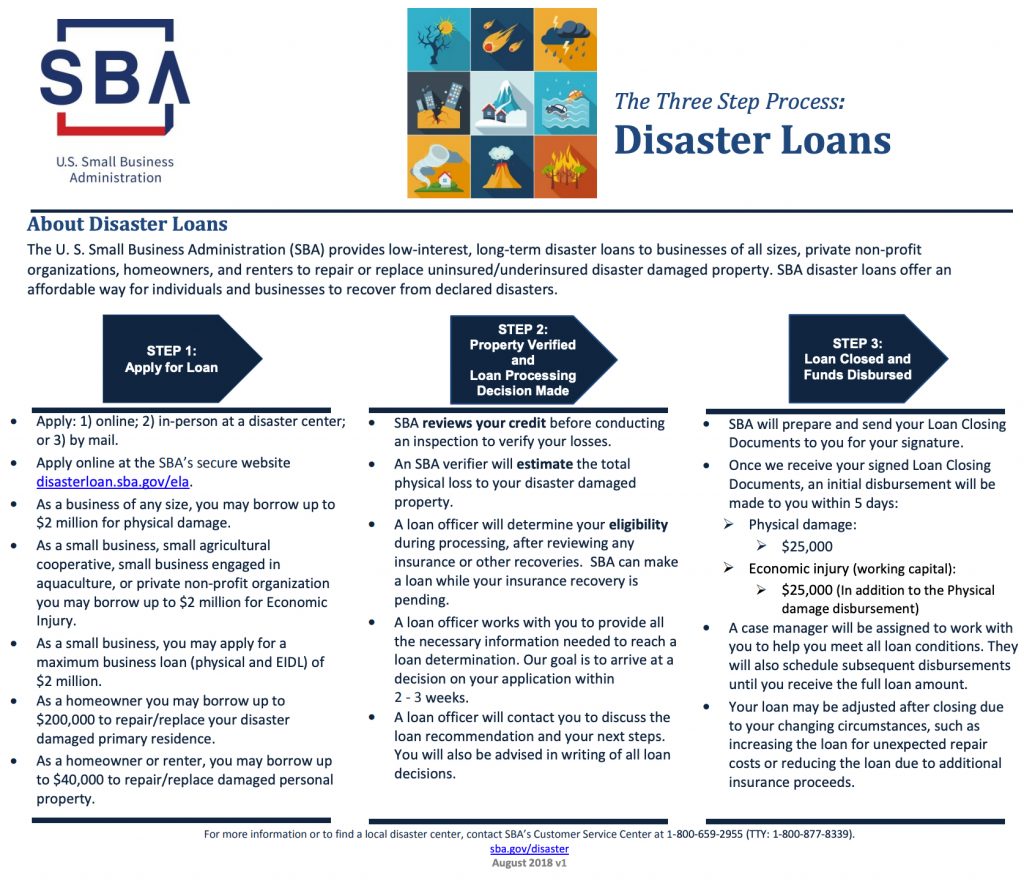

How long to get funds from sba disaster loan. The SBA Economic Injury and Disaster Loan EIDL is a low-interest loan for small businesses affected by COVID-19. If you are already paying on an existing SBA disaster loan SBA is offering an automatic deferment to the borrowerslocated in the federal disaster areas or in contiguous counties and parishes also effective 083117. EIDL funds cannot pay-off old debts refinance another debt or buy capital assets new construction vehicles etc.

How many people will be helped by the SBA Loan Payment Deferment. This will help you demonstrate how you used EIDL funds ifwhen. Small Business Administration Disaster Assistance Processing and Disbursement Center 14925 Kingsport Road Fort Worth Texas 76155.

Federal SBA Disaster Loans and Emergency Grants COVID-19 The US. By law SBA disaster loans cannot compete with private sector lending. The EIDL is a low-interest long-term loan for small business owners that have been impacted by COVID.

These loans offer low fixed rates and repayment terms up to 30 years. More information on this program is posted on. If your business is in financial trouble not due to a natural disaster or a national economic event like the COVID-19 pandemic it may still be difficult to be approved an SBA loan.

Small Business Administration is offering a low-interest federal disaster loans and a one-time emergency grant of up to 10000 for working capital to small businesses and private non-profits suffering substantial economic injury as a result of the Coronavirus COVID-19. One of the. Do not comingle EIDL with other funds.

According to the SBA you should send your application number and information required to overcome the reason for decline via email to pdcreconssbagov or mail to the US. Keep your EIDL funds in a separate account. SBA disaster loans are only available by applying on the Small Business Administrations websiteBut if youre interested in a non-disaster SBA loan you can apply by clicking on one of the lenders in the table below.

Heres how to apply for the loan and fill out your application. Businesses with fewer than 500 employees certain nonprofits and agricultural businesses can apply and be approved if they meet all criteria set by the SBA.

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Announces Extension Of Economic Disaster Loans The Business Journal

Sba Announces Extension Of Economic Disaster Loans The Business Journal

Covid 19 Disaster Loans Available Now To Wyoming Small Businesses Wyoming Sbdc Network

Covid 19 Disaster Loans Available Now To Wyoming Small Businesses Wyoming Sbdc Network

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Small Business Disaster Loan Information Veterans In Business Network

Sba Small Business Disaster Loan Information Veterans In Business Network

Sba Has Slashed The Maximum Available On Economic Injury Disaster Loans Newsday

Sba Has Slashed The Maximum Available On Economic Injury Disaster Loans Newsday

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

Sba Disaster Loan Information Kentucky Chamber

Sba Disaster Loan Information Kentucky Chamber

Sba To Increase Lending Limit For Covid 19 Economic Injury Disaster Loans New Jersey Business Magazine

Sba To Increase Lending Limit For Covid 19 Economic Injury Disaster Loans New Jersey Business Magazine

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Emergency Funding For Small Business How To Qualify Funding Circle

Emergency Funding For Small Business How To Qualify Funding Circle

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf