Which Of The Following Information Is Contained In A Payroll Register

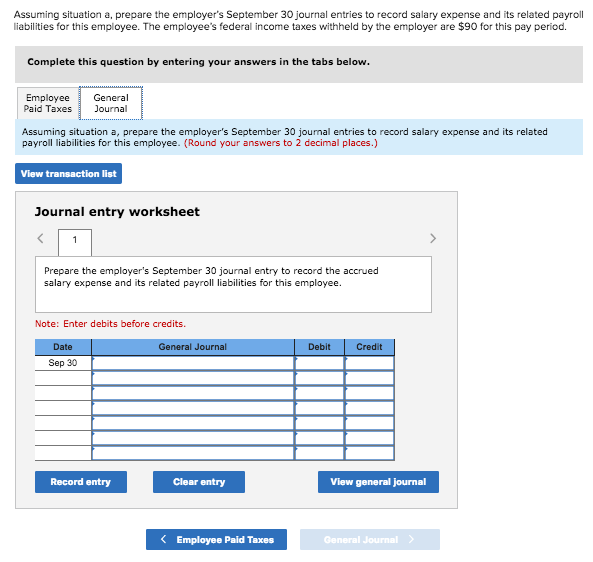

The totals on this register can be used as the basis for a payroll journal entry. Medicare tax withheld 4035.

In Quickbooks W2 Forms Is A Very Important Accounting Platform In Which Users Can Record All The Information Regarding Em Quickbooks Quickbooks Payroll Print

In Quickbooks W2 Forms Is A Very Important Accounting Platform In Which Users Can Record All The Information Regarding Em Quickbooks Quickbooks Payroll Print

The Social Security tax rate is 62 percent and the Medicare tax rate is 145 percent.

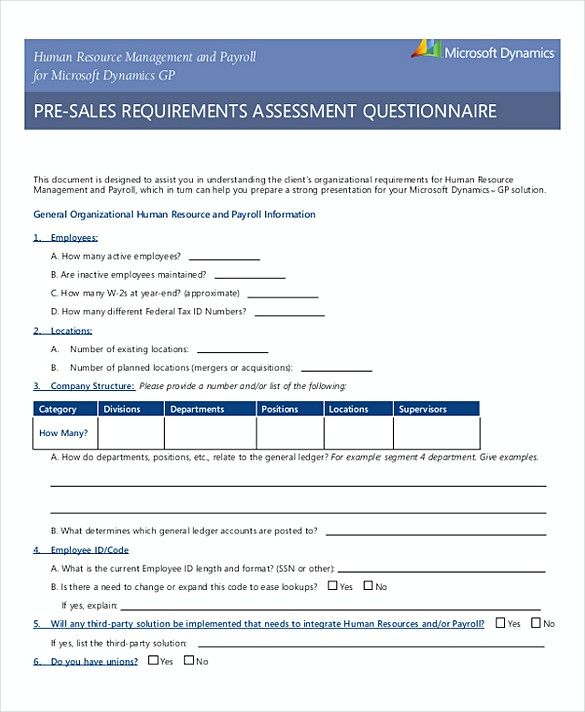

Which of the following information is contained in a payroll register. Supervisory review of payroll register and other reports. A company showed the following information in its payroll register for the week ended March 16 2018. A the employees name social security number and address B the name of the firm and the payroll accountant C the beginning and ending dates of the pay period D the total gross pay deductions and net pay during the period.

For agencies that use pay locations there will both be an agency total and totals by pay location. D the total gross paydeductionsand net pay during the period. In other words a payroll register is the document that records all of the details about employees payroll during a period.

The payroll register contains ______________________________________. NOW Solutions recommends that you print this register after all payroll checks are printed and retain it as a permanent record of the final payroll. Fill in the rest of the employee information.

Social Security tax withheld 17253. The report contains the following information. Employees are paid time-and-a-half for work in excess of 40 hours per week.

The information stated in a payroll register can include the following. Enter R for resident or NR for nonresident of the state where the income is paid. Wider range of benefits.

Aregular rate of pay. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. This register is printed after checks are printed.

The payroll register contains ________. The payroll register will include a recap page with a list of totals. Total Earnings Total to Clearing House Total Employer Benefits Total Agency Costs This Payroll and Total Deductions.

The Payroll Proof Register contains the same information as the Payroll Proof Report plus the check number assigned to each employee. F ields included on the report are. Employee social security number.

Other types of hours worked. Payroll liability voucher number employee number andor payroll liability vendor code liability vendor andor employee payee name and check amount. Frees up computer resources.

You can think of it as a summary of all the payroll activity during a period. In other words a payroll register is the document that records all of the details about employees payroll during a period. Should be created with the idea that the employers will verify the information contained on them.

Complete the payroll register. The payroll register for Candlelight Corporation contained the following totals at the end of July. A the employees namesocial security numberand addressB the name of the firm and the payroll accountantC the beginning and ending dates of the pay period.

Medical insurance deductions 9600. And wages subject to unemployment taxes 171720. Sales Salaries Expense300000 Federal Income Taxes Payable 60000 Social Security Taxes Payable 18600 employee Portion Medicare Tax Payable 4350 employee Portion Medical Insurance.

The main kinds of information contained in a payroll register include period covered by the payroll name of each employee marital status and number of withholding allowances for each employee a record of time worked regular hours and overtime hours regular and overtime pay rates total earnings deductions from total earnings net pay for each worker and taxable earnings columns. A typical register starts with details about each employee including their name social security number birthdate and employee number. Federal income taxes withheld 71163.

Year-to-date deposit information including the total amount withheld and the total amount due to the provincial government. Current month-to-date quarter-to-date and year-to-date totals for taxable wages and tax amounts withheld for provincial taxes and pension deductions. All of the above.

The report can be reached by selecting Reports Payroll Payroll Register Pre-Pay Check Listing Report and can be created as a PDF or Excel file. This information is the employees full legal name which is used on their annual tax filings and their residency. Fill out the first part of the payroll book or register.

Taxable earnings for federal and state unemployment are based on the first 7000. Deductions Pay Sales Salaries Expense 175000 Distribution Office Salaries Shop Salaries Expense Expense EI Premium Income Taxes 2905 35168 3237 47010 3735 56815 2656 25637 12533 164629 Medical Insurance 3500 4750 5250 2500 16000 CPP 8329 9319 10804. State income taxes withheld 11727.

Which of the following type of information is not provided on a payroll register. Starbucks Companys Payroll Register Contained The Following Information. Crecord of time worked.

Payroll service bureaus and professional employer organizations offer the following advantages. You can think of it as a summary of all the payroll activity during a period.

Quickbooks Pro Accounting Software Features Services Quickbooks Quickbooks Pro Accounting Software

Quickbooks Pro Accounting Software Features Services Quickbooks Quickbooks Pro Accounting Software

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

Federal Payroll Tax Form Payroll Taxes Tax Forms Payroll

Federal Payroll Tax Form Payroll Taxes Tax Forms Payroll

Quickbooks Payroll Need The Following Information To Set Up Your Desktop Or Online Payroll Account After That Quickbooks Quickbooks Payroll Payroll Accounting

Quickbooks Payroll Need The Following Information To Set Up Your Desktop Or Online Payroll Account After That Quickbooks Quickbooks Payroll Payroll Accounting

Vehicle Fire Investigation Report Sample Examples Template Regarding Sample Fire Investigation Report T Report Template Book Report Templates Business Template

Vehicle Fire Investigation Report Sample Examples Template Regarding Sample Fire Investigation Report T Report Template Book Report Templates Business Template

Solved Use The Following Information To Answer Questions Chegg Com

Solved Use The Following Information To Answer Questions Chegg Com

Solved Use The Following Information To Answer Questions Chegg Com

Solved Use The Following Information To Answer Questions Chegg Com

6 Steps Of Registering A Trademark In Uae Trademark Registration Uae Trademark

6 Steps Of Registering A Trademark In Uae Trademark Registration Uae Trademark

Shipping Log Templates 6 Free Printable Word Excel Pdf Formats Free Printables Printables Words

Shipping Log Templates 6 Free Printable Word Excel Pdf Formats Free Printables Printables Words

Where Is The Gear Icon In Quickbooks Quickbooks Online Quickbooks Chart Of Accounts

Where Is The Gear Icon In Quickbooks Quickbooks Online Quickbooks Chart Of Accounts

Solved Wages Python Solutionzip Payroll Text File Wage

Solved Wages Python Solutionzip Payroll Text File Wage

Wages Notice Request Separation Pay Or In Lieu Of Notice Pay Information California Business Names Separation

Wages Notice Request Separation Pay Or In Lieu Of Notice Pay Information California Business Names Separation

Pennsylvania Medical Records Release Form Download Free Printable Blank Legal Medical Record Release Form Template Or Waiver I Medical Records Medical Records

Pennsylvania Medical Records Release Form Download Free Printable Blank Legal Medical Record Release Form Template Or Waiver I Medical Records Medical Records

Solved Use The Following Information To Answer Questions Chegg Com

Solved Use The Following Information To Answer Questions Chegg Com

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Solved Bmx Company Has One Employee Fica Social Security Chegg Com

Solved Bmx Company Has One Employee Fica Social Security Chegg Com

Pin On 100 Examples Online Form Templates

Pin On 100 Examples Online Form Templates

Quickbooks Backup Fails Accountingerrors Quickbooks Backup Document Writer

Quickbooks Backup Fails Accountingerrors Quickbooks Backup Document Writer

Solved Use The Following Information To Answer Questions Chegg Com

Solved Use The Following Information To Answer Questions Chegg Com