Nh Business Tax Extension Forms

New Hampshire Corporate Business Profits Tax 2020 Estimates. New Hampshire Tax Extension Form.

Az Form 140 2018 Fill Out Tax Template Online Us Legal Forms

PAYMENT FORM AND APPLICATION FOR 7-MONTH EXTENSION OF TIME TO FILE BUSINESS TAX RETURN WHO MUST FILE Taxpayers who have not paid 100 of their Business Enterprise Tax BET andor Business Profits Tax BPT determined to be due by the due date of the tax and are requesting a 7-month extension to file their BET and BPT returns.

Nh business tax extension forms. 2020 Tax Information for Unemployment Benefits Available Friday January 22nd All of the information related to unemployment benefits needed to file your 2020 federal income tax return will be available on Friday January 22nd. No extension form is required. The e-File site is designed to allow easy access to some of the online services provided by the New Hampshire Department of Revenue Administration.

Form 8868 Due - May 17 2021 Nonprofit Tax Extension - Get 6 months Extension. Payment Form and Application for Extension of Time to File Business Tax Return. Arkansas Delaware Illinois Indiana Iowa Kentucky Maine Massachusetts Minnesota Missouri New Hampshire New Jersey New York Oklahoma Vermont Virginia Wisconsin.

Partnerships proprietorships and fiduciaries that obtain a New Hampshire extension will have until November 15 to file for calendar year filers. Taxpayers who have paid their tax in full by the return due date are entitled to an automatic 7-month extension of the time to file your New Hampshire Business Tax or Interest Dividends Tax return. Provided by the IRS The Internal.

Form 4868 Addresses for Taxpayers and Tax Professionals If you live in. If you need to make an additional payment in order to have paid 100 of the taxes determined to be due then you may file your payment online at wwwrevenuenhgov or file Form BT-EXT Payment Form and Application for 7 Month Extension of Time to File A Business Tax Return. 177 rows To request forms please email formsdranhgov or call the Forms Line at 603 230.

43 rows To request forms please email formsdranhgov or call the Forms Line at 603 230. Do not file Form BT-EXT if there is zero state tax balance due. There are only 11 days left until tax day on April 15th.

Utility Property Tax. And you ARE NOT enclosing a payment use this address And you ARE enclosing a payment use this address. This information is provided on a Form 1099-G and includes all unemployment benefits paid to you during 2020.

NH-1040 Instructions print Proprietorship Business Profits Tax Return Instructions. E-File New Hampshire Pay Taxes e-File is no longer available for Meals Rentals Tax Business Profits Tax Business Enterprise Tax Interest Dividends Tax and Communication Services Tax. EFile your return online here or request a six-month extension here.

BT-Summary fillable BT-Summary print Business Tax Summary Form. Filing this form gives you until Oct. You can make a state extension payment using New Hampshire Form BT-EXT Payment Form and Application for 7-Month Extension of Time to File Business Tax Return.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Corporate Business Profits Tax 2020 Estimates. Internal Revenue Service Forms 1120 and 1040-ES for the 2020 and 2021 tax year respectively are shown.

To get the extension you must estimate your tax liability on this form. E-file Your Extension Form for Free Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. PAYMENT FORM AND APPLICATION FOR 7-MONTH EXTENSION OF TIME TO FILE BUSINESS TAX RETURN FILE ONLINE AT GRANITE TAX CONNECT wwwrevenuenhgovgtc PRINT OR TYPE 100 OF TAX PAYMENT IS DUE ON OR BEFORE THE ORIGINAL DUE DATE OF THE TAX For the CALENDAR year 2020 or other taxable period beginning.

Form 7004 Due - Apr 15 2021 Business Tax Extension - Get Up to 6 months Extension. Check your state tax extension requirements. New Hampshires business extension is automatic so there is no official application or written request to submit.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. 15 to file a return. NH-1040 fillable NH-1040 print Proprietorship or Jointly Owned Property Business Profits Tax Return.

3 11 15 Return Of Partnership Income Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Form Nyc Ext Download Printable Pdf Or Fill Online Application For Automatic Extension Of Time To File Business Income Tax Returns 2020 New York City Templateroller

What Is A Schedule C Tax Form H R Block

3 11 15 Return Of Partnership Income Internal Revenue Service

Irs 8879 Eo 2020 Fill Out Tax Template Online Us Legal Forms

E File Irs Form 7004 Business Tax Extension Form 7004 Online

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 12 217 Error Resolution Instructions For Form 1120 S Internal Revenue Service

E File Irs Form 7004 1120 1120s 1065 1041 Extension Online

New Hampshire Tax Forms 2020 Printable State Nh Dp 10 Form And Nh Dp 10 Instructions

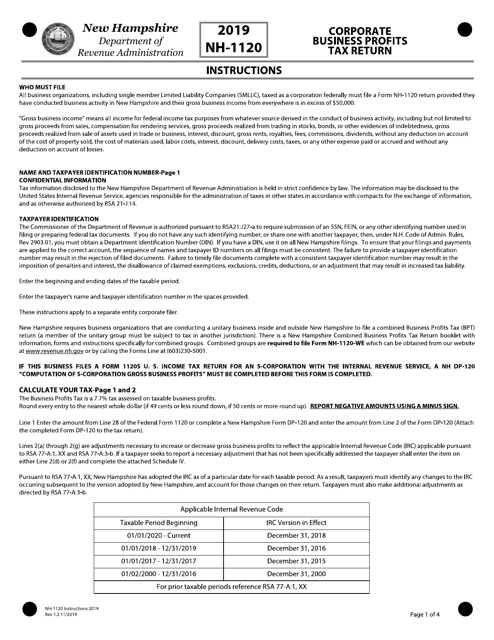

Download Instructions For Form Nh 1120 Corporate Business Profits Tax Return Pdf 2019 Templateroller

Set Bank Direct Deposit Authorization Form Template Form Example Templates Directions

Fillable Form 7004 2018 V 1 Irs Forms Tax Extension Tax Forms

Direct Deposit Form Form Example Told You So Form

Understanding The 1065 Form Scalefactor

Snowbound Businesses Get More Time To File Tax Extensions Tax Extension Filing Taxes The Weather Channel