How Does A Debt Agreement Work

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. Debt management plan.

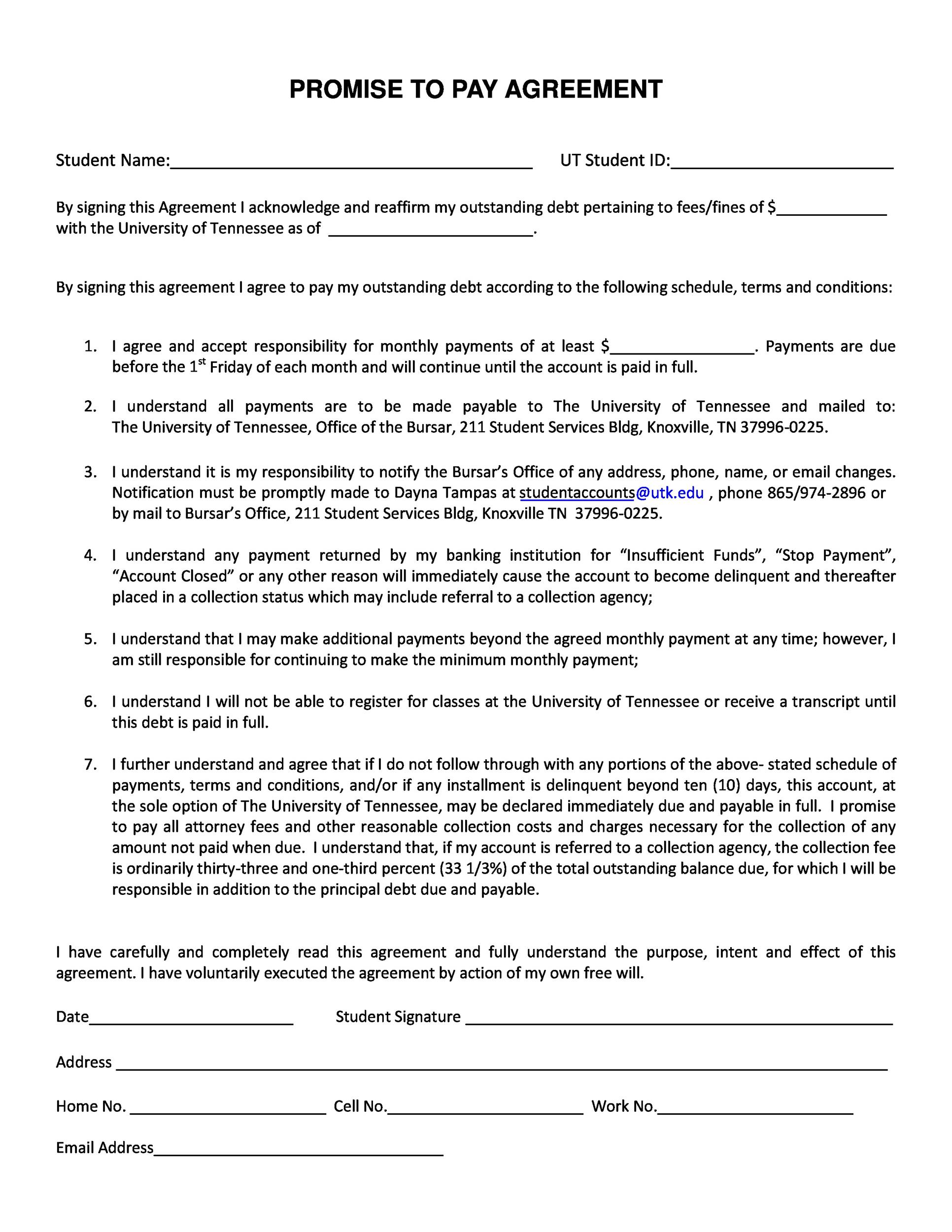

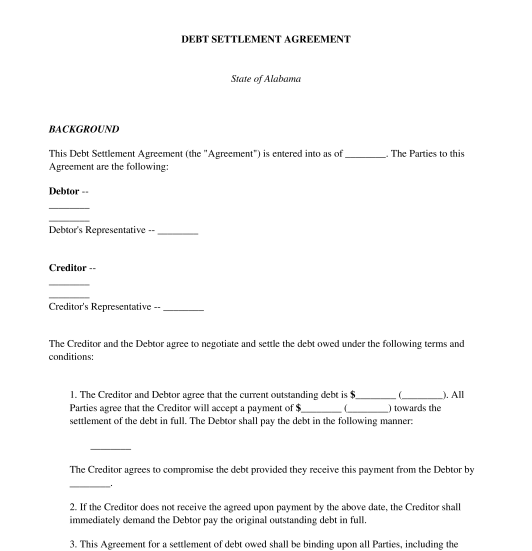

Payment Settlement Agreement Elegant Debt Settlement Agreement Legal Documents Lettering Debt Settlement Debt Agreement

Payment Settlement Agreement Elegant Debt Settlement Agreement Legal Documents Lettering Debt Settlement Debt Agreement

A Debt Arrangement Scheme is a formal Scottish debt solution which allows you to create a repayment plan for your debts.

How does a debt agreement work. How debt agreements work You negotiate to pay a percentage of your combined debt that you can afford over a period of time. This is an ongoing agreement that typically includes a small upfront fee and an ongoing monthly fee. In other words its a promise to pay in exchange for keeping the property you are seeking to retain.

A Debt Agreement is proposed according to what you can afford to repay The proposal is sent to AFSA and your creditors for voting During the voting period payments to your creditors are frozen If the majority of creditors based on debt value accept the terms the proposal is approved. You may also decide to work with your counselor to establish a debt management plan. Debt settlement companies negotiate with your creditors to settle your unsecured debt for less than what you currently owe.

A prenuptial agreement generally dictates how you and your spouse would divide your financial assets and responsibilities money property bill payments debt etc in the event of a divorce separation or death. A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. After you complete the.

A Debt Agreement is a legally binding arrangement between you and your creditors to repay your debts. A debt agreement doesnt release another person from a debt jointly owned with you. The way a Debt Agreement works is that you submit an agreement to your creditors whereby you propose to pay back as much as you can afford towards your debts usually for an amount less than what you owe over a period of time.

A Part 10 Debt Agreement also called a Personal Insolvency Agreement or PIA is a legally binding agreement administered by a trustee between you and your creditors. A debt agreement will release you from most unsecured debt when you complete all your obligations and payments. A Debt Agreement usually lasts between three and five years.

Before setting up your plan your DMP provider will help you put together a budget This will show how much you can afford to pay to your debts after all your priority payments. If you qualify for a short-term payment plan you will not be liable for a user fee. Secured creditors however may seize and sell any assets eg.

Once youve paid the agreed amount youve paid those debts. You make repayments to your debt agreement administrator rather than individual payments to your creditors. A debt management plan DMP is an agreement between you and your creditors to help you pay off your debt.

Who gets prenuptial agreements. You pay this over a period of time to settle your debts. How a debt agreement works.

With this arrangement you make one monthly payment to the debt counseling service. It is comparable to a Debt Management Plan which is an informal solution as well as a Trust Deed or Sequestration which are alternative formal Scottish debt solutions. This repayment amount is based on what you can reasonable afford to pay and has to be agreed upon by your creditors.

A prenuptial agreement is a legally-binding contract that is signed into effect before marriage. A reaffirmation agreement is a contract that you can enter into in which you agree to remain responsible for a debt so that you can keep the property. Nonprofit credit counseling is often the best choice when it comes to dealing with overwhelming credit card debt.

Instead of creating a modified repayment plan like a credit counseling agency does for-profit debt settlement companies encourage you to stop making payments on your debts and instead make payments into an account with the company. With a debt agreement your creditors agree to accept an amount of money that you can afford. Debt collection agencies collect delinquent debts of all types.

In a Debt Agreement you pay a percentage of your combined unsecured debt through your Debt Agreement Administrator. They in turn make monthly payments to your creditors. House which you have offered as security for credit if you are behind in your payments.

The consequences of a debt agreement. Under a Debt Agreement you agree to repay an amount to your creditors over a set period of time up to 3 or 5 years. The creditor pays the collector a percentage typically between 25 to 50 of the amount collected.

A debt agreement is not the same as a debt consolidation loan or informal payment arrangements with your creditors. Credit card medical automobile. A DMP is usually set up and managed by a third party provider for example a debt charity or debt management company.

These are the good guys who have established relationships with most major creditors and have already done the work of negotiating deals that will get you out of debt in five years or less. The Basics of Debt Settlement Debt settlement is an agreement between a lender and a borrower for a large one-time payment toward an existing balance in return for the forgiveness of the remaining.

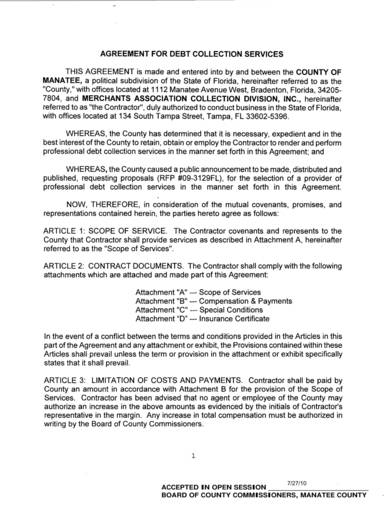

Debt Settlement Agreement Template Word Pdf

Debt Settlement Agreement Template Word Pdf

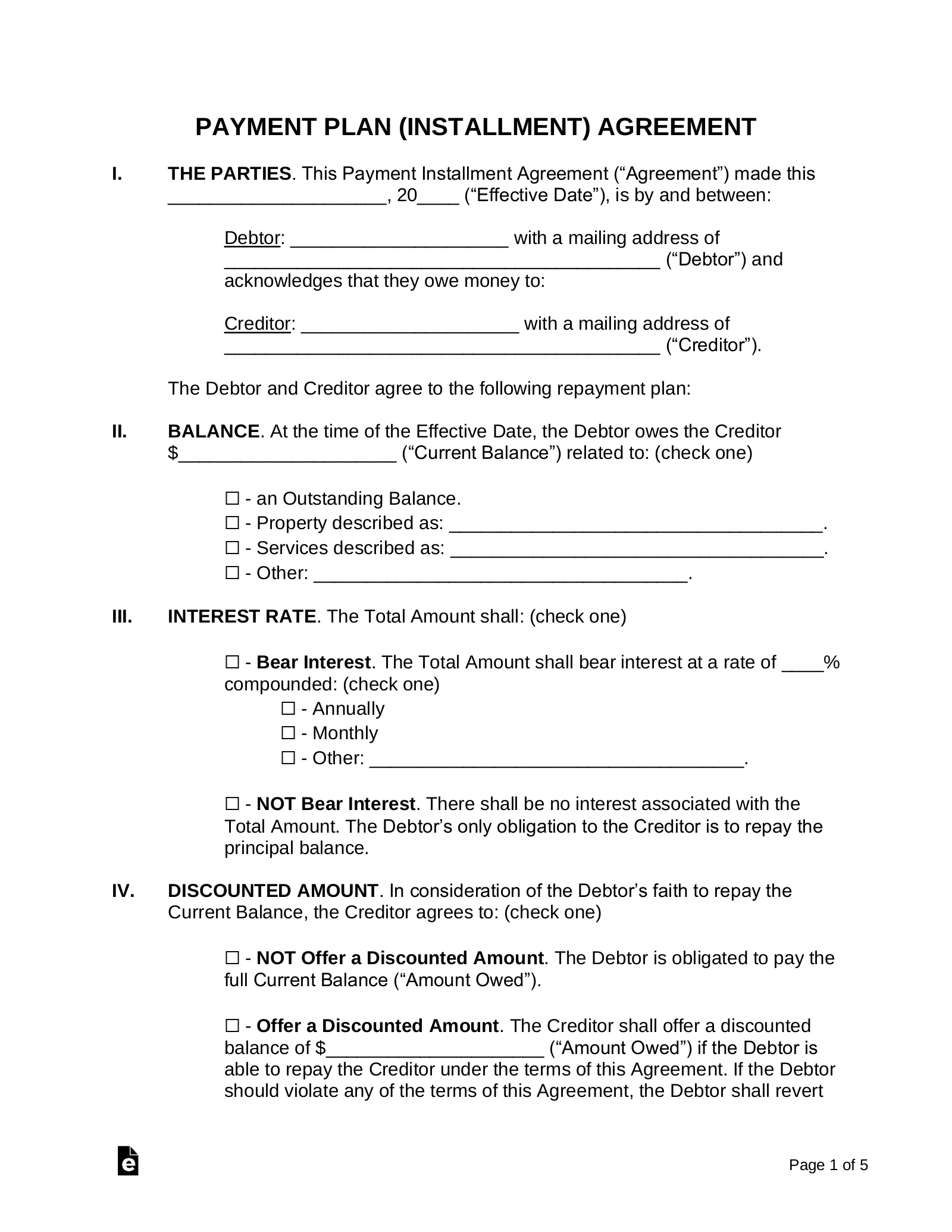

Free Payment Agreement Template Pdf Word Eforms

Free Payment Agreement Template Pdf Word Eforms

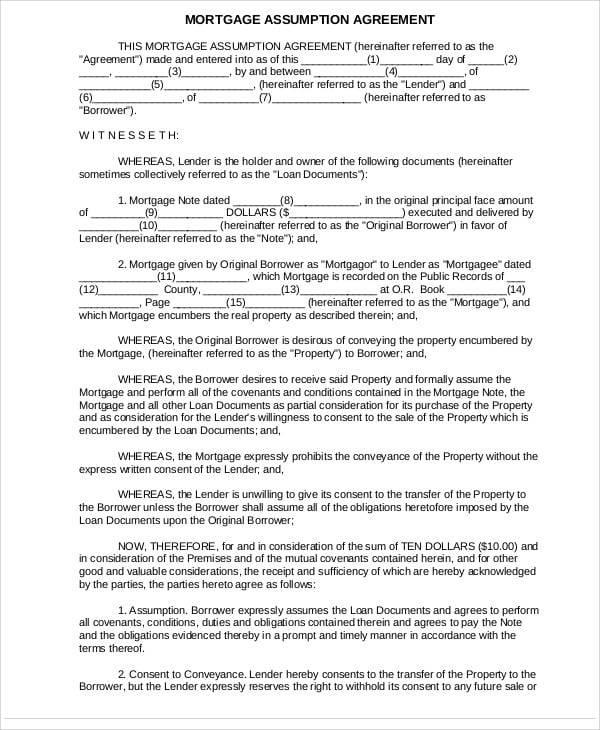

Assumption Agreement Templates 9 Free Word Pdf Format Download Free Premium Templates

Assumption Agreement Templates 9 Free Word Pdf Format Download Free Premium Templates

Assumption Of Debt Agreement Form Special Mortgage Assignment Regarding Debt Assignment Agreement Template 10 Prof Debt Agreement Notes Template Assignments

Assumption Of Debt Agreement Form Special Mortgage Assignment Regarding Debt Assignment Agreement Template 10 Prof Debt Agreement Notes Template Assignments

Debt Transfer Agreement Debt Agreement Debt Debt Collection

Debt Transfer Agreement Debt Agreement Debt Debt Collection

Free 8 Sample Debt Agreement Templates In Pdf

Free 8 Sample Debt Agreement Templates In Pdf

Free 37 Agreement Letter Examples In Pdf Ms Word Google Docs Pages

Free 37 Agreement Letter Examples In Pdf Ms Word Google Docs Pages

Assignment Of Contract Debt Form Legal Forms And Business The For Debt Assignment Agreement Template 10 Professional Templates Legal Forms Agreement Debt

Assignment Of Contract Debt Form Legal Forms And Business The For Debt Assignment Agreement Template 10 Professional Templates Legal Forms Agreement Debt

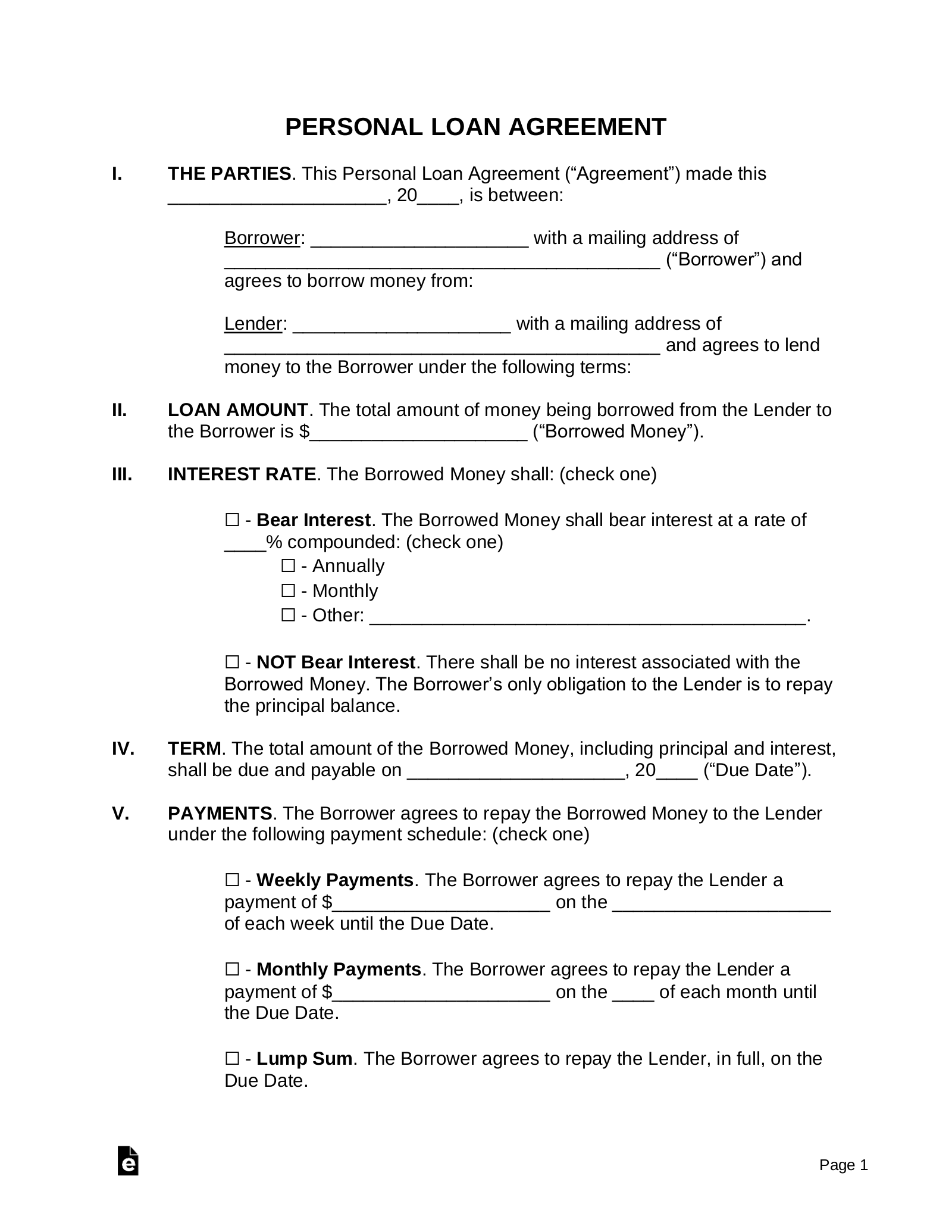

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Personal Loan Repayment Letter Template Gallery Inside Personal Loan Repayment Agreement Template 10 Profession Payment Agreement Lettering Letter Templates

Personal Loan Repayment Letter Template Gallery Inside Personal Loan Repayment Agreement Template 10 Profession Payment Agreement Lettering Letter Templates

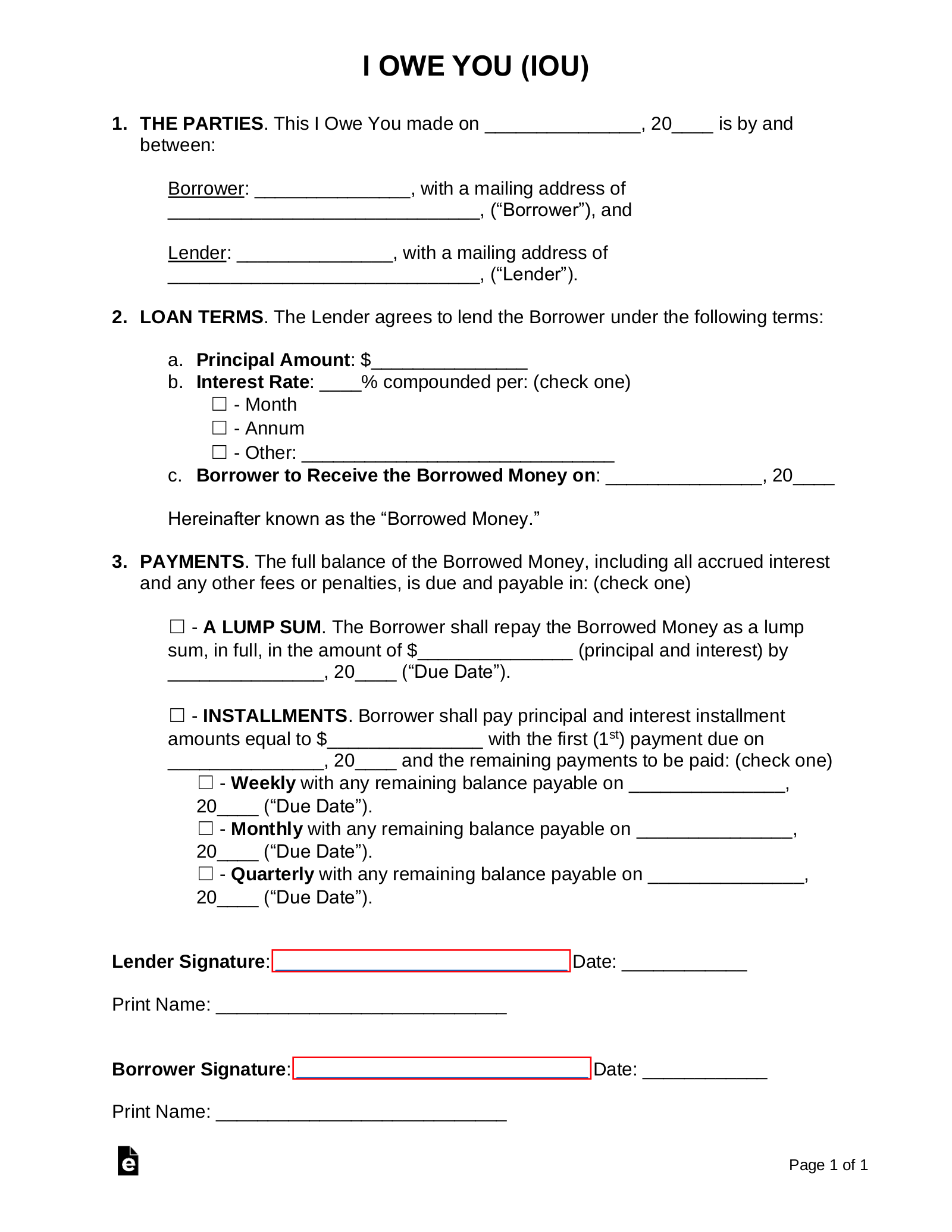

Free I Owe You Iou Template Pdf Eforms

Free I Owe You Iou Template Pdf Eforms

Free 8 Sample Debt Agreement Templates In Pdf

Free 8 Sample Debt Agreement Templates In Pdf

Free 8 Sample Debt Agreement Templates In Pdf

Free 8 Sample Debt Agreement Templates In Pdf

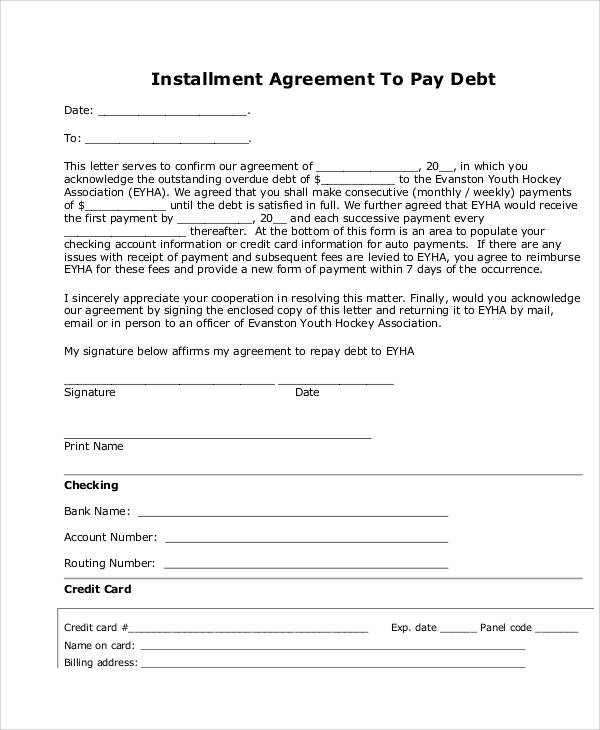

Browse Our Example Of Money Owed Agreement Template For Free Letter Templates Lettering Templates

Browse Our Example Of Money Owed Agreement Template For Free Letter Templates Lettering Templates

Agreement To Compromise Debt Smart Business Box Debt Debt Agreement The Borrowers

Agreement To Compromise Debt Smart Business Box Debt Debt Agreement The Borrowers

Free 8 Sample Debt Agreement Templates In Pdf

Free 8 Sample Debt Agreement Templates In Pdf

Debt Validation Letter Template Awesome Free Debt Validation Letter Template Fair Debt Collection Credit Repair Letters Debt Collection Credit Repair

Debt Validation Letter Template Awesome Free Debt Validation Letter Template Fair Debt Collection Credit Repair Letters Debt Collection Credit Repair

Payment Agreement Template Pdf Templates Jotform

Payment Agreement Template Pdf Templates Jotform