Does Mileage Reimbursement Count As Income For Child Support

And sometimes they get paid mileage reimbursement. Federal Tax Laws on Mileage Reimbursement.

Mileage Rates For 2016 With A Special Offer From Mileiq Mileage Deduction Gas Tax Deduction

Mileage Rates For 2016 With A Special Offer From Mileiq Mileage Deduction Gas Tax Deduction

Child support Child support and.

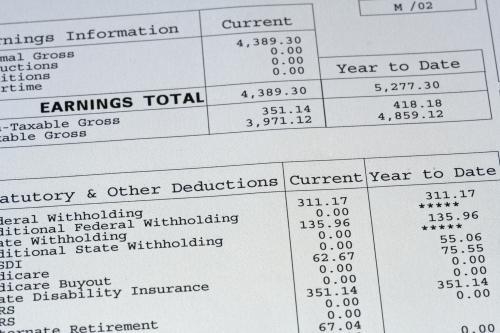

Does mileage reimbursement count as income for child support. Document that alimony child support or separate maintenance will continue to be paid for at least three years after the date of the mortgage application as verified by one of the following. Even if its included in your regular check. If a person earns any money while on unemployment she must report it on her weekly claims form to the Department of Labor.

Likewise interest dividends other investment income alimony and child support are not earnings and should not be reported. In re Marriage of Eaton. Theyll also check if the paying parent is getting benefits tax credits student grants and loans dont count as income.

1995 tax definitions of income are not determinative. According to IRS code a business expense reimbursement can sometimes count as income. Suppose your child is 16 years old.

Show 1 more Show 1 less. Annual income is the total of all income sources for a 12- month timeframe. N Earned income tax credit EITC refund payments received on or after January 1 1991 including.

The parents of the child do not have any control as to the amount or how the client is paid. They never set aside that money to buy a new. Income sources that will not be received for the entire ensuing 12 months must continue to be included in annual income unless excluded under 3555152b5.

Sometimes they get money. In re Marriage of Nimmo 891 P2d 1002 Colo. You cant count that support toward your income for mortgage purposes because qualifying income.

And that your child supports going to end when shes 18. Unemployment Income reported on a 1099-G. Is there a state statute you can refere.

Sometimes they get benefits. What about my car allowance. The paying parent does not have main day-to-day care of the child.

It has on w-2 for untaxable income however child support calculated as income. The program 4Cs only provides the payment for the child care but does not have any control in where or when the services are provided. Updated for Tax Year 2017.

Thats not how people use it though. For things like mileage we may bank a few dollars but when he supplies an ice cream truck for his customers we get reimbursed exactly what is paid. Earned Income Tax Credit EIC Child tax credits.

In Utah people get paid in all sorts of interesting ways. Just debating whether or not mileage reimbursement is considered income or not. No mileage is not considered income because it is an expense that you have paid and they are paying you back.

Is getting reimbursed for mileage for work considered income for calculation of child support. When calculating child Support - is mileage reimbursement from Work considered income. Examples include but are not limited to child support alimony maintenance Social Security etc.

Calculating child support in Texas is supposed to a relatively simple procedure using a state-specified formula which includes the paying spouses net income. The income does not represent more than 30 of the total gross income. This definitely isnt income for us and it would really make things tight for us if it was in the hypothetical case of child support determination.

M The value of any child care provided or arranged or any amount received as payment for such care or reimbursement for costs incurred for such care under the Child Care and Development Block Grant Act of 1990 42 USC. Sometimes they get stuff. Verification of Income From Alimony Child Support or Separate Maintenance.

Mileage is designed to reimburse for the wear and tear on your car. Ask a lawyer - its free. We are reimbursed at 49 a mile.

The child support guidelines indicate that income is defined as gross income from whatever source regardless of whether that income is recognized by the Internal Revenue Code or reported to the Internal Revenue Service or state Department of Revenue or other taxing authority. Child support Child support and travel expenses Family law Tax law. The client is a child care provider.

She provides child care for her niece and gets paid by the program 4Cs. Officials managing unemployment claims factor the extra earnings into her. However it can get a little tricky given the fine print regarding what types of income are included what types of income are exempt and what types of deductions you can make.

The court held that while non-recurring income can be included in calculating net income for the purpose of child support this is not an inflexible rule and the trial court has the discretion to exclude such income. We will provide one-on-one support with a tax professional as requested through our Audit Support Center for returns filed with TurboTax for the current tax year 2020 and the. IA these sources of income are for the purpose of establishing child support and do not necessarily correspond to the sources of taxable income as set forth by the Internal Revenue Service.

Travel Expense Claim Form Template Expense Reimbursement Form Free Word Document Templates Words

Travel Expense Claim Form Template Expense Reimbursement Form Free Word Document Templates Words

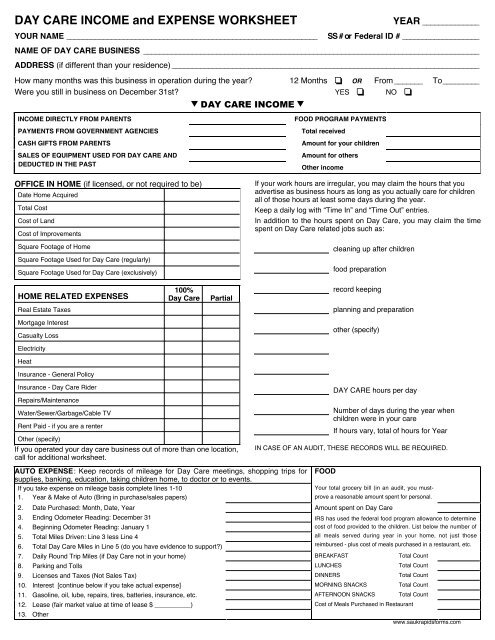

Day Care Income And Expense Worksheet Mer Tax

Day Care Income And Expense Worksheet Mer Tax

2020 Standard Mileage Rates Announced Nissen And Associates

2020 Standard Mileage Rates Announced Nissen And Associates

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Income Definition Exceptions Colorado Family Law Guide

Income Definition Exceptions Colorado Family Law Guide

2020 Standard Mileage Rates Announced Mileage Internal Revenue Service Money Matters

2020 Standard Mileage Rates Announced Mileage Internal Revenue Service Money Matters

Expense Report Mileage Horizonconsulting Co Within Gas Mileage Expense Report Template Mileage Reimbursement Time Sheet Printable Mileage

Expense Report Mileage Horizonconsulting Co Within Gas Mileage Expense Report Template Mileage Reimbursement Time Sheet Printable Mileage

![]() Home Loan Adding Business Mileage To Income

Home Loan Adding Business Mileage To Income

Credit Application Form Pdf Best Of Collect Credit Applications Line With Formstack Application Form Application Job Application Form

Credit Application Form Pdf Best Of Collect Credit Applications Line With Formstack Application Form Application Job Application Form

5 Steps To Take When The Tax Man Cometh Liberty Tax Liberty Tax Words Tax Attorney

5 Steps To Take When The Tax Man Cometh Liberty Tax Liberty Tax Words Tax Attorney

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective Tax Prep Checklist Business Tax Tax Prep

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective Tax Prep Checklist Business Tax Tax Prep

Rent Application Form Template Inspirational Tenant Application Form Template Rental Application Templates Application Form

Rent Application Form Template Inspirational Tenant Application Form Template Rental Application Templates Application Form

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Can I Buy A Car With Child Support Income Auto Credit Express

Can I Buy A Car With Child Support Income Auto Credit Express

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

How To Keep Track Of Mileage For Taxes In 2021 Save Your Money

How To Keep Track Of Mileage For Taxes In 2021 Save Your Money

Tax Spreadsheets For Photographers Home Budget Spreadsheet Budget Spreadsheet Spreadsheet Template

Tax Spreadsheets For Photographers Home Budget Spreadsheet Budget Spreadsheet Spreadsheet Template

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines