Where Do I Mail My 1099 To Pa

Box 931000 Louisville KY 40293-1000. Mailing Address for Form 1099-NEC.

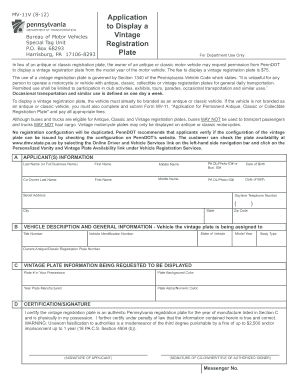

Penndot Form Mv 11v Fill Out And Sign Printable Pdf Template Signnow

Penndot Form Mv 11v Fill Out And Sign Printable Pdf Template Signnow

PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received.

Where do i mail my 1099 to pa. If you elected to get a cash refund you should have received the checkdirect deposit four weeks after the date in Box 7 of the 1099-G. The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a. If you live in PENNSYLVANIA.

If you file 250 or more 1099 forms with Pennsylvania you must file electronically. When you do youll see an option to view my 1099-G. HARRISBURG PA 17128-0904 Mailing Address For Form 1099-R or 1099-MISC Showing Zero Withholding.

The fields below are required for employers outside of Pennsylvania that do not have a PA Employer Account ID. Daily Limitation of an Employer Identification Number Effective May 21 2012 to ensure fair and equitable treatment for all taxpayers the Internal Revenue Service will limit Employer Identification Number EIN issuance to one per responsible. Department of the Treasury Internal Revenue Service Ogden UT 84201-0002.

You received a 1099-G because you probably received a refund last year from filing your PA income tax return. Do not take it person-ally. PA Department of Revenue Bureau of Individual Taxes.

Keep it for your records. Updated on December 18 2020 - 1030 AM by Admin ExpressEfile. Were do I send copy of my 1099-r in pennsylvania If you are submitting your Pennsylvania state return by the efile process then there will be nothing you would need to mail in to the state.

Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes this form will be an important part of preparing your tax returns. For your convenience clicking on the Yes option will take you directly to How to apply for an EIN. Mail your Pennsylvania state 1099 forms to.

The example we have shows the person paid federal taxes on their benefits but not the state. What is the 1099 filing address for Pennsylvania. Internal Revenue Service PO.

Please double-check your records for receipt of the refund around that. This means theyll probably owe the state a. What should I do.

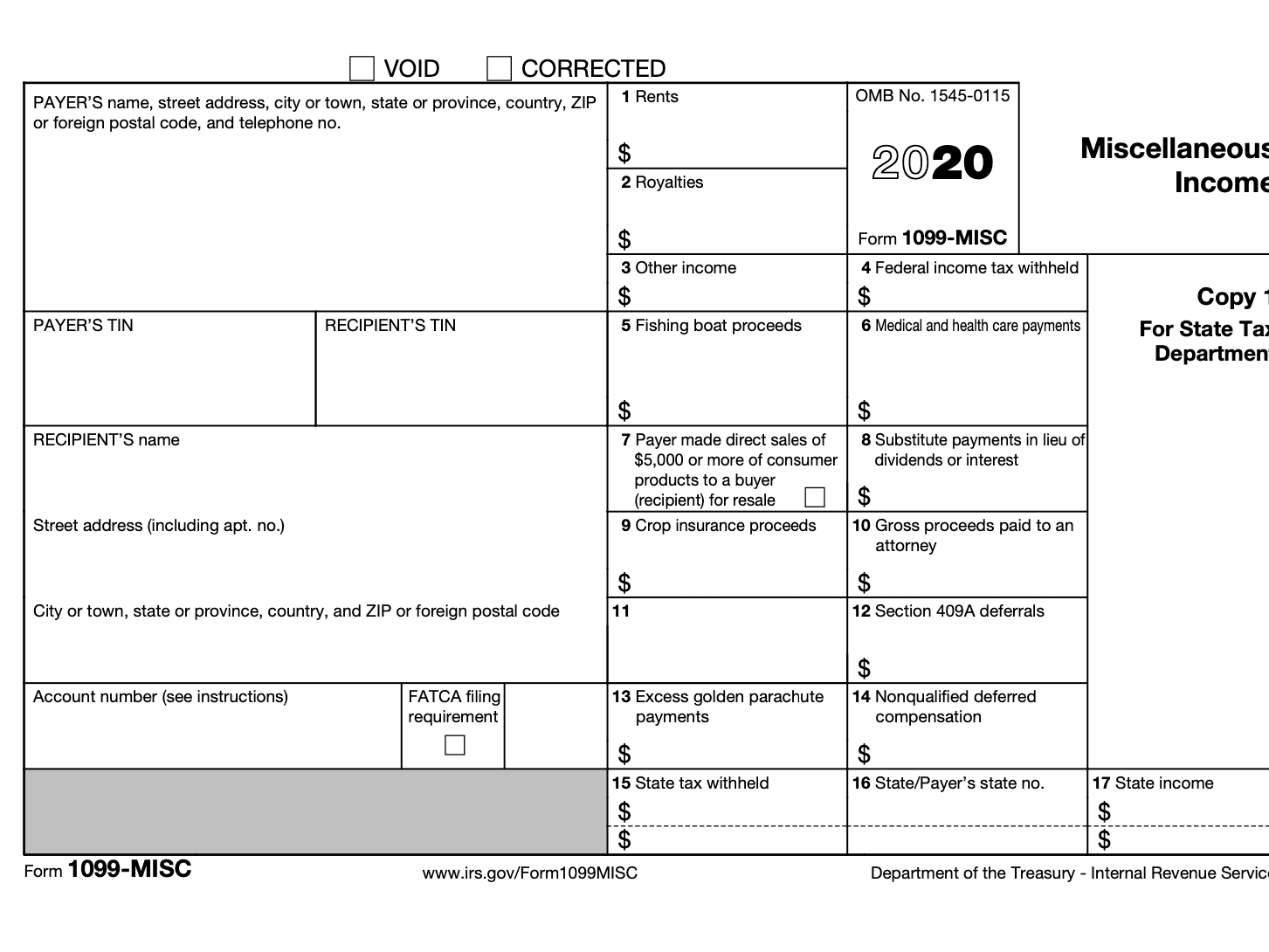

If you are thinking about paper filing Form 1099-NEC this year theres a lot to take into consideration. And you are filing a Form. Do not report negative figures minimum value 000 maximum value 99999999999.

Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year. 1099-R Box 14 Numeric only including 2 decimal places. If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office.

It is possible you may receive more than one 1099-G form. Box 280412 Harrisburg PA. Do not also send in federal Form 1099-R.

How to report amounts from Form W-2 Form 1099-R Form 1099-MISC and Form 1099-NEC as well. Ware should mail Form PA-8453 or PA-8879 to the following address. When filing federal copies of forms 1099 with the IRS from the state of Pennsylvania the mailing address is.

This may delay processing of your return. Listen to the entire complaint. RTAA benefits are also reported on a separate form.

If there is any PA tax withheld on any distributions the 1099-R1099-MISC1099-NEC forms should be mailed to. No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. The Pennsylvania Department of Labor and Industry is reminding taxpayers that the following 1099G forms are being mailed to claimants of the below programs.

More FAQ on 1099 State Filings. And you ARE NOT ENCLOSING A PAYMENT then use this address. PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES PO BOX 280509 HARRISBURG PA 17128-0509 Get started with TaxBandits today and stay compliant with the State of Pennsylvania.

Department of the Treasury Internal Revenue Service Center Austin TX 73330. And you ARE ENCLOSING A PAYMENT then use this address. Explore the following topics to get prepared determine your IRS mailing address and make the right decision for your business.

PA Department of Revenue PO. PA DEPARTMENT OF REVENUE. If you chose to mail in your return then please see this link.

Not required for employers who have a PA Employer Account ID. Do not interrupt.

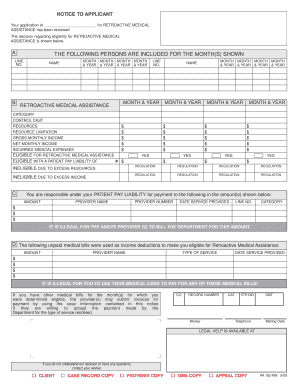

2018 2021 Form Pa H105 102 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Pa H105 102 Fill Online Printable Fillable Blank Pdffiller

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Pa 162 Rm Fill Out And Sign Printable Pdf Template Signnow

Pa 162 Rm Fill Out And Sign Printable Pdf Template Signnow

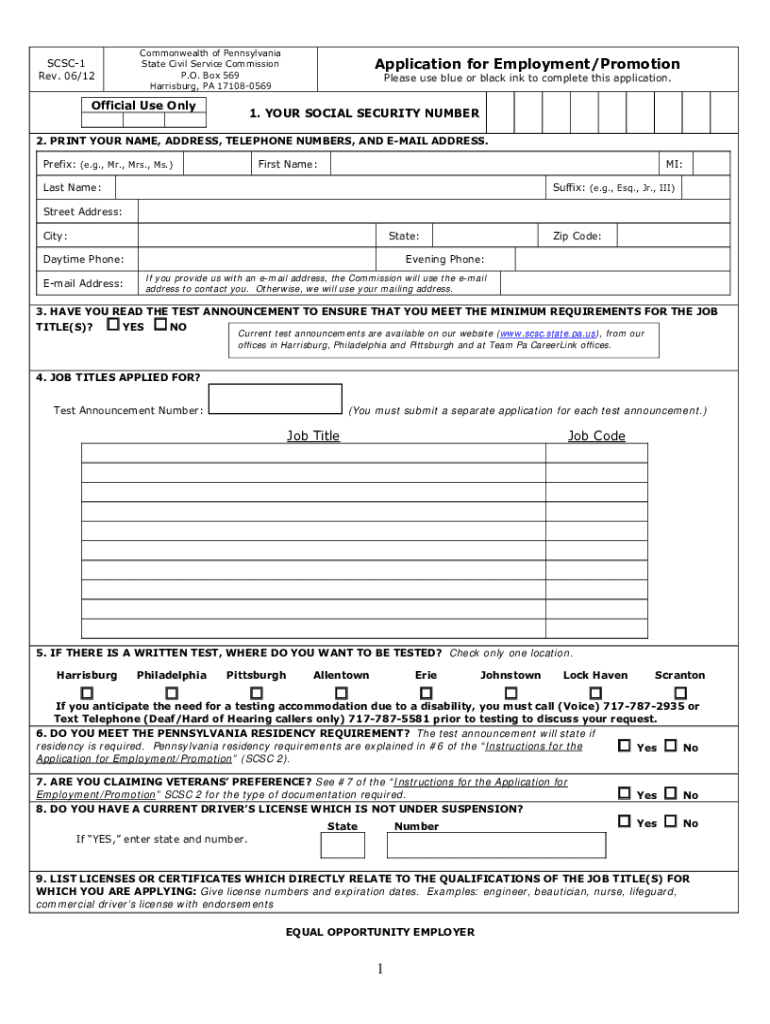

2012 2021 Form Pa Scsc 2 Fill Online Printable Fillable Blank Pdffiller

2012 2021 Form Pa Scsc 2 Fill Online Printable Fillable Blank Pdffiller

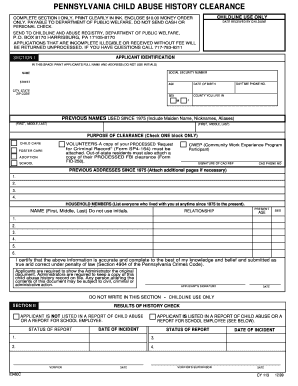

Childline Pa Fill Online Printable Fillable Blank Pdffiller

Childline Pa Fill Online Printable Fillable Blank Pdffiller

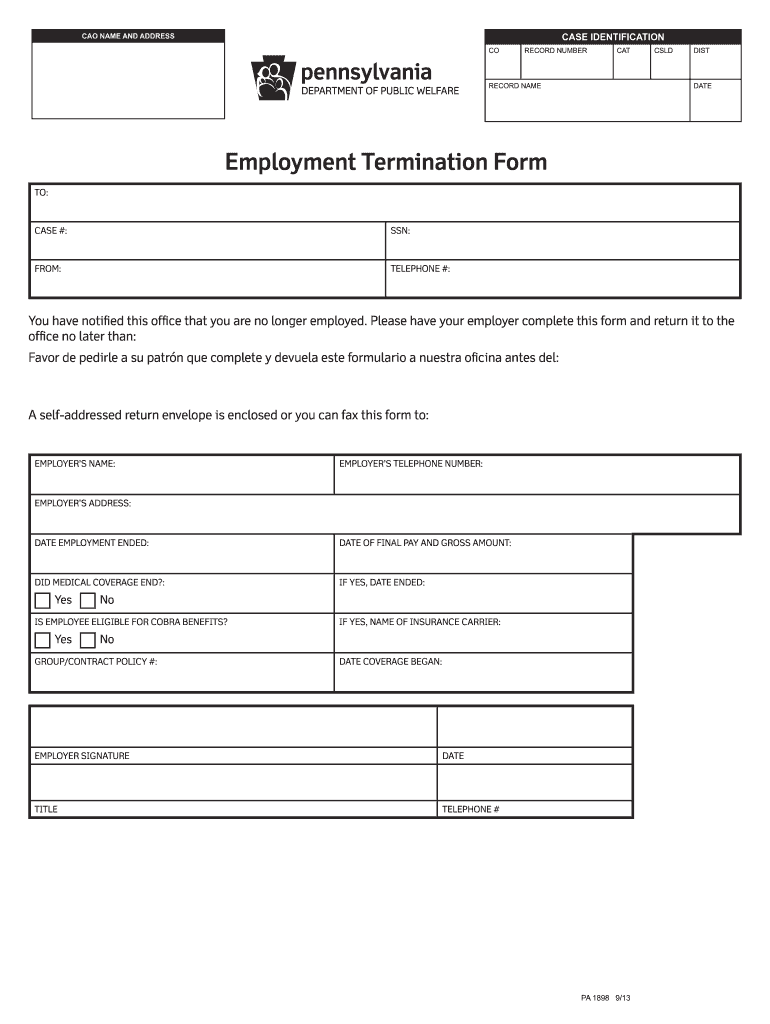

Form Pa 1898 Fill Online Printable Fillable Blank Pdffiller

Form Pa 1898 Fill Online Printable Fillable Blank Pdffiller

Amazon Com Pa Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Pennsylvania English Prints Office Products

Amazon Com Pa Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Pennsylvania English Prints Office Products

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

Pua Unemployment Claim In Pa Update Pua 1099g Form Youtube

Pua Unemployment Claim In Pa Update Pua 1099g Form Youtube

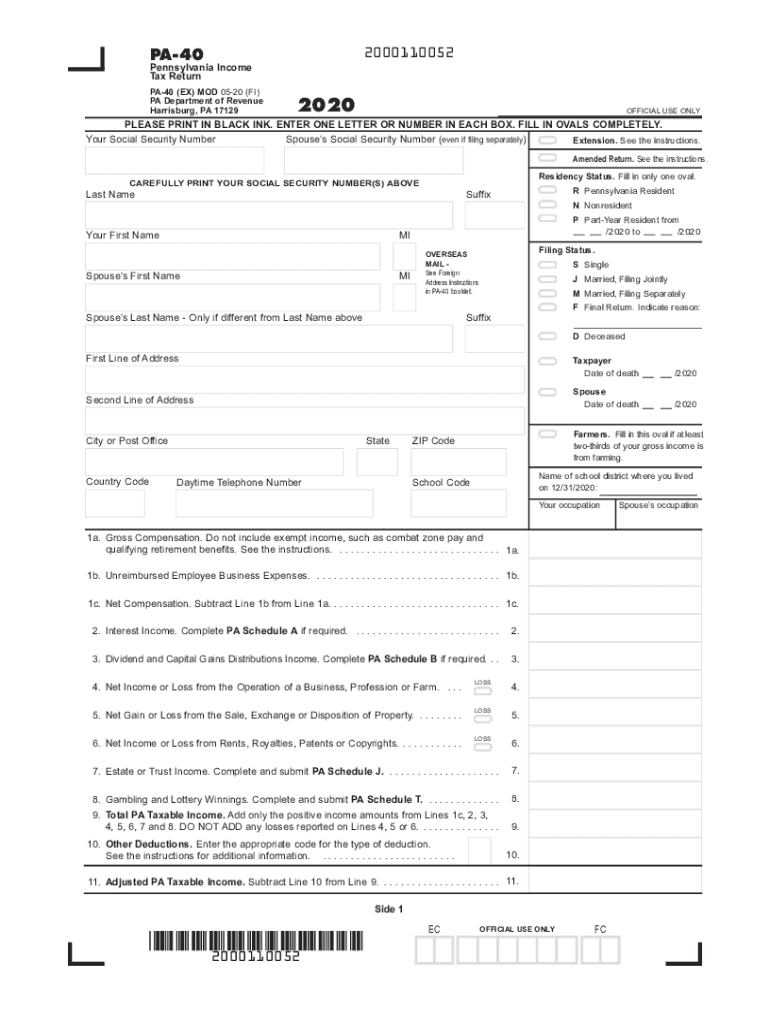

2020 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller

2020 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller

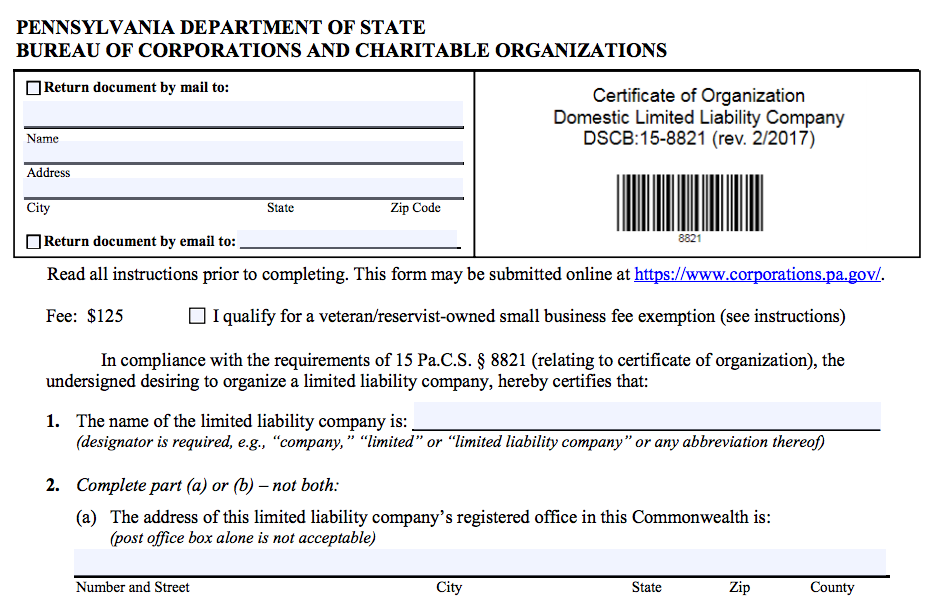

Stumped How To Form A Pennsylvania Llc The Easy Way

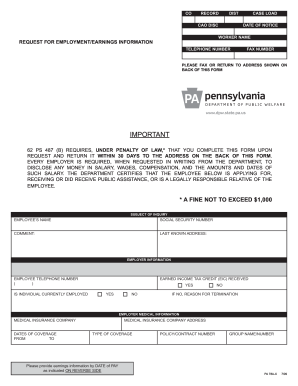

Form Pa 1897 Fill Out And Sign Printable Pdf Template Signnow

Form Pa 1897 Fill Out And Sign Printable Pdf Template Signnow

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

2016 2021 Form Pa Pa 1671 Fill Online Printable Fillable Blank Pdffiller

2016 2021 Form Pa Pa 1671 Fill Online Printable Fillable Blank Pdffiller

Forming An Llc In Pa A Step By Step Guide

Forming An Llc In Pa A Step By Step Guide

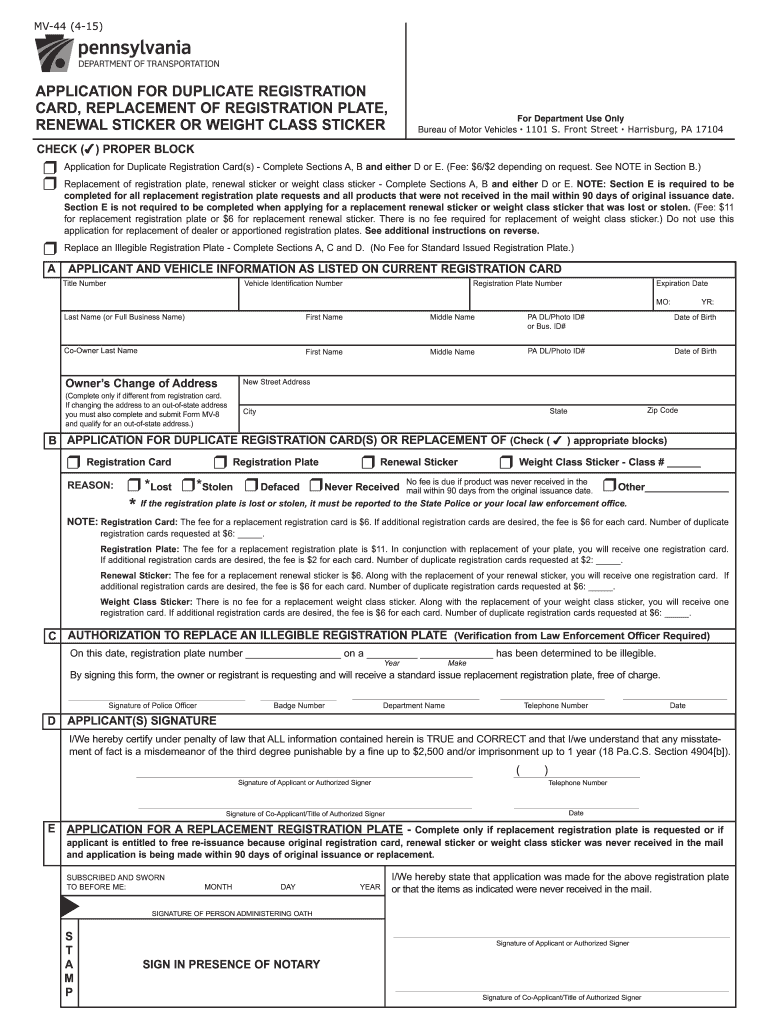

2015 2021 Form Pa Mv 44 Fill Online Printable Fillable Blank Pdffiller

2015 2021 Form Pa Mv 44 Fill Online Printable Fillable Blank Pdffiller