How Much Can A Business Pay Someone Without 1099

Enter schedule c hit Enter then click on jump to schedule c. Common 1099 and W2 Rules.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax.

How much can a business pay someone without 1099. The 1099 tax rate consists of two parts. Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was 600 or more. This will take you directly to the start of this section.

If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return. The good news is that you can subtract 100 percent of your business expenses on Schedule C as well and theres no 2-percent threshold. Rule 2 is pretty important so IRS auditors like to wrap it into Rule 1.

The exception to this rule is if you paid via credit card or a third party payment platform like Paypal. But this does not mean that the IRS doesnt and you should be. Someone is either an Independent Contractor and issued a 1099 or they are an employee paid by payroll and issued a W2.

So you will NOT issue yourself a W-2 a 1099-MISC or any other tax reporting document. The IRS considers and LLC to be a disregarded entity. One of the smartest procedures a business owner can implement is to request a W-9 from any vendor you expect to pay more than 600 before you pay them.

Its not necessary and will just mess you up with the IRS. In this case youre required to make an effort to get the form. Does the company control or have the right to control what the worker does and how the worker does his or her job.

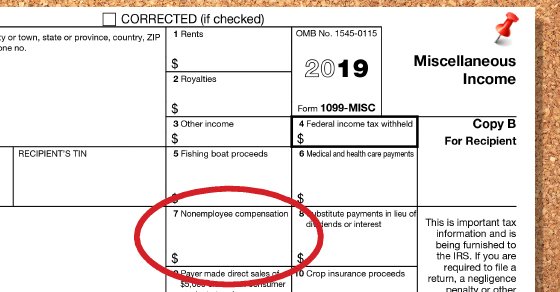

Beginning with Tax Year 2020 you must use Form 1099-NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099-MISC. Under Section 6721 of the Internal Revenue Code the IRS can charge you 100 for every person for whom you did not send a Form 1099. Yes you may report contract labor as a business expense on Schedule C even if you did not create Form 1099-MISC for those payments.

If you receive income as an independent contractor you must report on Schedule C the income that appears on your 1099-Misc. 600 is the triggering point. If youve earned less than that the paying company doesnt need to send out the form.

Youll also need to provide a 1099-Misc to anyone you pay 10 or more in royalties. Its important to understand that there is no such thing as a 1099 employee. According to the law a Form 1099 should only be issued for amounts of 600 or more.

124 for social security tax and 29 for Medicare. When you hire independent contractors for your small business you need to give them a 1099-Misc if you paid them 600 or more in the previous tax year. Not following Rule 2 has its own result.

If you pay someone not a business more than that for their services you must provide them a 1099-misc at year end and file a copy with the IRS. You made payments to the payee of at least 600 during the year. This means that as far as the IRS is concerned income earned by the business IS income earned by you.

That doesnt mean that lesser payments arent taxable but the client doesnt have to furnish a 1099 to the contractor. You do NOT pay yourself. The thing is there may be several people you pay in the course of the year for various services they provide for you who you may not even consider as contractors or workers.

When you pay someone less than 600 during the year for any services they rendered to you then you do not need to issue an IRS Form 1099-NEC. If you pay an independent contractor more than 600 in the year and their business entity is not an S corp or a C corp then you must file Form 1099-NEC. The form shows how much they earned from you.

Are the business aspects of the workers job controlled by the payer. An Employee or an Independent Contractor. The easiest way to to find Schedule C in TurboTax is to use the Search box at the top right side of the TurboTax header.

As it stands now federal law recognizes only two categories for people who get paid to do work. Using this as a normal business practice will give you the vendors mailing information Tax ID number and also require them to indicate if they are a corporation or not saving you the headache of sending them a 1099 next year. For the self-employed aggregate payments over 600 require a 1099.

Facts that provide evidence of the degree of control and independence fall into three categories. The self-employment tax applies evenly to everyone regardless of your income bracket. Now lets consider the possibility that you earned more than 600 but still didnt get your Form 1099.

As to the Form 1099-MISC filing requirements under current tax law businesses report cash and check payments for services rendered by non-corporate vendors such as qualified independent contractors on Form 1099-MISC which is filed annually and in the case of services only when payments total 600 or more during the calendar year.

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

16 Form Az Five Unconventional Knowledge About 16 Form Az That You Can T Learn From Books Tax Forms Irs Forms 1099 Tax Form

16 Form Az Five Unconventional Knowledge About 16 Form Az That You Can T Learn From Books Tax Forms Irs Forms 1099 Tax Form

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Reporting Payments To Independent Contractors If You Pay Independent Contractors You May Have Small Business Accounting Tax Organization Independent Contractor

Reporting Payments To Independent Contractors If You Pay Independent Contractors You May Have Small Business Accounting Tax Organization Independent Contractor

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler