How Do I Get A 1099 For My Employees

Where do I get 1099 forms for my employees. If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return.

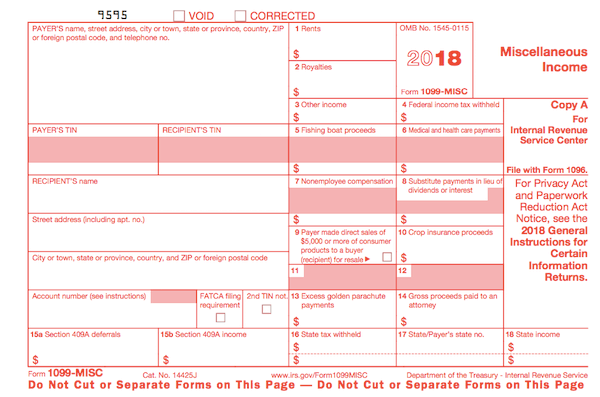

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

When you call please have the following information available.

How do i get a 1099 for my employees. The transcript should include all of the income that you had as long as it was reported to the IRS. Our experienced HR specialists can provide you forms resources tools and industry best practices for your staffing. In January look at how much youve paid the independent contractor over the past year.

To use this system you must be able to create a file in the proper format. If youre a contractor youll use this form to fill out the IRS form 1099 Misc when filing your taxes. Types of 1099 tax forms.

Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC. Generally the entity that paid you is responsible for sending a copy of your 1099 form to you in the mail. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer.

At this point you can include the information from the form you received. You may simply perform services as a non-employee. Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes.

7 hours ago1099-MISC and 1099-NEC. What Documents Do 1099 Employees Need to Apply for a PPP Loan. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

If you do not receive the missing or corrected form by February 14 from your employerpayer you may call the IRS at 800-829-1040 for assistance. Our experienced HR specialists can provide you forms resources tools and industry best practices for your specific. But if you wish to hire independent contractors these are the guidelines the IRS and some states uses to determine employee classification types.

Your name address including ZIP. For more information or if you have additional questions regarding 1099 employees or W-2 employees please contact VensureHR. If youve paid them more than 600 within the past calendar year and their business entity is not an S corp or C corp youll need to file a 1099-NEC form.

FLSA 6 Prong Test. Independent contractors use a 1099 form and employees use a W-2. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript.

However you do need to report the income on your. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly. If you havent yet filed a Schedule C you must complete one and submit it with your 1099-MISC.

You can file 1099 forms and other 1099 forms online with the IRS through the FIRE System Filing Electronic Returns Electronically online. While direct employees of a company receive a W2 that details their earnings and withholdings for the previous tax year contractors and self-employed individuals are eligible to receive a 1099 1099-Misc is the most common type form. 1099-MISC and W-9 forms and other pertinent forms can be found on the IRS website.

If youre using a 1099 employee you will first want to create a written contract. June 7 2015. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

You cant use a scanned or PDF copy. You may receive a 1099 tax form for all types of reasons. If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor.

For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for. Forms 1099 and W-2 are two separate tax forms for two types of workers. Where do I get 1099 forms for my employees.

If you are paid as a contractor by one or more of your clients you will receive the 1099-NEC but you do not need to send it to the IRS. If you do not receive your Form W-2 or Form 1099-R by January 31 or your information is incorrect on these forms contact your employerpayer. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor.

1099-MISC and W-9 forms and other pertinent forms can be found on the IRS website. For example you may get one if your bank paid you interest or you earned income as a contract or freelance worker. There are many different types of 1099 forms.

If you are doing your own tax return using a tax software program you will be asked if you have any 1099 income. If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace. 2019 Schedule C which is now required.

For more information or if you have additional questions regarding 1099 employees or W-2 employees please contact QBS. A color copy of your Drivers License front and back A voided check for. Generally your workers will not qualify as 1099 employees and will be classified as regular employees in the eyes of the IRS and the state.

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

1099 Form What It Is And How To Complete It Fairygodboss

1099 Form What It Is And How To Complete It Fairygodboss

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099