Hmrc Business Mileage Claim Rates

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. The latest business mileage rates or Approved Mileage Allowance Payments AMAP are.

Looking For Miles Tracker Visit Https Milecatcher Com Their Mile Tracking App Shows The Most Accurate Mileage Repo Mileage Tracker Tracking App Mileage App

Looking For Miles Tracker Visit Https Milecatcher Com Their Mile Tracking App Shows The Most Accurate Mileage Repo Mileage Tracker Tracking App Mileage App

From 1st September 2018 employees driving on business in a pure electric company car can claim 4p per mile.

Hmrc business mileage claim rates. You can claim over 45p tax-free as a business mileage allowance if you use your own car for a business journey. UK mileage rates can differ however HMRC advisory fuel rates state that in most circumstances you can claim business mileage at a rate of 45p per mile for the first 10000 business miles in a year this is an increase of 5p per mile since April 2011 and then 25p per mile thereafter. To give you an idea here are the present HMRC business mileage rates for vans cars motorcycles and bikes.

HMRC obliged and issued a new electric car business allowance called the advisory electric rate AER. Add up all your motor expenses for the year. The rates apply for any business journeys you make between 6 April 2018 and 5 April 2019.

To claim back your self-employed mileage allowance you simply need to include the amount in the expenses section of your self-assessment tax return. If you are keeping track of things yourself remember the HMRCs flat rates. When an employee or the business owner uses their own vehicle for business trips they can claim an allowance for their mileage.

If an employer pays more than these amounts then the additional amount paid will be taxed as income. Claim a fixed rate mileage allowance. When an employee uses a private car for business purposes and claims mileage at the pre-defined rates currently 45p per mile for the first 10000 miles and 25p per mile thereafter the mileage relief is granted from a wage tax perspective.

First 10000 business miles in the tax year Each business mile over 10000 in the tax year. To find your tax-deductible business mileage costs youd multiply 9000 miles by 35p which would give you 3150. HMRCs current AMAP rates are.

Is there anything else I should know about mileage claim rates. Once your business miles exceed 10000 in any one tax year the HMRC rate drops to 25p per mile so lets look at 2 examples. You can quickly calculate the approved amount for a car journey by breaking your total mileage down into the first 10000 miles and any mileage above this then multiplying the two resulting numbers by the 45p and 25p rate.

45p for cars and vans for the first 10000 miles. If you travel 17000 business miles in your car the mileage deduction for the year would be 6250 10000 miles x 45p 7000 miles x 25p. Since your employer has already reimbursed you at a rate of 10p per mile you can only claim 45p less 10p so 35p per mile.

You just need to multiply the miles you travelled by the specific mileage rate for your vehicle. For the first 10000 miles the rate for cars and vans is 045 the rate for motorcycles is 024 while the rate for bikes is 020. If youve been granted a company car by your employer and have been using it to make business journeys you cant claim mileage allowance but you can claim tax relief on your fuel costs if your employer isnt compensating you for them in line with the Advisory Fuel Rates AFR or the Advisory Electricity Rate AER if your company.

And when employees drive their company car on private journeys they will use the AER to repay the cost of electricity at 4p per mile. Less than 10000 miles You travel 8000 business miles in a tax year and your employer pays a flat rate of 20p per mile. And the HMRC recommended rate for cars is 45 pence per mile reducing to 25 pence per mile after 10000 miles.

What are other travel expenses that are tax deductible. In this case you can claim tax back on the difference which is 10p per mile. The Mileage Allowance Relief is based on HMRCs approved mileage rates.

Your boss reimburses you at a rate of 35p per mile. The current rates are. 45p per mile for your first 10000 miles and 25p per mile for everything above 10000 miles.

Theyre identical to the rates that applied during 2017-18. This percentage can be used to work out the business percentage of your costs. You can also claim an extra 5p per mile if you have a passenger with you on a business drive.

After 10000 miles the rate changes to. Youve racked up 10000 in business mileage on your personal car. 3 rows As self-employed you can claim tax deductions on your business mileage and other.

The costs of purchase and upkeep are included in the rate. Calculate the number of business miles as a percentage of your total miles. This makes calculating business mileage fairly simple.

To find out more check out the infographic in our blog claiming mileage expenses. This means you can deduct 1000 from your taxes 10000 multiplied by 10p.

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Mileage Log Business Mileage Tracker Shipt Shopping Colors To Match Your Shipt Gear In 2021 Mileage Tracker Mileage Tracker Printable Mileage Log Printable

Mileage Log Business Mileage Tracker Shipt Shopping Colors To Match Your Shipt Gear In 2021 Mileage Tracker Mileage Tracker Printable Mileage Log Printable

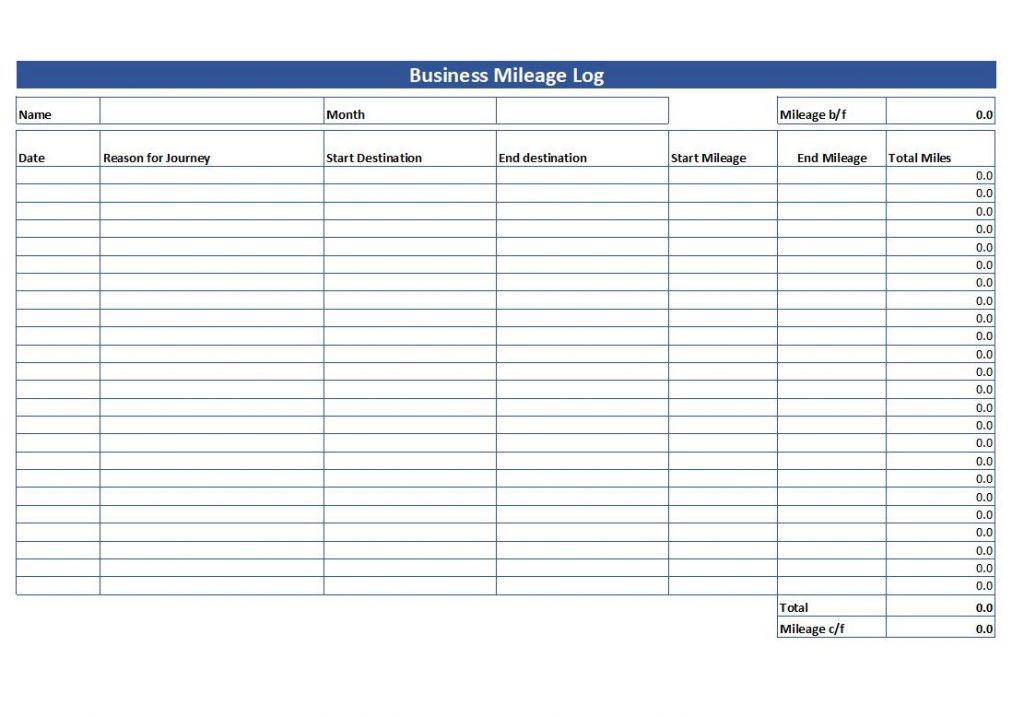

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

Uk Business Mileage Rates 2021 Car Petrol Allowances

Uk Business Mileage Rates 2021 Car Petrol Allowances

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Uk Business Mileage Rates 2021 Car Petrol Allowances

Uk Business Mileage Rates 2021 Car Petrol Allowances

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

6 Mileage Form Templates Word Excel Templates Mileage Tracker Printable Mileage Log Printable Mileage Printable

6 Mileage Form Templates Word Excel Templates Mileage Tracker Printable Mileage Log Printable Mileage Printable

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

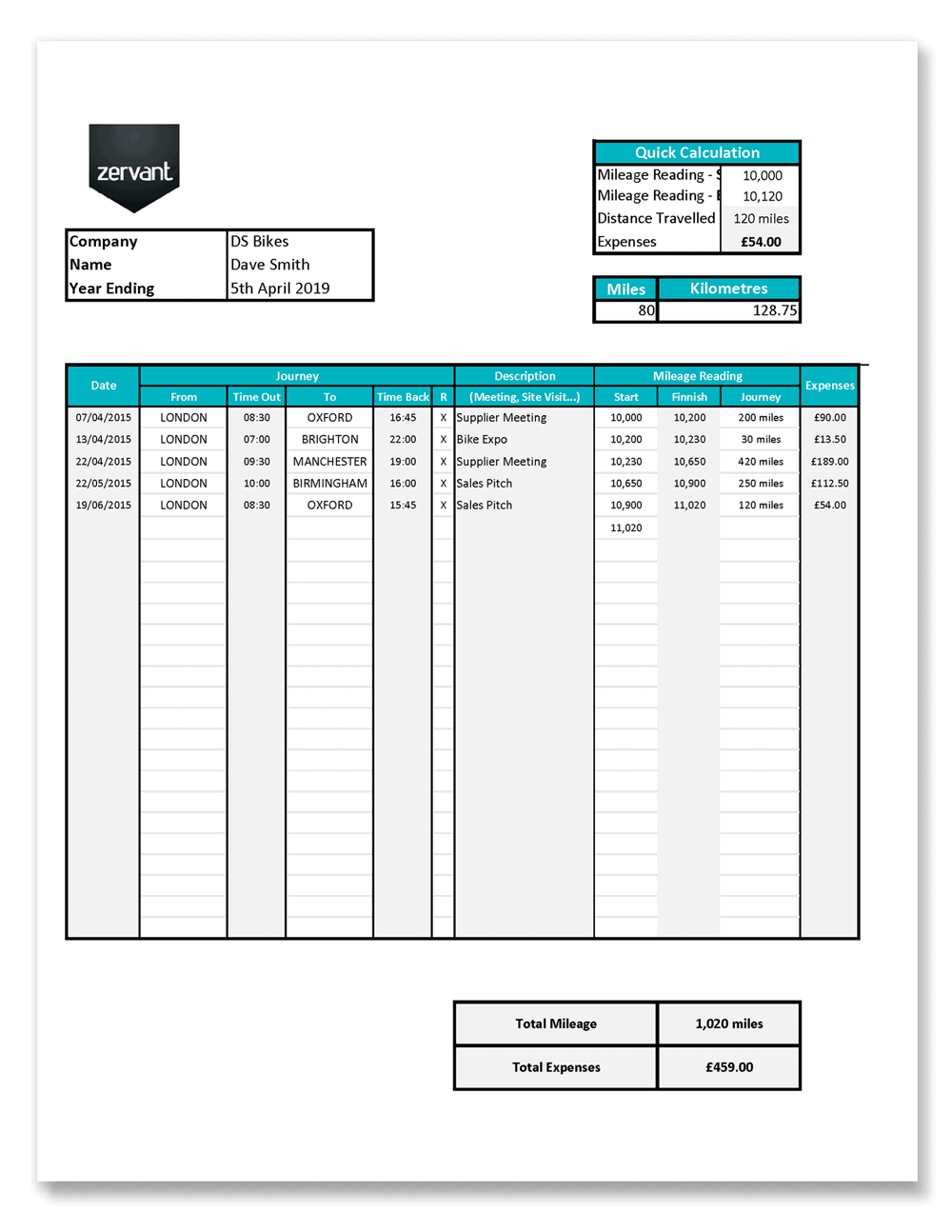

Free Uk Mileage Log Excel Zervant Blog

Free Uk Mileage Log Excel Zervant Blog

Milecatcher Is A Free Mileage Tracker That Automatically Logs The Miles You Drive For Business It Tracks How Long Y Mileage Tracker Mileage Tracker App Mileage

Milecatcher Is A Free Mileage Tracker That Automatically Logs The Miles You Drive For Business It Tracks How Long Y Mileage Tracker Mileage Tracker App Mileage

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

Get Organised For Your Accountant Tax Return Bookkeeping Business Self Assessment

Get Organised For Your Accountant Tax Return Bookkeeping Business Self Assessment

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Travel Expenses Per Mile Uk Travel Travel Cost United Kingdom Travel

Travel Expenses Per Mile Uk Travel Travel Cost United Kingdom Travel

Self Employed Guide How To Claim For Business Mileage

Self Employed Guide How To Claim For Business Mileage

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

What Are The Business Mileage Rates For Employees Vehicles

What Are The Business Mileage Rates For Employees Vehicles