Do You Get A 1099 When You Sell Land

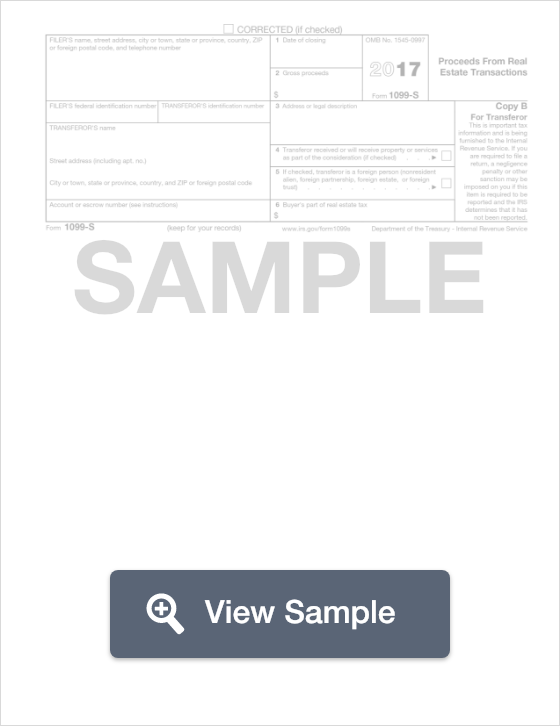

A 1099-S can also be used to report income made on rental property or investment property. Depending on who handles the closing of a property sale in your state you may or may not receive a Form 1099-S.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

You could request a corrected 1099 from the company.

Do you get a 1099 when you sell land. Tim Cohen sold timber from his 44-acre woodland to a timber buyer for 5500. If you do receive a Form 1099-S then the sale has to be reported regardless if you. But do not request one if not needed.

Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. You may also be. Youll need to attach the form to your Form 1040 and youll need to complete a Form 8949 and file it along with your return.

Basically the taxable amount is the resulting amount when you deduct the sale price from the price you originally paid for the land. Tax reporting purposes the closing costs represented by the difference between 13 of the proceeds reported on the 1099-S and the checks that you received should be added to 13 of the purchase price of the land. The 1099 probably should have reported the income as other income not a s nonemployee compensation.

Lets try to clear up some of these questions. You may not always receive a 1099-S form. In some cases when you sell real estate for a capital gain youll receive IRS Form 1099-S.

If you completed a 1099-S Exemption Certification Form and you met all six criteria for not having to report the sale on your tax return the title company or closing attorney may not send IRS Form 1099-S which reports the sale to the IRS and to you. Add this information to IRS Form 1099-S in the year you sell the property. Farmers and ranchers or any other businesses are required to issue 1099s for any payments of 600 or more made in the course of their trade or business.

Because you would not receive a 1099-B from the sale of your vacant land. Determine if you need an employer identification number EIN by answering these questions. You will need an EIN if you answer Yes to any of the following questions.

Alternatively if they wont. A form 1099-S is a tax document used to ensure that the full amount received for a real estate sale of some kind is accurately reported. Form 1099-S Proceeds from Real Estate Transactions is used for reporting sale or exchange of real estate including standing timber sales Sec.

This basically means that if you are deducting that. FORM 1099-S If you are the reporting person under the above rules then you must provide the sellers with a Form 1099-S on or after the closing date and before February 1 of the year following the year of the sale or exchange. Youll need to also report all the totals from the Form 8949 on.

Both sections have an option selection regarding Form 1099-B that brokers use to report the sale of stocks to the IRS. Form 1099-S - Sale of Real Estate Property. Certain exemptions apply if you sell your own primary residence.

Where this information is reported depends on the use of the property - main home timesharevacation home. When real estate is sold the seller is often subject to a capital gains tax. For your convenience clicking on the Yes option will take you directly to How to apply for an EIN.

The Internal Revenue Service requires owners of real estate to report their capital gains. When selling your home you may have signed a form certifying you will not have a taxable gain on the sale. Thats the correct procedure if the person responsible closing doesnt have the Social Security numbers.

About Form 1099-S Proceeds from Real Estate Transactions Use Form 1099-S to report the sale or exchange of real estate. Yes - the 1099 is erroneous if it is for nonemployee compensation when in fact you were paid not for personal services but for the sale of a piece of property. If a property has gone up in value while you own it you may have to pay tax on capital gains on the land sale.

Since you have sold at a loss then the sale is not reported on a federal tax return assuming that the home was never used as a rental or in a business. Speak to your closing attorney or realtor to see if a 1099-S is being sent. If you receive a Form 1099-S you must report the sale to the IRS regardless of your gain exclusion.

How To Determine If A Home Has Good Resale Value Real Estate Resale Real Estate Articles

How To Determine If A Home Has Good Resale Value Real Estate Resale Real Estate Articles

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Statement

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Statement

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Now In Today S Market It Has Been Verified That Buying Your Own Personal Short Sale Residence Is Going To Become Yo Shorts Sale Real Estate Real Estate Career

Now In Today S Market It Has Been Verified That Buying Your Own Personal Short Sale Residence Is Going To Become Yo Shorts Sale Real Estate Real Estate Career

I Am A Real Estate Agent T Shirt Real Estate Shirts Real Estate Career Real Estate Quotes

I Am A Real Estate Agent T Shirt Real Estate Shirts Real Estate Career Real Estate Quotes

How To Get More Real Estate Deals Real Estate Marketing Real Estate Career How To Get

How To Get More Real Estate Deals Real Estate Marketing Real Estate Career How To Get

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Should You File Taxes On Ebay Earnings My Money Chronicles Filing Taxes Ebay Tax

Should You File Taxes On Ebay Earnings My Money Chronicles Filing Taxes Ebay Tax

How Do I Enter The Sale Of Land

How Do I Enter The Sale Of Land

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Clovelline St Lender Secton 8 Real Estate Lender The Unit

Clovelline St Lender Secton 8 Real Estate Lender The Unit

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

A Real Estate Exit Strategy That Can Save On Taxes Home Staging Tips Home Staging Home Selling Tips

A Real Estate Exit Strategy That Can Save On Taxes Home Staging Tips Home Staging Home Selling Tips

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

How To Build A Financially Healthy Business What Numbers To Aim For Morgan Nield Business Tips Etsy Marketing Business Advice

How To Build A Financially Healthy Business What Numbers To Aim For Morgan Nield Business Tips Etsy Marketing Business Advice

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster