Canada Business Corporations Form 17

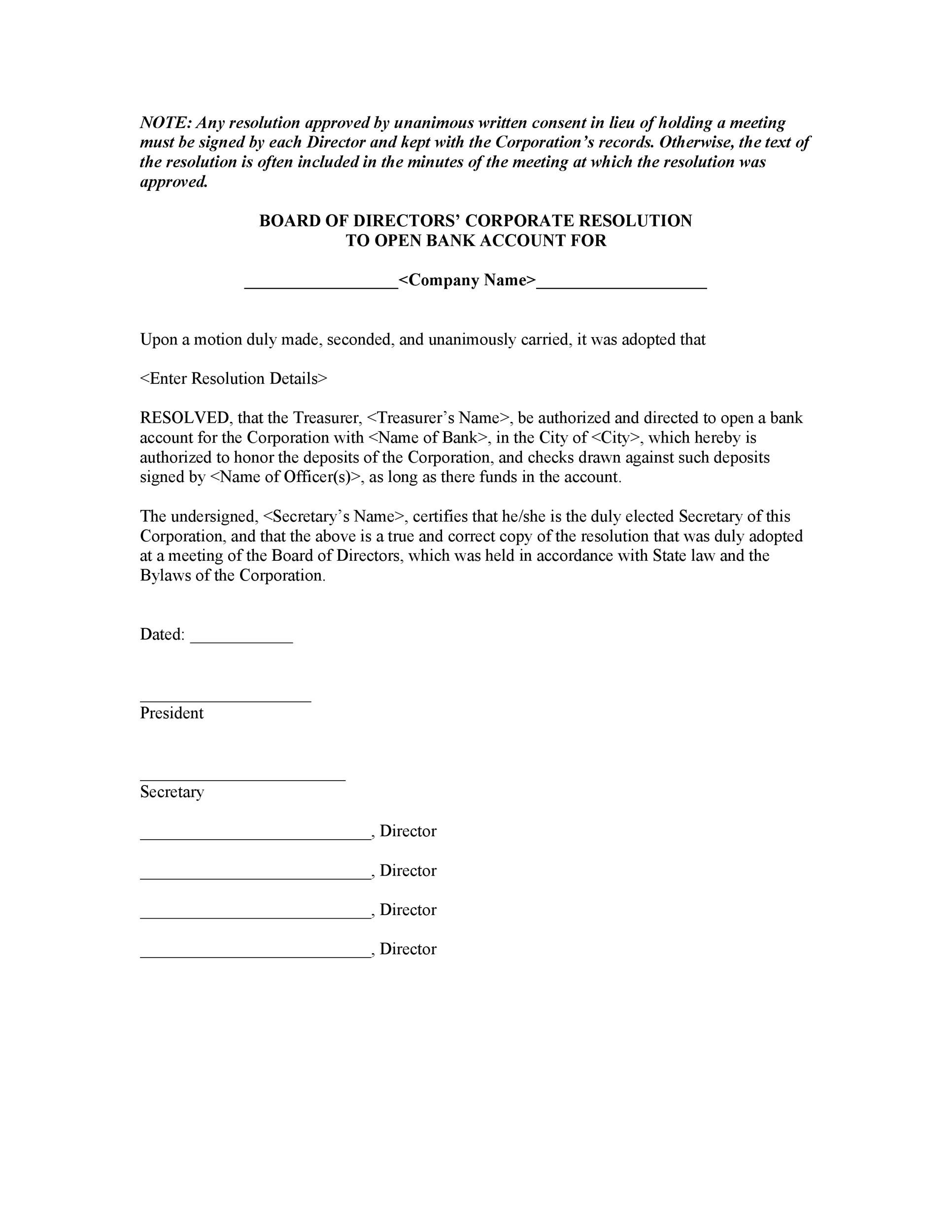

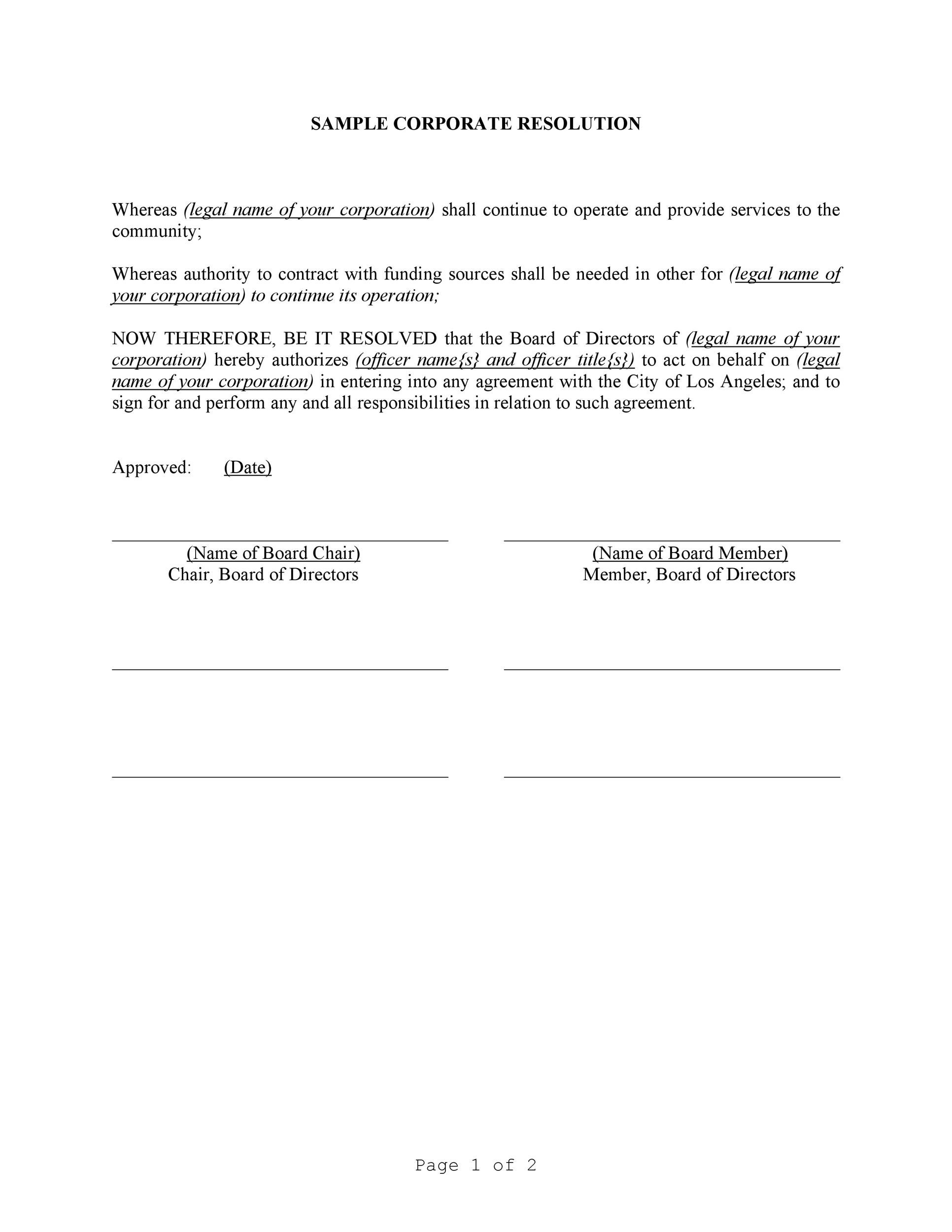

This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta. Articles of incorporation 6 1 Articles of incorporation shall follow the form that the Director fixes and shall set out in respect of the proposed corporation a the name of the corporation.

Federal laws of canada.

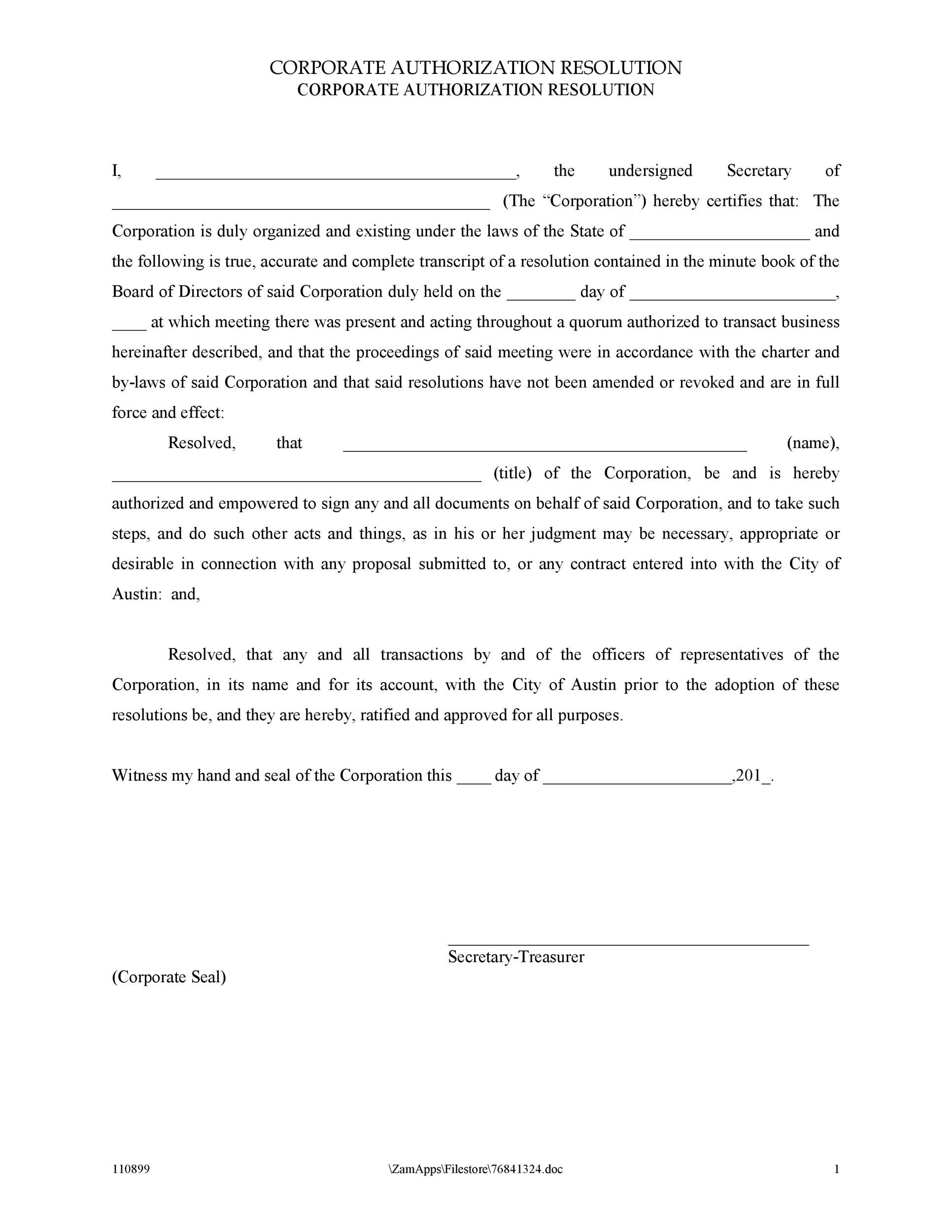

Canada business corporations form 17. Check only one box. Federal laws of canada. FORM 17 ARTICLES OF DISSOLUTION Item 4 Indicate if the corporation is applying for a dissolution under section 210 or 211 of the CBCA.

Do not mail forms to us unless the form indicates a paper copy should be submitted or you are instructed to do so by BC Registries staff. B the province in Canada where the registered office is to be situated. Canada Business Corporations Regulations 2001.

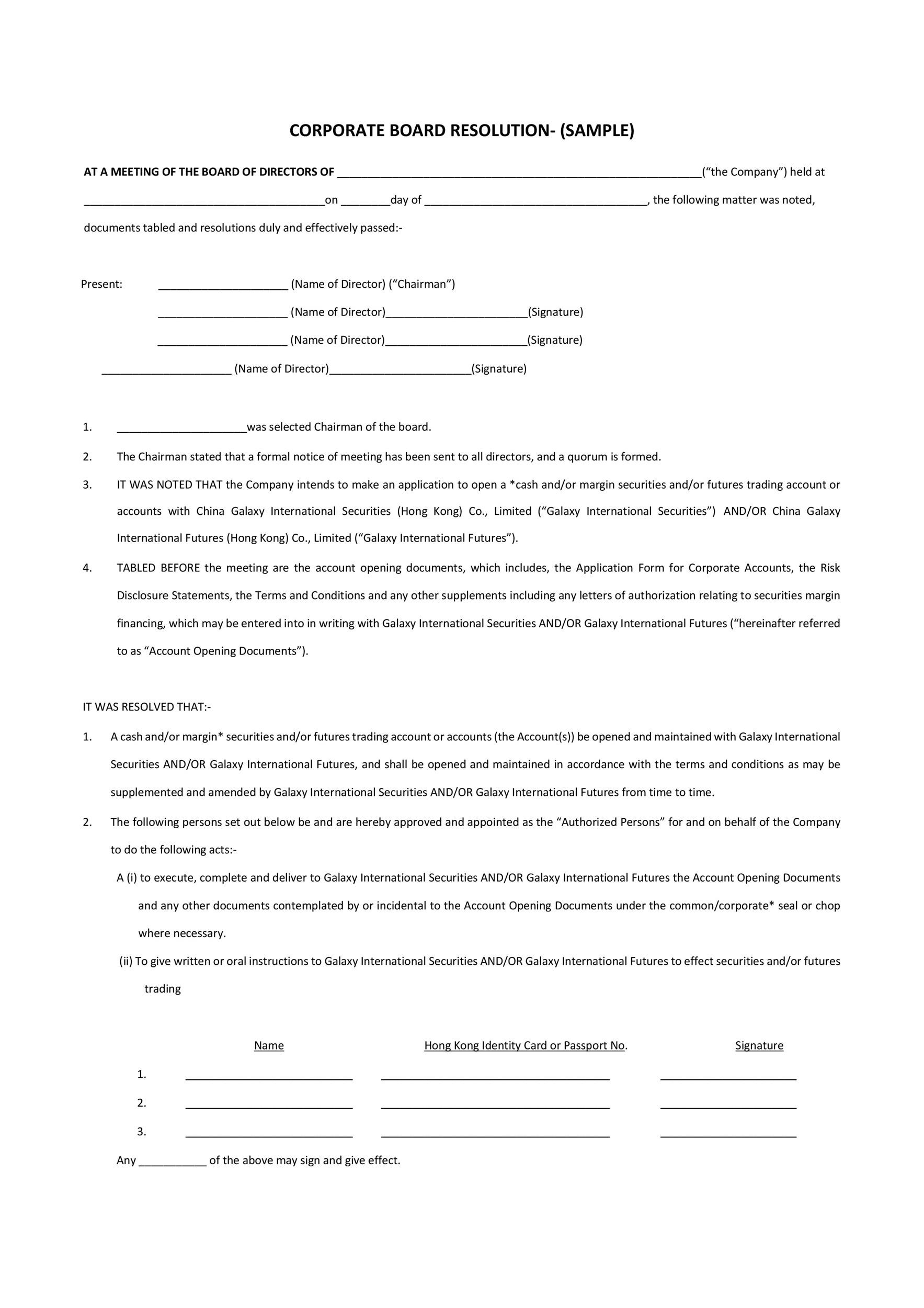

At that first meeting of shareholders the shareholders elect the corporations directors. Annual returns Form 17 for all corporations are due by the end of the month following the anniversary date of incorporationamalgamation. 150 1 A person shall not solicit proxies unless a proxy circular in the prescribed form is made available in the prescribed manner to the auditor of the corporation to each shareholder whose proxy is solicited.

Articles of incorporation 6 1 Articles of incorporation shall follow the form that the Director fixes and shall set out in respect of the proposed corporation a the name of the corporation. INFO 17 COM MAR 2018 4 IN THE MATTER OF insert full company name AND THE BRITISH COLUMBIA BUSINESS CORPORATIONS ACT SECTION 316 AFFIDAVIT I insert name of director of insert full residential address in the Province of British Columbia make oath and say as follows. Subsection 194 of the CBCA requires a corporation to send a Form 3 to Corporations Canada within 15 days of any change to its registered office address.

Subsection 2101 of the CBCA applies to a corporation that has not issued any shares. Paper forms may be used however to assist. Diversity in corporations 1721 1 The directors of a prescribed corporation shall place before the shareholders at every annual meeting the prescribed information respecting diversity among the directors and among the members of senior management as defined by regulation.

Subsection 1131 of the CBCA requires a corporation to send a Form 6 to Corporations Canada within. Due to a high volume of requests applications are taking longer than usual to process. Forms - For federal business corporations its faster and less expensive to file through Corporations Canadas Online Filing Centre.

17 Subsections 1501. Subsection 2102 of the CBCA applies to a corporation that has no property and no liabilities. You can assume your application is processing right up to 5 business days following your incorporation application and you dont need to contact us to confirm.

The exception is a bankrupt corporation. Revival 209 1 When a corporation or other body corporate is dissolved under this Part section 268 of this Act section 261 of the Canada Business Corporations Act chapter 33 of the Statutes of Canada 1974-75-76 or subsection 2976 of the Canada Not-for-profit Corporations Act any interested person may apply to the Director to have the. A bankrupt corporation cannot request to be dissolved under the Canada Business Corporations Act CBCA.

If such is the case you have to file a. Same 3 No persons associated in partnership shall carry on business or identify themselves to the public unless the firm name of the partnership is registered by all of the. A corporation can apply to dissolve when it has no property or liabilities.

C the classes and any maximum number of shares that the corporation is authorized to issue and. Guide on dissolving a business corporation. Forms policies models and legislation.

Bankruptcy does not end a corporations existence. B the province in Canada where the registered office is to be situated. The mandate of the first directors begins on the date Corporations Canada issues the certificate of incorporation and ends at the first meeting of shareholders.

PART XIV1 Disclosure Relating to Diversity. Federal corporation forms and instructions On January 15 2020 Corporations Canada adopted a digital-first approach to forms for business and not-for-profit corporations. Same 2 No individual shall carry on business or identify his or her business to the public under a name other than his or her own name unless the name is registered by that individual.

To receive the latest news on business corporations. Have your GSTHST refunds and rebates payroll andor corporation income tax refunds deposited directly into your bank account or change the direct deposit information. Her Excellency the Governor General in Council on the recommendation of the Minister of Industry pursuant to subsection 2611 a of the Canada Business Corporations Act b hereby makes the annexed Canada Business Corporations Regulations 2001.

The Canada Business Corporations Act allows businesses to incorporate federally and operate under one name right across the country. Benefit Companies can file online filings through the Business Registry. Canada Business Corporations Act RSC 1985 c.

This form lists the first members of the board of directors of your corporation. C the classes and any maximum number of shares that the corporation is authorized to. Federal laws of canada.

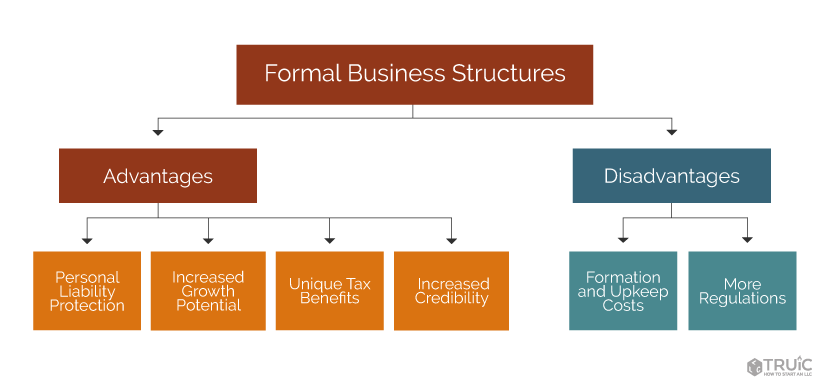

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Free Business Credit Application Application Form Job Application Form Credit Card Application

Free Business Credit Application Application Form Job Application Form Credit Card Application