What Taxes Does An Llc Pay In New York

The amount of the filing fee for an LLC that is treated as a disregarded entity for federal income tax purposes and that has any income gain loss or deduction from New York Sources is 25. For more information see.

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

How a Multiple-member LLC Pays Income Taxes An LLC that has more than one member typically pays income tax as a partnership.

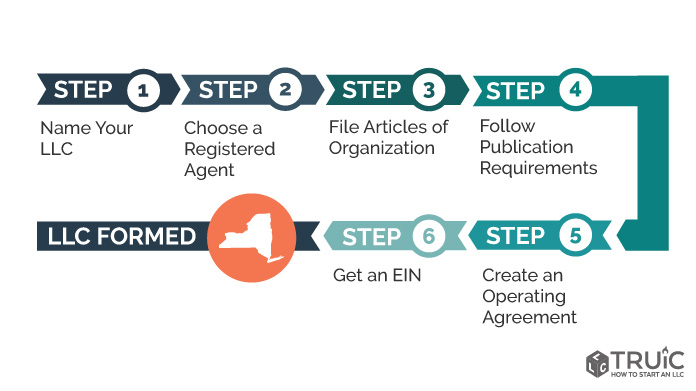

What taxes does an llc pay in new york. This must be paid each year when you file the NJ-1065 Partnership Return. Chris Windsor Answered October 7 2020 To establish and run an LLC in NYC you will have to pay NY Filing Fees 220 USD Publication Fees 50 USD and Annual State Filing Fees. Forming a Limited Liability Company in New York State.

Four brothers agree to be equal members at LLC registration. Currently the MTI tax rate for New York corporations is 15 percent however certain New York manufacturers may qualify for a reduced tax rate is 075 percent. Reporting your income as an LLC member has several steps.

The tax has two parts. Does an LLC pay Taxes. Members will report any of this income that is passed on to them on their individual tax returns as dividends or interest and once again pay taxes on it.

The net income shown on Schedule C is added to the persons other income on their tax return Form 1040 or 1040-SR to figure their total income and tax liability for the year. New York recognizes many business forms including the limited liability company LLC corporation limited partnership sole proprietorship general partnership and other less familiar forms. A one-member LLC is treated as a disregarded entity.

This computation is determined in accordance with the provisions of section 631 of the New York State Tax Law as if those provisions and any related provisions expressly referred to a computation of federal gross income from New York sources. As such they do not pay federal income tax or state tax in most places including New York. Like LLCs however they are subject to the state filing fee which is calculated using the same.

In New York individual LLC members must pay state income tax on the amount distributed to them but the LLC itself must also pay the state filing fee. Each has its own advantages and disadvantages. Small business owner you must pay self-employment taxes which is a flat rate of 153 which is 124 for Social Security and 29 for Medicare.

Personal Income Tax for Business Taxpayers. If you have a New Jersey Multi-Member LLC 2 or more owners along with your NJ-1065 return you must pay the LLC Partner Tax which is 150 per LLC Member. Using FDM New York C corporations pay a flat fee based on their New York State receipts rather than a.

Consequently a New York S corporation having income form New York City sources will be taxed as a corporation for New York City tax purposes and has to pay New York Citys General Corporation Tax. LLC as a C Corporation. As an example youll pay 7500 in taxes for a 50000 salary.

An LLC or LLP that is treated as a corporation for federal income tax purposes may be required to file a New York State corporation franchise tax return. The amount of the filing fee for an LLC. LLCs An LLC is a kind of legal protection granted to companies willing to file that way on the state level.

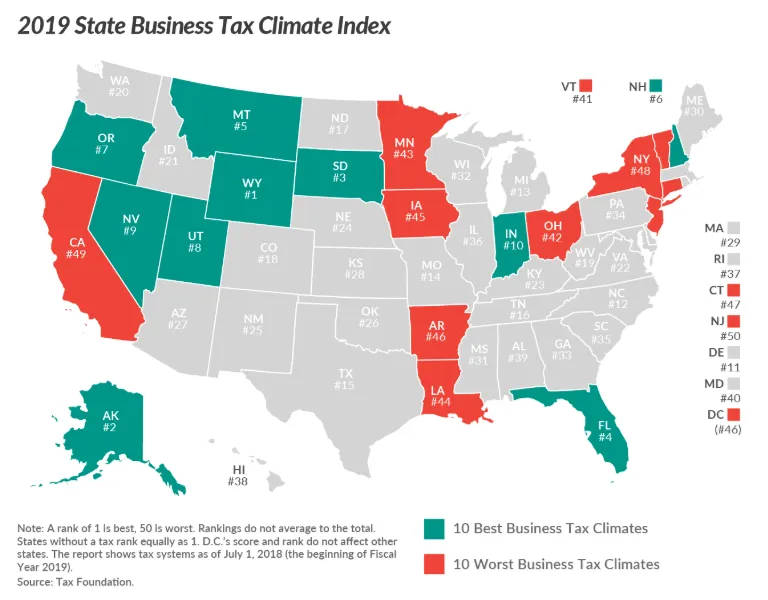

According to an SBA report the tax rates for sole proprietorships is 133 percent rate small partnerships is 236 percent and small S corporations is 269 percent. New York LLC owners pay self-employment tax on business profits. A single-member LLC pays taxes by filing a Schedule C report that calculates the net income of the business income minus deductions credits and other items.

Multi-owner LLCs treated as a partnership pay tax similarly. New York LLC owners pay state tax on any profits less state allowances or deductions. As a self-employed individual you pay both parts both the employee and the employer.

The profits of a New York LLC are not taxed at the business level like those of C Corporations. The corporation will have to pay a tax on profits. The individual partners pay tax based on their share of ownership in the partnership.

Businesses that are obligated to pay it are capped at 1 of income which is much lower than the state income tax in many places. The taxes levied across your full income are Medicare Social Security tax and FICA. The LLC Partner Tax is not required for Single-Member LLCs.

The State Filing Fees vary depending on your annual income. LLC Partner Tax. The business has 500000 in.

An LLC or LLP may be required to pay a filing fee andor estimated income tax on behalf of certain partners or members. Instead tax for a New York LLC works as follows. The partnership itself does not pay taxes directly to the IRS.

One is paid by the employee and the other paid by the employer. If you elect for your LLC to be taxed as a C corporation youll file the Form 1120 corporation tax return. New York City does not recognize S corporation status.

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Screenshot New York Business Express Business New York Expressions

Screenshot New York Business Express Business New York Expressions

Tax Preparer Resume Sample Job Resume Samples Resume Accountant Resume

Tax Preparer Resume Sample Job Resume Samples Resume Accountant Resume

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Limited Liability Companies Frequently Asked Questions Nys Dos

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

What Is An Llc And What Are The Benefits Llc Taxes Llc Ways To Save

What Is The Best Type Of Company Co Inc Llc Corp Ltd Etc And What Do They All Mean Law Firm Business Business Law Business Tax

What Is The Best Type Of Company Co Inc Llc Corp Ltd Etc And What Do They All Mean Law Firm Business Business Law Business Tax

How To Get A Resale Certificate In New York Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Time

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Time

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Forget The Package Delivering Drones Online Retailers Are Really Focused On Taxes This Holiday Season Corporate Law Sales Tax Tax

Forget The Package Delivering Drones Online Retailers Are Really Focused On Taxes This Holiday Season Corporate Law Sales Tax Tax