The Form Of Business Organization Where Capital Is Owned

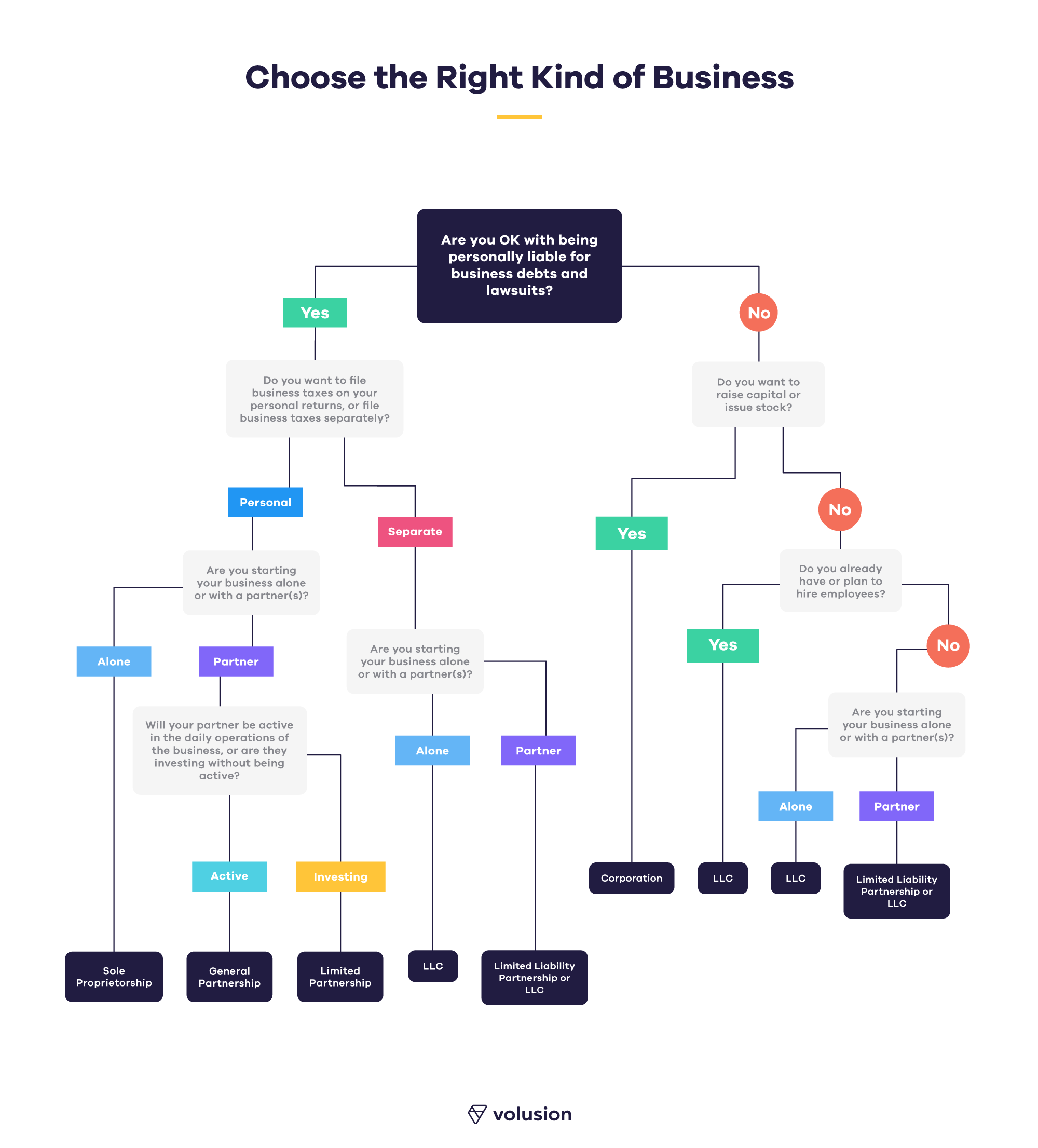

Use the description of each business to classify it as a proprietorship partnership corporation or limited liability partnership andor limited liability company LLPLLC. When beginning a business you must decide what form of business entity to establish.

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Sole proprietorship or individual entrepreneurship is a business concern owned and operated by one person.

The form of business organization where capital is owned. The business is owned by one person. Sole proprietorships do not. A business established or operated under an authorization to sell or distribute a companys goods or services in a particular area cooperative A business that is owned by the members it serves and is managed in their interest.

The business has access to more capital than a sole trader. Public corporations are owned by shareholders who elect a board of directors to oversee primary responsibilities. These businesses are owned by one person usually the individual who has day-to-day responsibility for running the business.

All partners always have limited liability o B. One of the advantages of a partnership form of business organisation is that. The most common forms of business are the sole proprietorship partnership corporation and S corporation.

Sole proprietorships can be owned by more than one person. The owner faces unlimited liability. Sole proprietorships are the most common form of business organization in the United States.

The owners may disagree. Meaning the creditors of the business may go after the personal assets of the owner if the business cannot pay themIt is usually adopted by small business entities. He alone contributes the capital and skills and is solely responsible for the results of.

The best definition of a sole trader form of business organization is. It is easy to set-up and is the least costly among all forms of ownership. Your form of business determines which income tax return form you have to file.

Which of the following forms of business organization can be privately owned. A corporation is a legal entity doing business and is distinct from the individuals within the entity. Which of the following is not one of the three forms of business organization.

The assets of an association are contributed directly or indirectly by its membersdirectly if a member transfers a personally owned business or property or investments to the association in return for a share in its capital indirectly if a members share of capital is paid in cash and the association then uses that contribution and like contributions in cash made by other members to purchase a business property. Decisions take too long to make o C. Topic 5 Forms of Business Organizations Sole Proprietorship A sole proprietorship is a business owned by only one person.

A Corporations b Investors c Proprietorship d Partnerships. Sole proprietors can be independent contractors freelancers or home-based businesses. Along with standard for-profit corporations.

Business 1 Business 2 Rudo Pablo and Jose own an accounting firm in DDX Co. One of the claimed advantages of a sole trader business is that. Sole proprietorships generate about 40 percent of all sales in the United States.

The firm has a single customer. There is a single firm in the industry. The sole proprietor is a person who carries on business exclusively by and for himself.

Is a short-haul trucking company. Capital is limited to owners savings and bank loans o B. As they are government owned there is no profit motive o D.

Shares can be sold on the Stock Exchange o C. Sole proprietorship The vast majority of small businesses start out as sole proprietorships. Rudo owned 1000 shares of DDX stock.

A Limited Liability Company LLC is a business structure allowed by state statute. When capital accounts are fixed than all adjustments are made in.

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Llc Operating Agreement Template Llc Operating Agreement Template Http Webdesign14com Operati Limited Liability Company Separation Agreement Template Agreement

Llc Operating Agreement Template Llc Operating Agreement Template Http Webdesign14com Operati Limited Liability Company Separation Agreement Template Agreement

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Pin By Myusacorporation On Business In The Usa Drop Shipping Business Location Independent Writing

Pin By Myusacorporation On Business In The Usa Drop Shipping Business Location Independent Writing

Benefits Of Incorporating Business Law Small Business Deductions Business

Benefits Of Incorporating Business Law Small Business Deductions Business

Sole Proprietorship Registration Sole Proprietorship Opening A Bank Account Business Structure

Sole Proprietorship Registration Sole Proprietorship Opening A Bank Account Business Structure

A Limited Liability Company Can Be Formed Of Minimum 2 To 50 Person Whose Liability Is Limited To Their Shares Limited Liability Company Llc Business Liability

A Limited Liability Company Can Be Formed Of Minimum 2 To 50 Person Whose Liability Is Limited To Their Shares Limited Liability Company Llc Business Liability

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

What Is Fixed Capital Definition Meaning And Examples Capital Definition Meant To Be Starting A Company

What Is Fixed Capital Definition Meaning And Examples Capital Definition Meant To Be Starting A Company

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

The Seven Most Popular Types Of Businesses Legal Business Business Ownership Profit And Loss Statement

The Seven Most Popular Types Of Businesses Legal Business Business Ownership Profit And Loss Statement

What Is The Corporate Veil And Why Is It So Important To Keep It Intact Secret Entourage Limited Liability Company Sole Proprietorship S Corporation

What Is The Corporate Veil And Why Is It So Important To Keep It Intact Secret Entourage Limited Liability Company Sole Proprietorship S Corporation

Should I Incorporate My Canadian Small Business Fbc Daycare Business Plan Business Tax Small Business Tax

Should I Incorporate My Canadian Small Business Fbc Daycare Business Plan Business Tax Small Business Tax

Choosing Ownership Structure For Your Startup Business Format Business Structure Management Infographic

Choosing Ownership Structure For Your Startup Business Format Business Structure Management Infographic

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship