How To Determine Present Value Of Future Cash Flows

FV of a mixed stream cash flow C1 FVIF1 C2 FVIF2 C3 FVIF3. The discount rate used to determine the present value of future cash flows from ACG 3024 at Lake-Sumter State College.

Npv Calculator Calculate And Learn About Discounted Cash Flows Investing Finance Investing Finance Advice

Npv Calculator Calculate And Learn About Discounted Cash Flows Investing Finance Investing Finance Advice

The present value of cash flow uses a discounting formula to calculate the present value of future cash flows at a specified rate of return.

How to determine present value of future cash flows. Present value Expected Cash Flow 1Discount RateNumber of periods Thus for year one the math would look like this. After we get the future value interest factors of each year at a given interest rate we just simply multiply each stream of cash flow with the future value interest factors. How do you calculate the present value of a cash flow stream.

Formula to Calculate Present Value PV Present Value a concept based on time value of money states that a sum of money today is worth much more than the same sum of money in the future and is calculated by dividing the future cash flow by one plus the discount rate raised to the number of periods. You will also need to evaluate whether or not interest. PV C 1 r n where PV Present value.

The future value FV of a series of cash flows is the future value at future time N total periods in the future of the sum of the future values of all cash flows CF. How to Calculate Present Value of Future Cash Flows. PV 412 512 0 15000 Therefore if an investment has a stated annual interest rate of 4 compounded monthly and returns 15000 after 5 years the present value of the investment can be calculated as follows.

PV 412 512 0 15000 which returns the result -1228505. How do you calculate the future value of a cash flow stream. Internal rate of return.

This rate of return is discounted from the future cash flows. In order to determine the future value of a cash flow you will need to assess whether or not the flow is a one-time or recurring transaction. This means the higher the discount rate the lower the present value of future cash flows.

What is the intuition behind the fact that an infinite stream of cash flows has a finite present value. What are some examples of perpetuities. The bigger the discount rate the smaller the present value.

For this reason present value is sometimes called present discounted value. The discounted cash flow DCF formula is equal to the sum of the cash flow in each period divided by one plus the discount rate WACC raised to. If the NPV of a project or investment is positive it means that the discounted present value of all future cash flows related to that project or investment will be positive and therefore.

The present value of an investments future cash flows divided by the initial cost of the investment is called the. Thus we can summary the formula of the future value of a mixed stream cash flow as follows. The formula for finding the present value of future cash flows PV C 1 - 1i-ni where C the cash flow.

We start with the formula for FV of a present value PV single lump sum at time n and interest rate i F V P V 1 i n. The present value of annuity can be defined as the current value of a series of future cash flows given a specific discount rate or rate of return. Cn FVIFn.

Present Value Pv Formula Present Value Is A Current Value Of Come Future Cash Flow Present Value Formula Is Used To Determine The Pr Cash Flow Finance Flow

Present Value Pv Formula Present Value Is A Current Value Of Come Future Cash Flow Present Value Formula Is Used To Determine The Pr Cash Flow Finance Flow

Discounted Cash Flow Learn What Is Discounted Cash Flow Stockmarket Stockmarkettips Stoc Finance Investing Money Management Advice Accounting And Finance

Discounted Cash Flow Learn What Is Discounted Cash Flow Stockmarket Stockmarkettips Stoc Finance Investing Money Management Advice Accounting And Finance

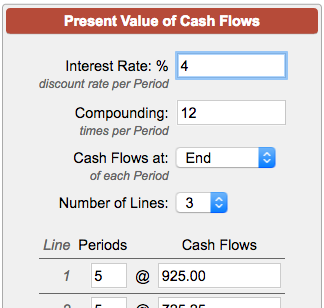

Present Value Of Cash Flows Calculator

Present Value Of Cash Flows Calculator

Discounted Cash Flow Npv Time Value Of Money Examples Calculated Time Value Of Money Cash Flow Financial Accounting

Discounted Cash Flow Npv Time Value Of Money Examples Calculated Time Value Of Money Cash Flow Financial Accounting

Present Value Formula Calculator Examples With Excel Template

Present Value Formula Calculator Examples With Excel Template

Present Value How To Memorize Things Pmp Exam Pmbok

Present Value How To Memorize Things Pmp Exam Pmbok

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

What Is Net Present Value In 2020 Time Value Of Money Financial Investments Financial Modeling

What Is Net Present Value In 2020 Time Value Of Money Financial Investments Financial Modeling

Time Value Of Money How To Calculate The Pv And Fv Of Money Time Value Of Money Cash Flow Statement Budget Forecasting

Time Value Of Money How To Calculate The Pv And Fv Of Money Time Value Of Money Cash Flow Statement Budget Forecasting

Net Present Value Npv Definition Examples How To Do Npv Analysis Cost Of Capital Business Valuation Company Financials

Net Present Value Npv Definition Examples How To Do Npv Analysis Cost Of Capital Business Valuation Company Financials

Profitability Index Calculator Technology Solutions App Cash Flow

Profitability Index Calculator Technology Solutions App Cash Flow

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Whi Financial Decisions Cash Flow Inbound Marketing Strategy

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Whi Financial Decisions Cash Flow Inbound Marketing Strategy

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg) Net Present Value Npv Definition

Net Present Value Npv Definition

Tactical Trading Definition Investing Fundamental Analysis Technical Analysis

Tactical Trading Definition Investing Fundamental Analysis Technical Analysis

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

How To Use The Excel Npv Function Exceljet

How To Use The Excel Npv Function Exceljet

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions