Do Canadian Companies Need To Complete A W8

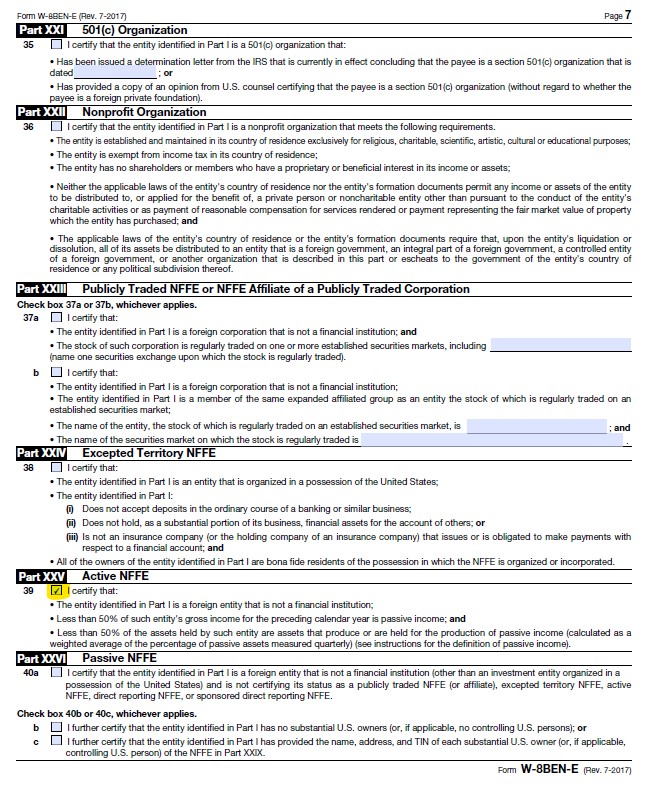

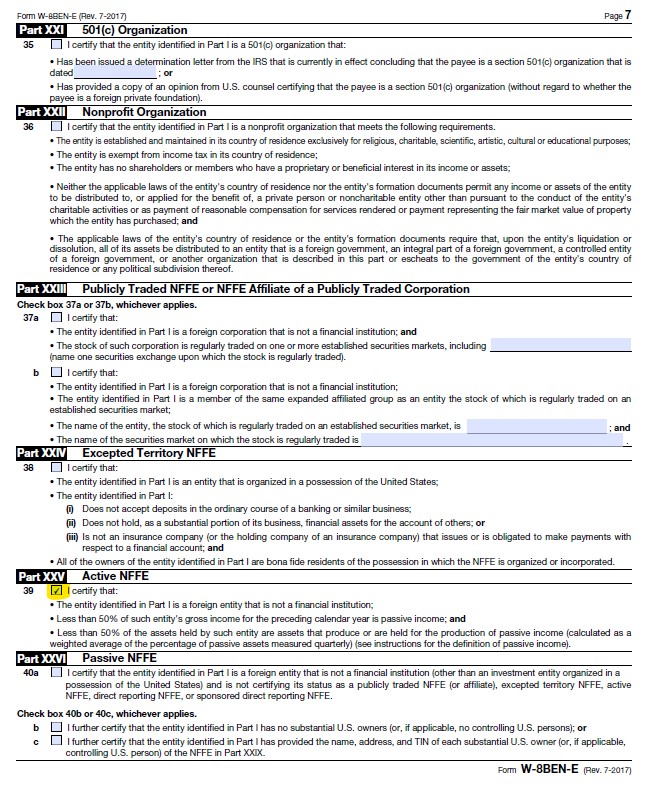

By stating that youre an Active NFFE Part XXV in the 2016 version of the form youre stating that youre not a financial institution and that more than half of your income was produced from active business in Canada. Sellers who sell on Amazon Shopify eBay WooCommerce and other eCommerce platforms are often required to present this form to identify themselves as a foreign company in the US.

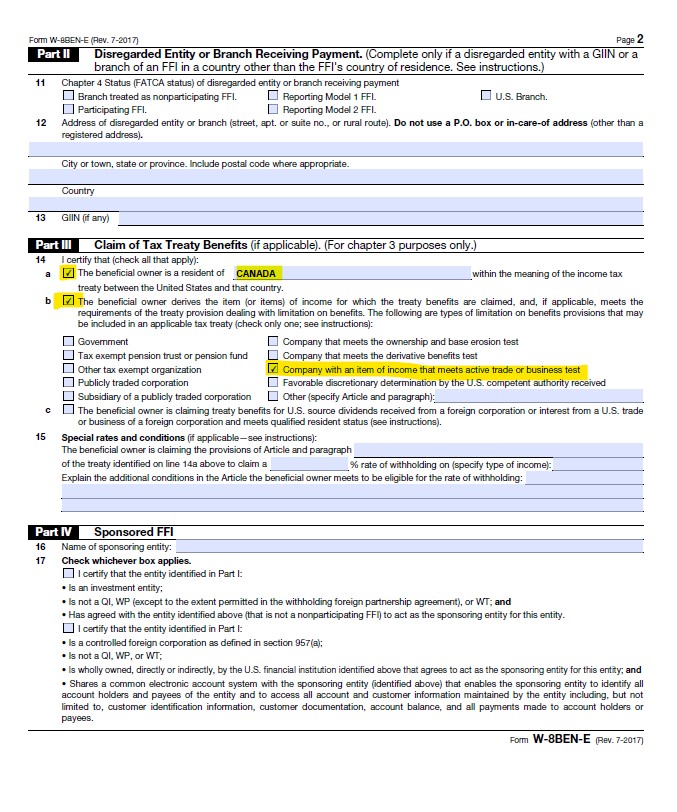

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

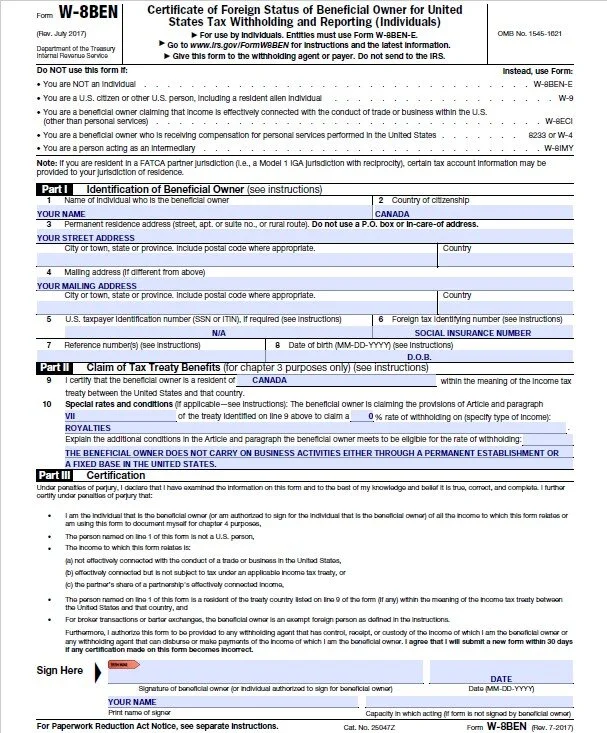

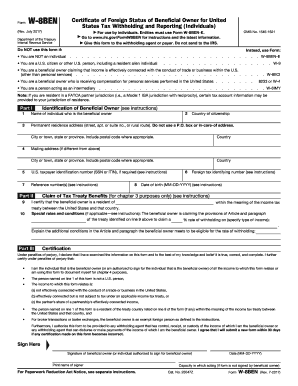

The W-8BEN is used to confirm that a vendor is a foreign person and must be provided even if the vendor is not claiming a tax treaty reduction or exemption from withholding.

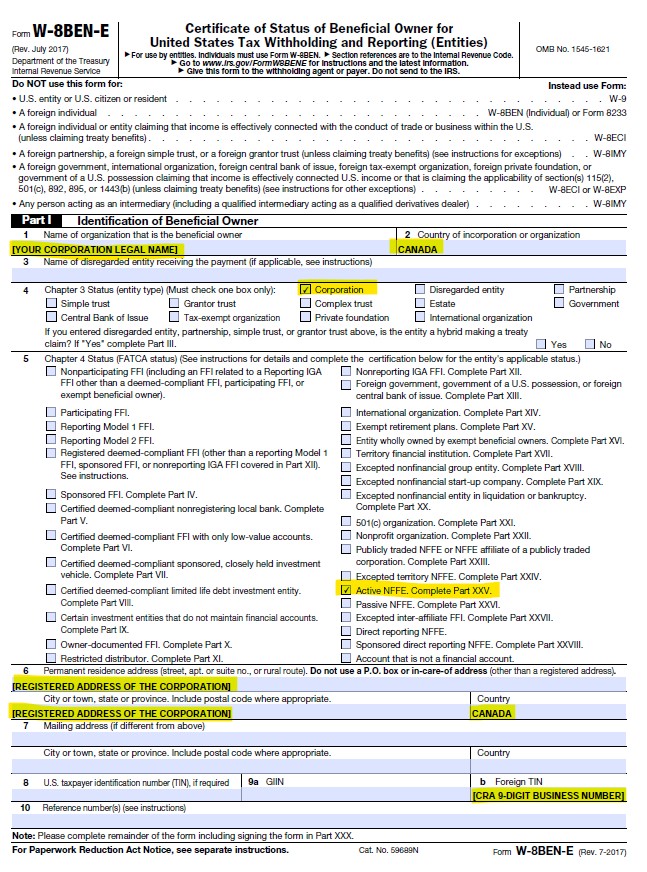

Do canadian companies need to complete a w8. What do I need to do here. To comply with FATCA all US companies have to request their overseas partners to complete W-8BEN-E form in order to reduce or eliminate 30 withholding tax. If you get the form for individuals for your corporation you will need to ask them for the company form.

Ive also never been asked to do a W9 before. We provide you with all the information you need in this article to fill out the W8 form and to. Im excited but they want me to complete a W9.

In order to determine its status the US. If you are an FFI documenting an account holder that is a tax-exempt organization or exempt beneficial owner each as defined for chapter 4 purposes to which you do not pay amounts subject to withholding under chapter 3 you may require that the account holder complete Form W-8BEN-E rather than Form W-8EXP to establish its status for chapter. For most active Canadian companies the W8-BEN-E form will be used to determine that no withholding taxes should apply on the money paid to you due to the Canada US tax treaty.

I just got a new client a huge US-based international company that is giving me 300 per blog post. Dont skip the formDo not panic either. The form includes a declaration that youll include this US.

Do not complete Part XXVI or XXVII. Form 1120F is due on June 15 and must be prepared based on calendar year end. Foreign individuals who receive certain types of income from US.

We provide the service for the Canada office but US office reports we have to complete a W8 tax form to get paid. As a Canadian Controlled Private Corporation you complete the form W-8 BEN-E form. We perform services for a US-based company with an office in Canada.

You must ensure you complete the correct form for this. You only need a w8 if services were provided on the US. You need to know that US entities are not supposed to pay you any invoice before you send them the W8 form correctly filled and signed so this is serious business.

For entities corporations youll need to complete Form W-8BEN-E. If you hired a consultant and they did work in the US you need a W8 only Id they claim no taxes because they are from a treaty country. Canadian Corporations Providing Services in the United States must file Foreign Corporate Tax Return or Form 1120F.

The W-8 BEN form is for individuals. However if youre already paying tax on your income to the Canadian Revenue Agency CRA you can complete the W8-BEN form and give it to your client to confirm that they should release your full payment with nothing withheld. Source you are required to submit a properly completed Form W-8BEN to the party or company that is providing you with income.

We frequently receive requests to assist with filling out the form W-8BEN-E from Canadian eCommerce sellers. If you have a foreign contractor working for you that person will need to. Instead complete the IGA Certification Form for Canadian Entities.

Form W-9 is used to gather information only from US persons and businesses. As a Canadian contractor earning income from a US. This works because the US and Canada have a tax treaty which is in place to stop double taxation².

If you bought something from overseas and it was imported no. Mandatory - Enter the permanent residence address of the entity the physical location or the registered address indicated on the organizational documents Must be consistent with line 2. Does a Canadian based business require filling out a US W8 form to be paid by a US company.

Im Canadian and never lived in the US. Canadian Corporations are normally in a good position to save thousands of dollars in social security taxes if the entire tax situation is handled. In the past we used to charge 150 CAD for our work to.

The American payor of this income typically withholds the appropriate amount of tax from their payment to the foreign person or business and is therefore called the withholding agent. Private Canadian companies were among the first to face the new reporting requirements under FATCA and just like others were required to complete the new W-8BEN-E form in order to get paid by their US clients. Therefore all foreign vendors must provide a W-8BEN even if no ITIN or SSN exists unless another W-8 series form is provided.

In some cases Form W-9 is provided however Form W-9 should only be completed by US. Based sources are subject to taxation by the US government. Income on your Canadian tax return.

Clients may request the Canadian business to complete Form W-8BEN W-8ECI W-8IMY or W-8EXP depending on the situation.

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

How To Fill W8ben E Form As A Company 2018 Youtube

How To Fill W8ben E Form As A Company 2018 Youtube

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer