Do I Need To File Form 4562

You should file it for the same year you bought the property youre planning to depreciate or amortize. Depreciation refers to the calculated loss in value of an asset through its working life span.

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Form 4562 is the tax document you can use to claim deductions for the properties you use for your business.

Do i need to file form 4562. Some intangible assets that can be deducted with Form 4562 include patents trademarks franchise agreements and. A depreciable asset is anything you buy for your business that you plan on using for more than one financial year. Who must file Form 4562.

Form 4562 should be included as part of your annual tax return. Filing Form 4562 File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election. Use Form 4562 to.

You are only obligated to file Form 4562 if youre deducting a depreciable asset on your tax return. When you enter depreciable assetsvehicles buildings farm equipment intellectual property etcwell generate Form 4562 and apply the correct depreciation method. In that case each vehicles mileage and actual expenses will both be entered via the depreciation module see below and the program will calculate both the depreciation and the allowable expenses.

Youll need to file Form 4562 for every year that you continue to depreciate your asset. Income Tax Return for an S Corporation regardless of when it was placed in service. If you need more space attach additional sheets.

Depreciation or amortization on any asset on a corporate income tax return other than Form 1120S US. Form 4562 is also used for amortizing certain intangible business assets. However complete only one Part I in its entirety when computing your section 179 expense deduction.

Any business entity that owns a depreciable asset will need to file Form 4562. Also sometimes the Form 4562 contains depreciation for other items associated with the rental property. That way the IRS can easily see why you are not claiming required depreciation on your rentals.

If you still file a Schedule E with rental income and expenses you should continue to include your Form 4562 with your return. File a separate Form 4562 for each business or activity on your return for which Form 4562 is required. A depreciable asset is an asset that you plan on using for more than one year.

Attach Form 4562 to your tax return for the current tax year if you are claiming any of the following items. Information about Form 4562 Depreciation and Amortization including recent updates related forms and instructions on how to file. Business owners must file Form 4562 if they are claiming depreciation for property that was placed into service during the current tax year or a previous tax year section 179 deductions.

Form 4562 is the Depreciation and Amortization form used when filing an income tax return. Form 4562 is required if you are using actual expenses and are depreciating the vehicles andor claiming a Section 179 deduction. If you need assistance completing the form find a financial advisor or accountant who specializes in taxes.

Do I need to fill out Form 4562. IRS Form 4562 is used to calculate and claim deductions for depreciation and amortization. When you claim depreciation its incredibly important that you retain copies of all 4562s so you can track your prior deductions and claim the appropriate amount in future years.

You must file a Form 4562 for the first year you claim depreciation or amortization on any particular piece of property for any year you claim a Section 179 expensing election including an amount carried over from a previous year and for every year you claim depreciation on a car other vehicle or any other type of listed property. For example when you purchase a set of computers for the office you expect them to last for at least the next five years. Figuring out how to depreciate assets isnt always simple though.

Form 4562 is used to claim a depreciationamortization deduction to expense certain property.

Learn How To Fill The Form 4562 Depreciation And Amortization Youtube

Learn How To Fill The Form 4562 Depreciation And Amortization Youtube

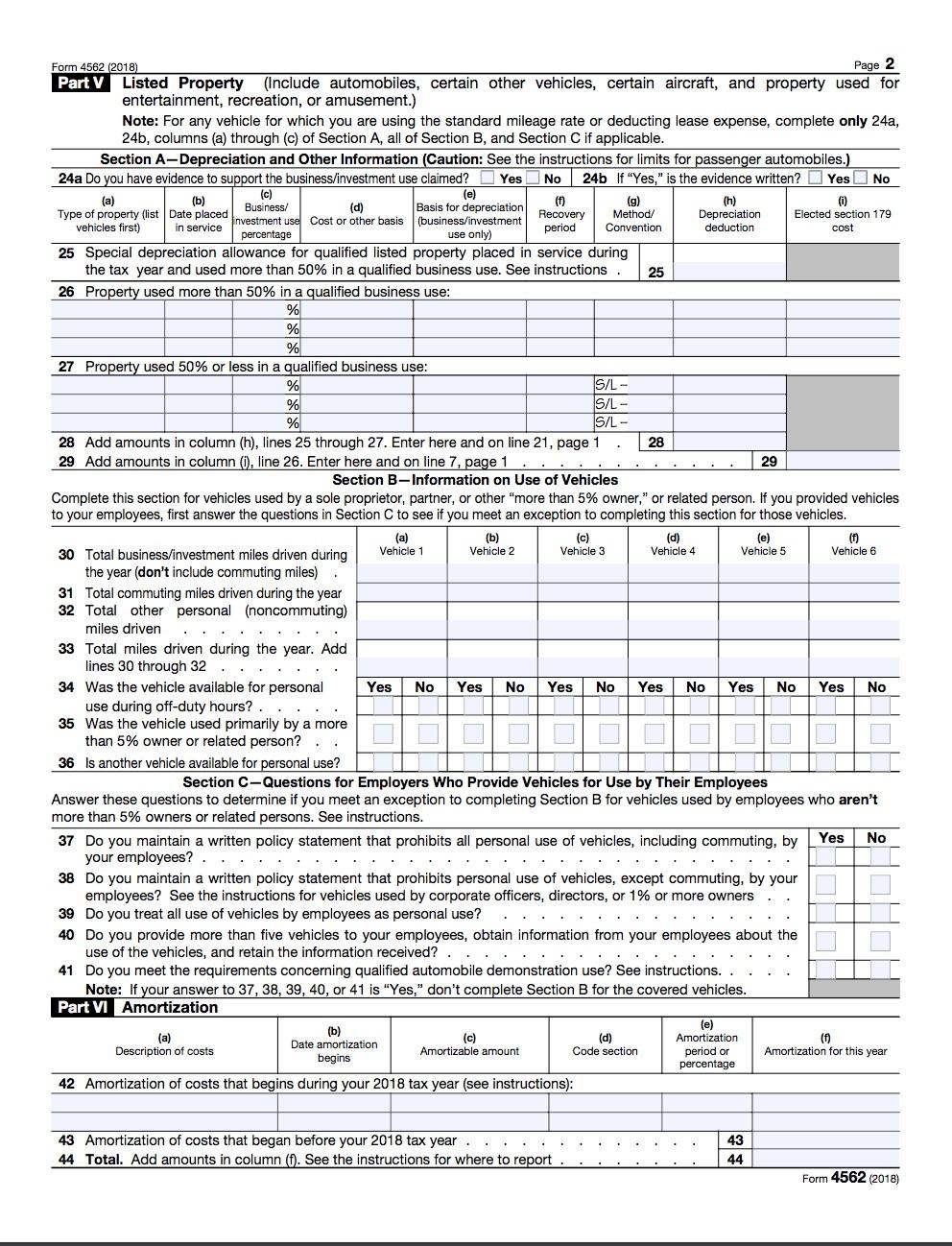

4562 Listed Property Type 4562

4562 Listed Property Type 4562

Form 4562 Depreciation And Amortization Youtube

Form 4562 Depreciation And Amortization Youtube

All About Irs Form 4562 Smartasset

All About Irs Form 4562 Smartasset

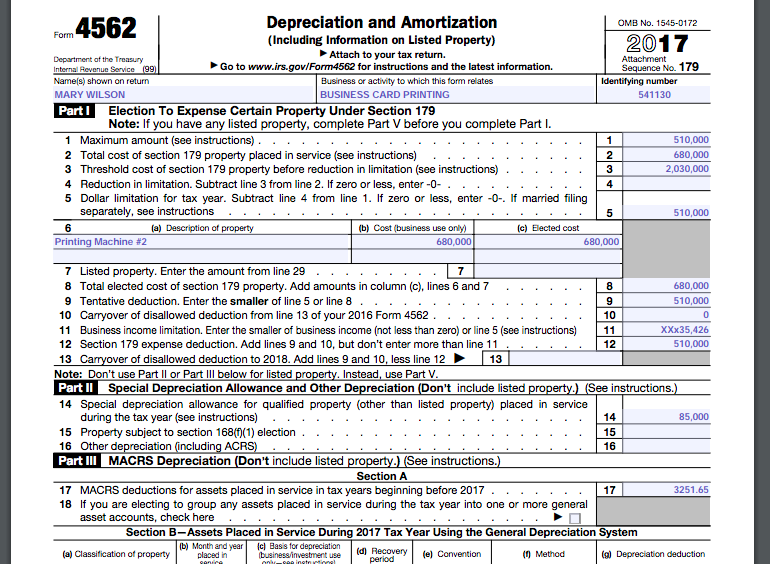

![]() Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png) Form 4562 Depreciation And Amortization Definition

Form 4562 Depreciation And Amortization Definition

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

![]() Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions

Checklist For Irs Form 4562 Depreciation 2019 Tom Copeland S Taking Care Of Business

Checklist For Irs Form 4562 Depreciation 2019 Tom Copeland S Taking Care Of Business

Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

![]() Form 4562 Do I Need To File Form 4562 With Instructions

Form 4562 Do I Need To File Form 4562 With Instructions

Section 179 Addback Example 1 Sole Proprietor Minnesota Department Of Revenue

Section 179 Addback Example 1 Sole Proprietor Minnesota Department Of Revenue

2020 Form Irs 4562 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 4562 Fill Online Printable Fillable Blank Pdffiller

Irs Form 4562 Instructions The Complete Guide

Irs Form 4562 Instructions The Complete Guide

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

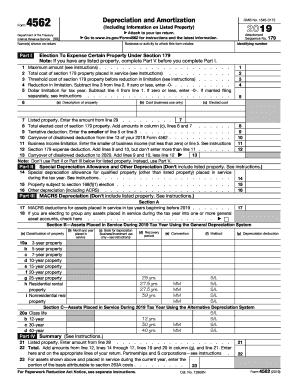

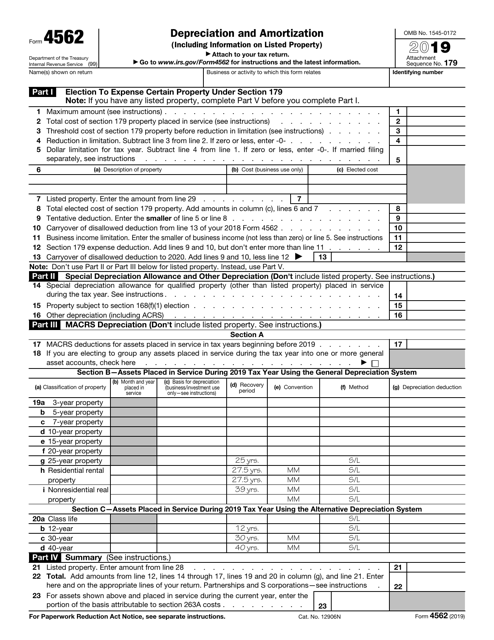

Irs Form 4562 Download Fillable Pdf Or Fill Online Depreciation And Amortization 2019 Templateroller

Irs Form 4562 Download Fillable Pdf Or Fill Online Depreciation And Amortization 2019 Templateroller

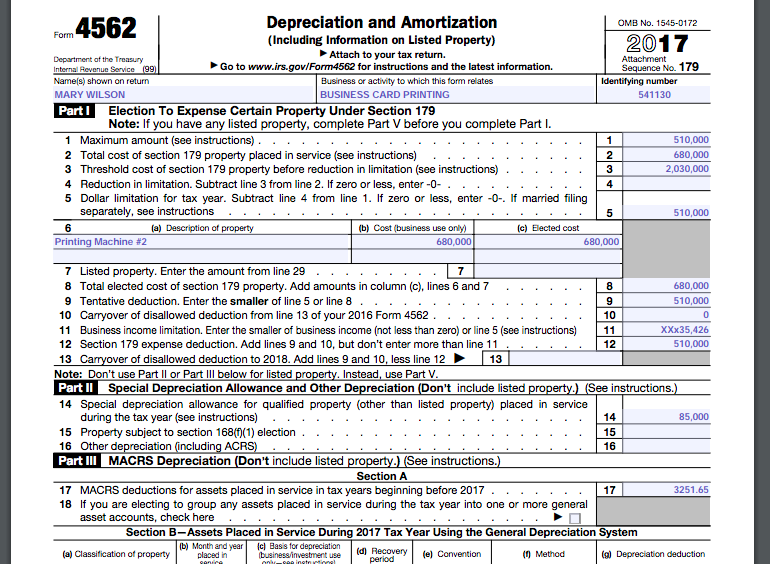

Need Help Filling Out The First Part Of The Form 4 Chegg Com

Need Help Filling Out The First Part Of The Form 4 Chegg Com